Morning View: The big European story out of Greece? Not this morning, as IMF head Christine Lagarde weighed in on US monetary policy during a press briefing in Washington overnight.

“The inflation rate is not progressing at a rate that would warrant, without risk, a rate hike in the next few months.”

“That means the Fed should wait until early 2016, even if there’s a risk of slight over-inflation relative to the central bank’s 2% target.”

With Janet Yellen and the Fed still moving down the data dependent path to rate hikes most likely starting in December, she agrees with Lagarde’s comments re inflation but has stated over and over her ‘reasonable confidence’ that inflation will come back down towards 2% where it needs to be.

Nothing is changing.

But no, we can’t have a morning report without mentioning Greece somewhere along the way and today is no different.

Greece has now informed the IMF that they will not be able to make this week’s €321 million payment. They have instead asked to bundle it into one €1.5 billion payment at the end of the month.

EUR/USD Daily:

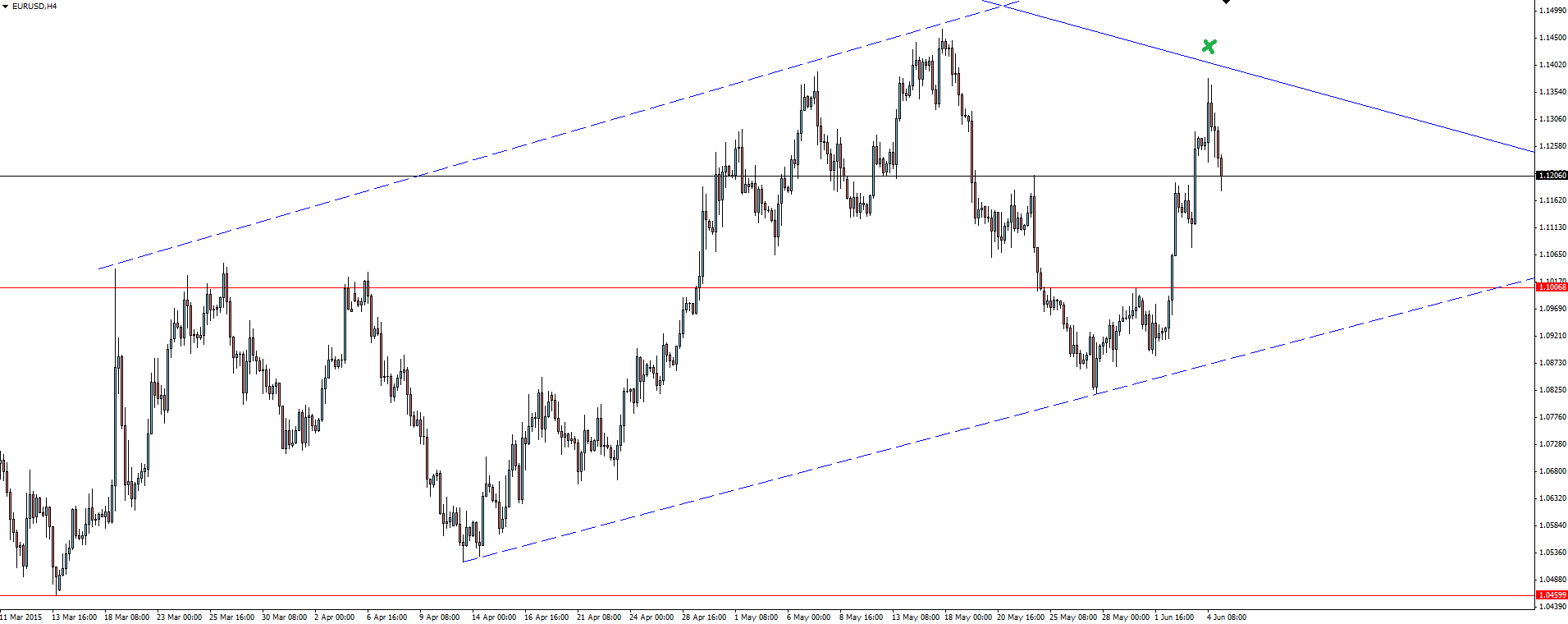

EUR/USD 4 Hourly:

Well in to anyone who was shorting that top into resistance. Stepping in front of the steamroller like that following the momentum behind the rally we have been seeing lately would have took guts. But it’s all about levels that you can manage your risk around and I know plenty of you jagged it with good trade management.

The request to bundle payments is a game changer in that for the first time, this is Greece actually not doing what was asked of them. There was no sideways deal from the IMF, this was Greece putting it off.

They won’t get many chances like this.

On the Calendar Today:

Quiet one in Asia with no tier 1 data on the calendar. It’s all about NFP during the US session with NY Fed’s Dudley due to speak a few hours later in Minneapolis which could see some interesting questions asked if we get a big miss either way.

Friday:

USD OPEC Meetings

CAD Employment Change

CAD Unemployment Rate

USD Non-Farm Employment Change

USD Unemployment Rate

USD FOMC Member Dudley Speaks

Chart of the Day:

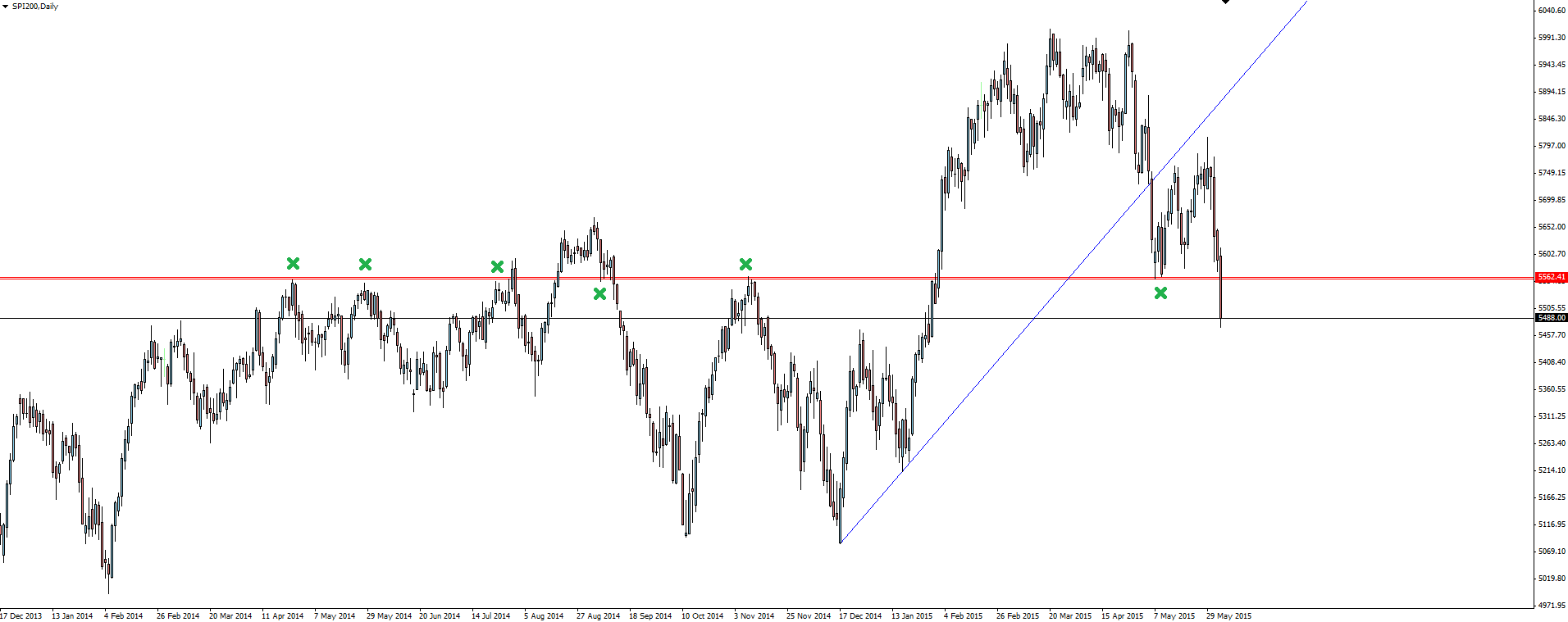

SPI200 Daily:

With the 6000 level now long gone, the Australian market broke through major support at 5560 yesterday, showing good momentum in it’s follow through to close on it’s daily lows.

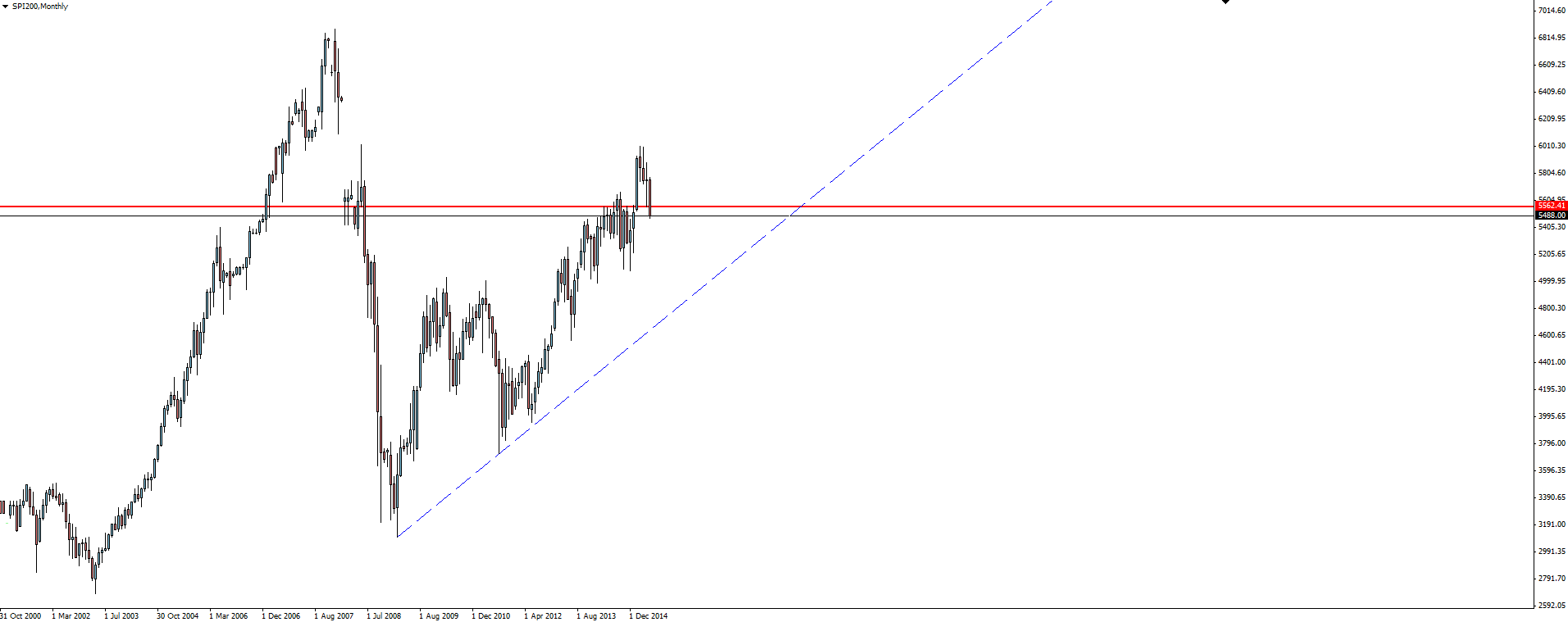

SPI200 Monthly:

What looks like a big deal on the daily is shown on the Monthly chart as a healthy correction that a market in an up trend needs to have. Always good to use that chart with the GFC carniage on it for some perspective when we get some bearish days.

Finally, just a heads up that there will be no Asian Session Morning blog on Monday as I’m out of the office due to the Queen’s Birthday long weekend.

For one day a year the colonies still love you. God Save the Queen!

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0900, eyes on tariffs

EUR/USD keeps the bid bias well in place so far on Tuesday, hovering above the 1.0900 barrier on the back of fresh downside pressure in the Greenback amid investors' hope of trade negotiations.

GBP/USD looks bid and approaches 1.2800

GBP/USD maintains its fresh bullish bias in the upper-1.2700s, printing marked gains in response to some loss of impulse in the US Dollar, which in turn lent fresh legs to the risk-associated universe on Tuesday.

Gold trims gains and breaches $3,000

Gold prices now lose some upside momentum and slip back below the critical $3,000 mark per troy ounce. Tuesday's recovery in the yellow metal comes on the back of the weaker US Dollar as well as steady trade tensions, while higher US yields continue to cap gains.

Who is Satoshi? Crypto lawyer sues DHS to reveal Satoshi Nakamoto's identity

James Murphy, a cryptocurrency lawyer popularly known to his followers on X as "MetalLawMan," has filed a lawsuit in a D.C. District Court against the Department of Homeland Security (DHS). He intends to uncover the real face or faces behind Satoshi Nakamoto, the pseudonymous creator of Bitcoin.

The Fed is looking at a hefty price level

We are still in thrall to tariffs, the faux-macro “data” driving markets. The WSJ editorial board advised other countries to take their tariffs to zero so that Trump’s “reciprocal” tariffs will have to be zero, too. Cute, but no cigar.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.