Market Brief

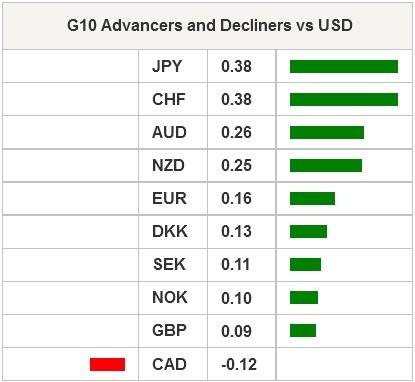

The Japanese CPI read has been solid in December. The headline CPI remained unchanged at 2.4% y/y, prices ex-food and energy increased at stable pace of 2.1%, while core CPI (ex-fresh food) eased down from 2.7% to 2.5% (vs. 2.6% exp.). The contraction in household spending accelerated, despite lower unemployment in December, 3.4% (vs. 3.5%). FX markets gave little reaction to economic data. The month-end JPY demand kept the upside limited on JPY-crosses. USD/JPY resistance remained solid at daily Ichimoku cloud top (118.46). The MACD will step in the green zone for a daily close above 118.34. The option bets are supportive of weaker JPY from next week. EUR/JPY should challenge Fibonacci 23.6% on Dec-Jan drop (134.78) as downside pressures ease.

Commodity markets were hit hard yesterday. Nat gas lost above 5%, gold wrote-off 2%, silver, platinum slid above 5% and 3% respectively, amid USD demand sharpened across the board as US jobless claims improved surprisingly. The US releases fourth quarter advance GDP and core PCE (closely watched by the Fed) before the closing bell. Soft growth and inflation read should give reason to Gross who voices that Fed should raise rates late this year to save capitalism. The safe haven CHF and the AUD subject to dovish RBA specs have been the heaviest knee-jerk losers in New York yesterday. USD/CHF tests 200-dma (0.9288) before the US data. A break above should ease tensions on the EUR/CHF and speculations that the SNB may be intervening to help CHF depreciating.

The Cable sold-off aggressively to 1.5061. Numerous GBP-negative news came out, among which the YouGov released 1-year CPI expectations at 1.2% versus 1.5% in December while warning of a rise in inflation uncertainty (and most importantly Citi analysts mentioned YouGov survey in their comments), the BoE’s Haldane said there is no need to hurry for rate hike and the normalization should be gradual. Combined to broad USD demand, GBP/USD hit 1.5019. Trend and momentum indicators remain positive (MACD +0.0014), while offers above 21-dma (1.5140) are now a stronger barrier before the Sep-Jan downtrend top (1.5363). Light vanilla puts are placed at 1.5135/55 zone pre-weekend.

EUR/USD traded water at 1.1317/45 range in Asia. The January preliminary CPI data is due today. The deflation is expected to have accelerated at the pace of 0.5% in January (y/y estimate), while the core CPI has probably stabilized at 0.7% y/y according to market surveys. Any negative surprise is EUR-negative yet the impact is expected to remain limited given that the EUR-complex has not finished correcting last week’s significant squeeze post-ECB QE. There is no concrete expectation/speculation attached to today’s CPI read. EUR/GBP remained capped by offers above 7.25. Yesterday’s unexpected GBP unwind eased selling pressures on EUR/GBP. Market turns bid at 0.75 and below.

USD/CAD extends weakness to 1.2677 as WTI crude consolidates below $45. Trend momentum is steadily bullish. Despite overbought conditions, soft Canadian GDP read today should push for extension of gains toward the key mid-run technical resistances: 1.2734 (2005 high), then 1.3065 (2009 high). The key support stands at 1.2205 (Fibonacci 76.4% level on 2009-2011 sell-off).

Today’s economic calendar is crowded today: German December Retail sales m/m & y/y, French December Consumer Spending and PPI m/m & y/y, Spanish 4Q (Prelim)GDP q/q & y/y, Spanish November Current Account Balance, Swiss January KOF Leading Indicator, Spanish January (Prelim) CPI y/y, Swedish November Wages Non-Manual Workers y/y, Italian December (Prelim) Unemployment Rate, UK December Nez Consumer Credit, Net Lending Sec. on Dwellings, Mortgage Approvals and M4 Money Supply y/y, Euro-Zone December Unemployment Rate, Euro-zone January CPI Estimate Y/y and CPI Core (Advance) y/y, Italian December PPI m/m & y/y, Canadian November GDP m/m & y/y, US 4Q (Advance) GDP Annualized q/q, Personal Consumption, GDP Price Index and Core PCE q/q, January ISM Milwaukee, US January Chicago Purchasing Manager and University of Michigan’s January Final Sentiment, Current Conditions, Expectations, 1year and 5-10 year Inflation Survey.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.