Markets stabilize after Powell rules out rate hike, but the signs don’t look good

Markets are volatile right now; however, a relative calm has descended on the market and US. US stocks are down a touch, but the Vix is lower, US Treasury yields are lower, and the dollar is mostly lower vs. its G10 FX counterparts.

The drivers of the market recovery seem to be twofold: firstly, although Fed chair Jerome Powell dialed back expectations for rate cuts during a speech on Tuesday, he also indicated that the Fed was not considering rate hikes either. Instead, it looks like after a number of months where inflation and labour market data has come in hotter than expected, the Fed will keep rates at their current level for as long as needed. Powell explicitly ruled out rate hikes by saying: ‘We think that policy is well positioned to handle the risks that we now face’. Secondly, the sell-off has been brutal this week, so a pause is to be expected.

Europe stock market recovery

European stock markets are a sea of green, led by the Cac. The French index has been given a boost by the luxury sector, including Hermes and LVMH, after steady results eased market fears about a slowdown in sales at LVMH. Its results were not as weak as feared and they could act as a catalyst for a recovery in this sector, after LVMH shares fell 5% in the past month. The share price is higher by just under 3% so far on Wednesday.

Market breadth still a problem

The focus is now shifting to market fundamentals. Earnings season needs to deliver for the market rally to get back on track. Another factor to consider is market breadth. Investors don’t want to see the next leg of any stock market rally dominated by just a handful of names; they want more companies to share in the good times. However, the recent sell off could make that tricky. For example, there are zero firms on the S&P 500 making a new 4-week high on Wednesday, with 14 making a fresh 4- week low. The percentage of firms above their 200-day moving average on the S&P 500 has also fallen, and is now just 67%, the percentage of firms above their 50-day moving average is just 32%. These are key medium- and short-term indicators that suggest stocks are losing important ground during this broad sell-off, and further downside could be likely. A similar theme is visible in Europe, 25% of FTSE 100 members have made a 4-week low in recent days, while 12% of the Eurostoxx 50 have made a 4-week low.

Momentum stocks drag the index lower

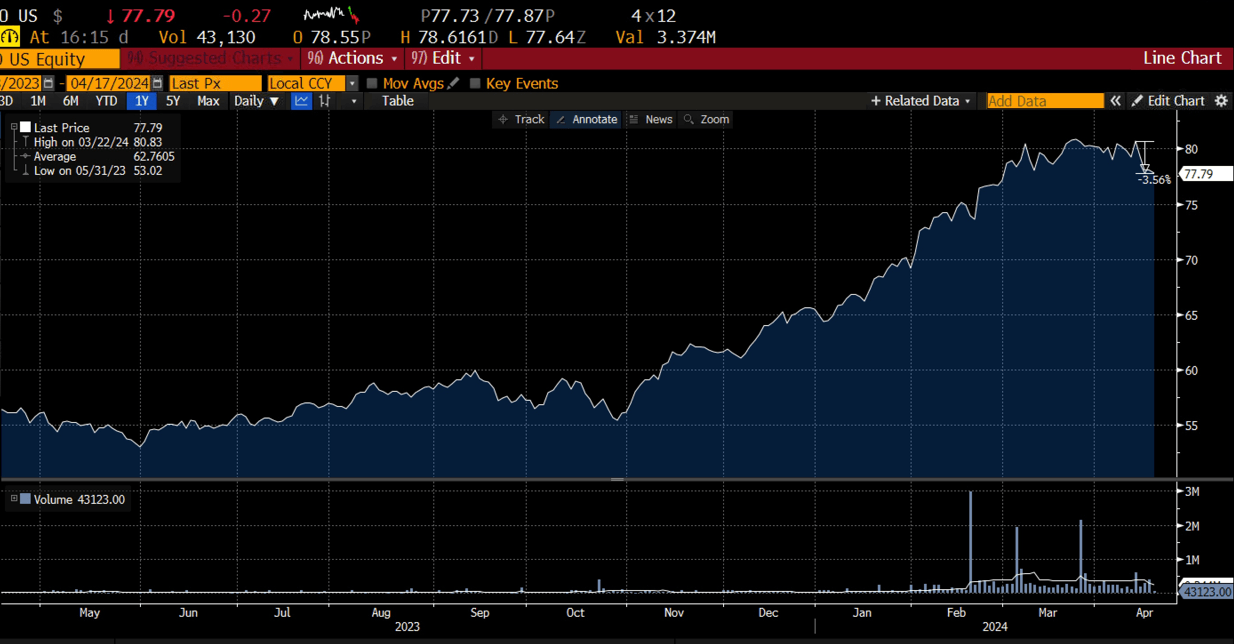

Another menacing sign for the US stock market is momentum, the ETF SPMO, which measures the performance of the biggest momentum stocks in the S&P 500 has dropped by more than 3% in recent sessions, which is more than the overall market. Momentum stocks were one of the biggest drivers of market gains in recent months, so if they are falling, it could limit the recovery in the overall US index.

Invesco S&P 500 momentum ETF (SPMO)

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.