Market Brief

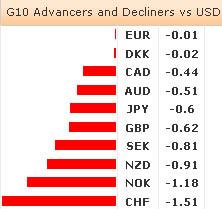

The Asian trading session was dominated by a risk-on rally amid China’s economic data came in better than expected. Chinese y/y real GDP (4Q) increased by 7.9% (vs. 7.8% exp. & 7.4% prev), the real year-to-date GDP came up to 7.8% (vs.7.7% expected & previous), December y/y Industrial production advanced to 10.3% (vs. 10.1% prev), while December y/y retail sales surged to 15.2% (vs. 15.1% exp. and 14.9% prev). The encouraging data out of the World’s leading emerging economy drove the markets to the upside overnight. The Nikkei 225 rallied 2.86%, Hang Seng advanced 0.99%, Shanghai’s Composite surged 1.39%, while Kospi and Taiex added 0.69% and 1.53% respectively. The US and European stock futures followed the bullish move. The currency markets focused on the aggressive rally of USDJY, as the Japanese media speculated on BoJ’s consideration on removing 0.1% floor on short term interest rates. Overnight Japan announced that the foreign bond purchases surged to Yen391.3B from the Yen -398.2B, the foreign stock purchases decreased to Yen -155.3B from Yen 6.8B, while Foreign purchases on Japanese bonds and stocks increased to Yen 139.0B (vs Yen -1.8B) and Yen 233.8B (vs. Yen178.9B previously). The Japanese November m/m and y/y Industrial Production improved to -1.4% and -5.5% respectively (from -1.7% and -5.8%), while the November Capacity Utilization disappointed ( -0.2% vs. 1.6% previously). USDJPY crossed over 90.00, its lowest level since June 2010, while EURJPY broke 120.00 to the upside, and hit 120.71 early in the session. In US, the initial jobless claims and December Housing starts surprised to the upside, while Philadelphia Fed business outlook index reversed to -5.8% from 8.1% the month before. In New Zealand, the consumer confidence increased, the q/q CPI pointed down at -0.2% m/m, while y/y CPI failed to beat the expectations (actual 0.9%, vs. 1.2% exp. & 0.8% prev). In European leg, EURUSD recovered to month’s highest levels, EURCHF continued its rally up to 1.2569 early in the session. EURGBP hit 0.8380 (highest level since March 2012), while GBPUSD slumped down to 1.5964, amid David Cameron’s speech raising the specter of a potential U.K. exit from EU. Today, the focus is on UK m/m and y/y Retail Sales ex&with Auto Fuel, Canadian m/m November Manufacturing Sales, and the University Of Michigan Survey of Consumer Confidence Sentiment.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.