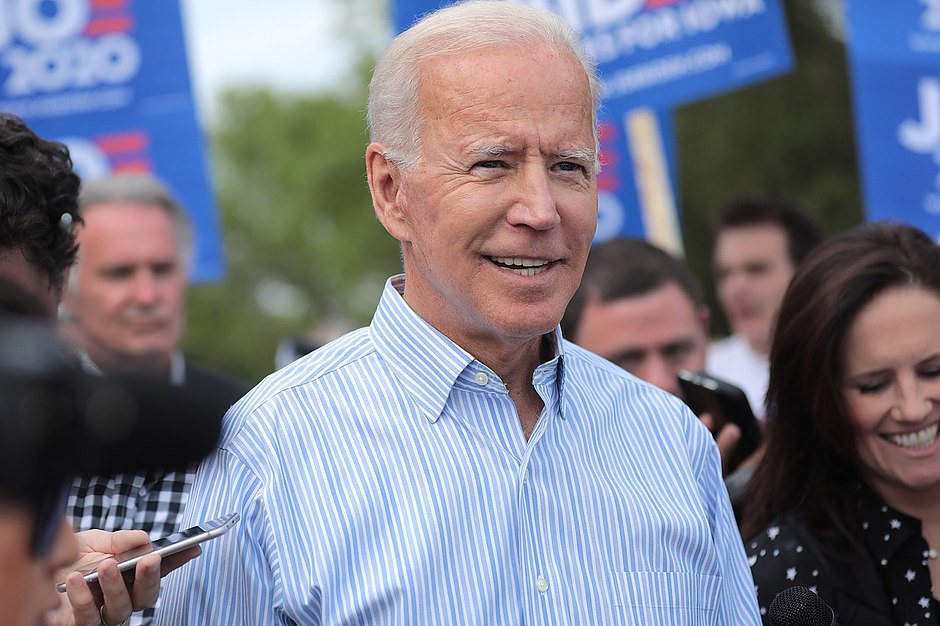

Markets rebound buoyed by Biden-Xi call

Top daily news

Equity index futures are up currently with market sentiment boosted by news of 90-minute call between leaders Xi Jinping and Joe Biden ahead of US producer prices report today at 14:30 CET after Wall Street finished down again on Thursday. Ford shares lost 2.07% underperforming market after the auto maker said will stop manufacturing cars in India and expects to record a $2 billion restructuring charge, Facebook shares added 0.11% on Thursday while Australia’s highest court ruled media companies are liable for the comments that Facebook users post under their articles.

Forex news

| Currency Pair | Change |

| EUR USD | +0.56% |

| GBP USD | +0.82% |

| USD JPY | +0.12% |

| AUD USD | +0.54% |

The Dollar weakening continues currently . The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.3% Thursday despite the US Labor Department report 310 thousand Americans sought unemployment benefits over the last week, down from 345 thousand the previous week.

Both GBP/USD and EUR/USD reversed their sliding Thursday as the European Central Bank kept its monetary policy unchanged but announced would slow down the pace of net asset purchases under its pandemic emergency purchase program. Both pairs are higher against the Dollar currently. USD/JPY reversed its advancing yesterday while AUD/USD ended little changed with yen lower against the Greenback currently while the Australian dollar is higher.

Stock market news

| Indices | Change |

| Dow Jones Index | +0.46% |

| Nikkei Index | +1.25% |

| Hang Seng Index | +1.44% |

| Australian Stock Index | +1.31% |

Futures on three main US stock indexes are up currently with US 10-year Treasury note yields inching up to 1.311%. The three main US stock benchmarks ended lower Thursday despite better weekly jobless claim data: they recorded daily losses in the range of -0.25% to -0.46%.

European stock indexes are higher currently following ECB’s revision upward of the euro zone’s growth forecast for this year . Indexes closed down Thursday with basic resources shares leading losses. Asian indexes are mostly higher today with Hong Kong’s Hang Seng leading gains in dip buying after the selloff the previous day.

Commodity market news

| Commodities | Change |

| Brent Crude Oil | +1.97% |

| WTI Crude | +1.93% |

Brent is edging higher currently. Prices fell yesterday as China announced plan to release state oil reserves in order to help domestic refiners control costs. At the same time the Energy Information Agency reported US domestic crude stockpiles declined by smaller than expected 1.5 million barrels las week. The US oil benchmark West Texas Intermediate (WTI) futures fell 1.7% but is higher currently. Brent crude lost 1.6% to $71.45 a barrel on Thursday.

Gold market news

| Metals | Change |

| Gold | +0.45% |

Gold prices are extending gains today. Spot gold added 0.3% to $1,793.97 an ounce on Thursday, rebounding after a three-session loss stretch.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

Author

Dmitry Lukashov

IFC Markets

Dimtry Lukashov is the senior analyst of IFC Markets. He started his professional career in the financial market as a trader interested in stocks and obligations.