The Bank of England hiked interest rates in a widely expected move, raising the rates by 25 basis points. The BOE Governor advised that rate hikes will be gradual. Yesterday's rate hike was the first in a decade. The dovish forward guidance saw the British pound weakening strongly. GBPUSD fell 1.4% on the day while the EURGBP rose 1.8%. It was one of the strongest declines in the British pound in a year.

In the US President Trump officially nominated Fed member, Jerome Powell to be the next central bank chair. Powell was one of the main contenders for the post. However, markets view Powell as a cautious dove, but he is expected to continue to push ahead with the current monetary policy course.

Looking ahead the October payrolls report will be coming out today. According to the economists polled, the US economy is seen adding +300k jobs as normalcy returns. Revisions to September's payrolls data could also be weighing on investors as data showed a decline in jobs during the September month. The average hourly earnings are expected to rise 0.2% while the US unemployment is expected to remain steady at 4.2%.

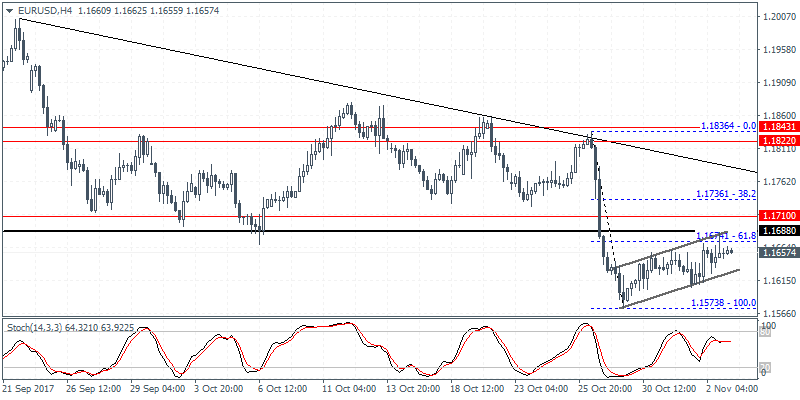

EURUSD intraday analysis

EURUSD (1.1657): The consolidation in the EURUSD continues as price action remains trading flat below 1.1672. The euro was seen posting modest gains, but did not manage to make any significant progress. With price trading below the main resistance level of 1.1704 and 1.1672 we expect the bias to remain to the downside. On the 4-hour chart, the bearish flag pattern remains the main point of focus. Price action is expected to break down to the downside and will be validated on a close below the previous low of 1.1573. This will open the downside target in EURUSD towards 1.1411 eventually marking the completion of the bearish flag pattern. To the upside, a breakout above 1.1704 - 1.1672 could however signal a shift in the short-term direction.

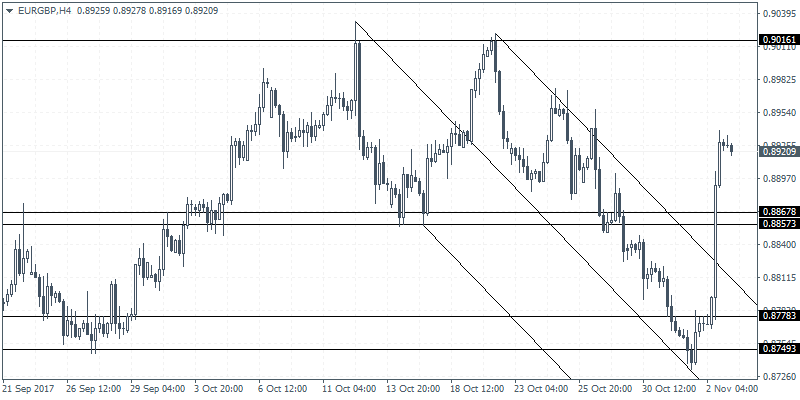

EURGBP intraday analysis

EURGBP (0.8920): The EURGBP posted a strong rebound yesterday as price rallied to a 4-day high. With price action breaking past the 0.8867 - 0.8850 minor resistance level we expect further upside gains to continue. In the near term, any declines are likely to be supported near 0.8867 - 0.8850 price level that could turn to support. In such a case, the next upside target in EURGBP will be near 0.9016 level which was previously tested. While the bias remains to the upside, EURGBP could be seen moving back into a range if price falls below 0.8850 support. This could keep the sideways price action intact and will see the EURGBP testing the lower support near 0.8778

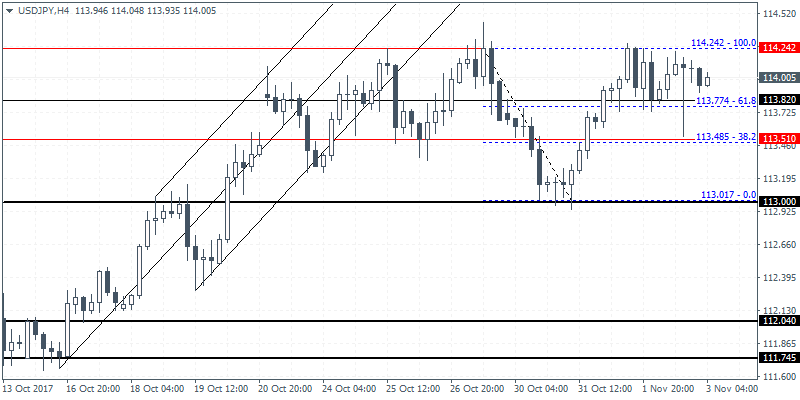

USDJPY intraday analysis

USDJPY (114.00): The USDJPY continues to trade near the major resistance level of 114.31 - 114.00 region. The sideways price action could signal a major breakout in the near term. On the 4-hour chart, we notice the inverse head and shoulders continuation pattern taking shape. Neckline resistance is formed at 114.24 which could be breached in the short term. This could put the upside bias in USDJPY towards 115.00 in the near term. However, failure to breakout above 114.24 resistance could mean that USDJPY will maintain the sideways range in the near term.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Gold corrects from record high set at $3,500

Gold price pulls away from the record peak it set at $3,500 earlier in the day as buyers take a breather amid overbought conditions on short-term charts. Any meaningful corrective downfall, however, still seems elusive as US Dollar downtrend remains intact.

EUR/USD retreats below 1.1500 as US Dollar stabilizes

EUR/USD corrects lower following Monday's rally and trades below 1.1500 on Tuesday. The pair loses traction as the US Dollar finds its feet, even as investors remain wary of the US financial stability amid Trump's attacks on Fed Chair Powell. Speeches from ECB and Fed officials are on the radar.

GBP/USD stays below 1.3400 as USD selloff pauses

GBP/USD fluctuates in a tight range below 1.3400 on Tuesday as the modest recovery seen in the US Dollar caps the pair's upside. Nevertheless, the pair's further downside appears limited as fears of a US economic slowdown and concerns about the Fed's independence remain a headwind for the Greenback.

3% of Bitcoin supply in control of firms with BTC on balance sheets: The good, bad and ugly

Bitcoin disappointed traders with lackluster performance in 2025, hitting the $100,000 milestone and consolidating under the milestone thereafter. Bitcoin rallied past $88,000 early on Monday, the dominant token eyes the $90,000 level.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.