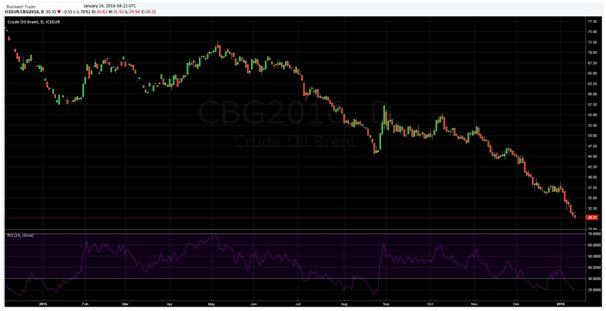

The looming spectre of Iranian oil shipments has spooked world oil markets as the price of Brent crude has declined below $30 a barrel for the first time since 2004. Speculation is mounting that world oil markets could be in for a rough year as global demand continues to sag.

Despite US domestic concerns over the viability of an Iranian nuclear deal, it appears that an agreement is close to being achieved. Such a monumental step would allow Iranian crude oil to flow freely following the lifting of sanctions. Subsequently a nuclear deal could have a significant impact on world crude markets as Iranian exports could further depress a sector already mired in over-supply.

Subsequently, as the parties appear close to reaching a resolution, the increasing risks of the additional supply are being priced into global oil prices. In fact, crude oil prices in London have slumped over 1.8 percent whilst WTI desperately clings to the $30.00 handle. The widening gulf between Brent and WTI prices continues largely due to the risk that the additional seaborne supply poses to Brent.

The return of Iran to the oil exporting fold has the potential to significantly impact global oil prices. The beleaguered state is likely to exacerbate the current global oversupply by an additional 500,000 barrels per day. This level of supply could potentially rise to 1 million barrels a day, within 6 months, following the lifting of sanctions.

Subsequently, Brent crude oil prices are likely to remain under pressure until some certainty is obtained regarding the lifting of sanctions. Currently, London crude oil is trading around the $29.92 a barrel mark but the additional Iranian supply could very well see prices around the $24.00 range. Subsequently, traders are keenly watching the outcome of the nuclear negotiations for a hint at Brent’s future trend direction.

In addition, poor US consumption and inventory data further complicates the markets view of future demand. As the world’s largest consumer of oil products markets typically look towards the US data for signs of strength. However, gasoline stockpiles continue to grow and are currently at over 240 million barrels, the highest since February of 2015. Subsequently, concerns continue to mount over a US led slowdown in demand that could have a long lasting impact in crude markets.

Given the current lack of demand, coupled with the continuing oversupply of crude, the coming quarter looks bleak for Brent and WTI prices. Crude oil markets are in a perilous position and as the essential rebalancing occurs we could very well see a significant change to the market structure and power of Middle Eastern participants in the coming year.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.