Market players don't believe the US Congress will fail to get a second “stimulus” spending package

Outlook:

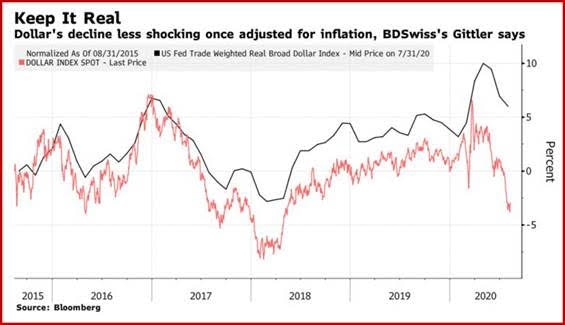

We get PPI today, yawn. The market movers come later in the week, especially retail sales. The big story of the day is Bloomberg reprinting the core of a story in the Nasdaq newsletter by by Gittler at BDSwiss that says what is surprising is not the recent drop in the dollar index, which is hardly representative, anyway, but rather the big run-up earlier. “Back in April, the recent peak, the dollar’s real value was the highest it’s been in nearly 18 years. That was the extraordinary move, not the recent decline.”

The dollar index, which we have long despised for inaccuracy (overweights the euro and underweights the CAD) is down 7.1% from the April week. But the more representative Fed’s dollar index is down by a lesser 3.6%. And this is in line with its historical long-term trading pattern. It’s also in keeping with the huge drop in dollar demand by foreign central banks for dollars under swap lines at the Fed. Bloomberg notes that “Gittler joins other strategists, including those at JPMorgan Chase & Co., pushing back on the intensifying debate over the future of the dollar, including threats of a structural decline voiced by analysts at Goldman Sachs Group Inc.”

Returning to the theme of risk-on/risk-off, it looks like market players simply do not believe the US Congress will fail to get a second “stimulus”/recovery spending package. If so, that would remove one risk-on factor on yesterday’s list of scary uncertainties, allowing the dollar to resume its drop.

Something that gets little attention is the divergence between sanguine market players---see the rising equity markets and even oil and other commodities—and central bank officials. We didn’t make a list, but statements from various regional Feds all indicate they are scared to death of the worst-case scenario—bankruptcies, foreclosures/evictions, etc. Central banks can provide liquidity until the cows come home, but liquidity is not solvency. If we are returning to a strong dollar scenario, it might be because those in the know are starting to influence those with the deep pockets. The discrepancy between economic data and market response is Alice-in-Wonderland weird.

We continue to think a tipping point has been reached and confidence in economic recovery is following Covid-19 recovery, and that means Germany and Japan. As for the UK, it’s endangering the UK-Japan trade deal over Stilton, which is so British and so dumb the mind boggles. We are sticking to our forecast of a euro drop to the channel bottom and beyond (1.1700) unless we get a rise to the previous high, 1.1916 from Aug 6. For the euro to trade under the 10-day moving average (or any other average) is meaningful only if it lasts 3-5 days. The clock is ticking.

Tidbits: Trump is now talking about cutting the capital gains tax, which would apply to less than 1% of the population. Seems like desperation. We still await Biden’s choice of a VP candidate.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat