As crude oil and other commodity prices have rallied over the past few weeks, some analysts have pointed to a new, resurgent age, in commodity demand out of China. However, the recent rally hides the current supply side rebalancing that is occurring within the Asian power house.

October has been a watershed month for commodity markets as the weaker US economic data, along with supply cuts to metals, have provided some buoyancy to depressed prices. In particular, crude oil (WTI) has fought its way out, from a tight range, to rally to nearly $50.00 a barrel. The metals markets were also relatively upbeat with both Gold and Silver experiencing rallies. However, the negative fundamentals, that led us to where we are today, are still present within the global markets.

Despite the short term bullish trends, an oversupply is still the key fundamental aspect in the long term. Production capacity across a range of commodity markets has been increasing for well over a decade due to growing demand from emerging markets (EM). Rising commodity prices meant a growing incentive for increased production capacity and innovation within many of the operations. This phase of capacity build-up has effectively led us to where we are today, a fundamental over-supply, and significantly depressed prices.

There is a view that the decline in commodity prices that has occurred since 2014, was primarily caused by macroeconomic factors, including deflation in input costs and the US Dollar. However, this argument seems to avoid any mention of China and the ongoing rebalancing that is occurring between CAPEX and OPEX.

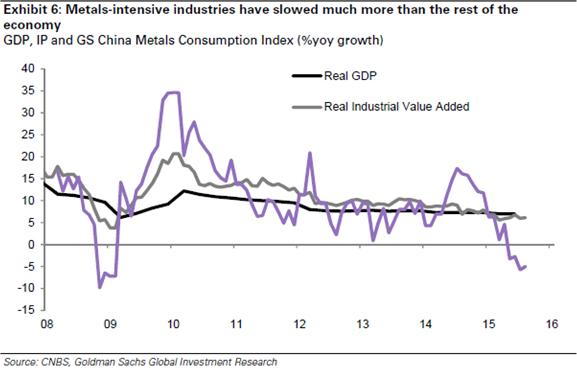

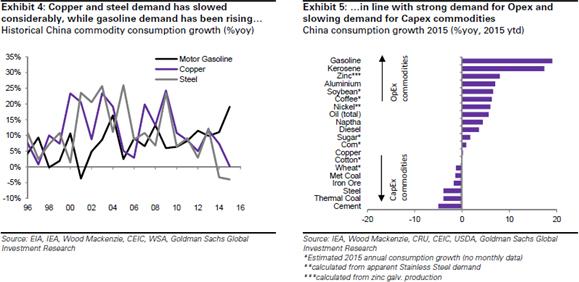

As China’s markets mature, there are some key indicators that investment is moving away from CAPEX industries (Steel, Cement, Iron et.al) towards OPEX based industries (Energy, Aluminium, and consumption based commodities). Historically, China has reached a point where their level of income and growth supports a structural move away from industries requiring significant capital expenditure. This structural change is not at all unexpected, and has been bandied about by analysts for some years, but the reality of the change is yet to become fully apparent to market participants.

The rebalancing of commodity demand within China is likely to pose some challenges for those within the metals industry as it becomes clear that “peak metals demand” might actually now be behind us. China has also recently come some way in developing a level of independence within their domestic metals industry, especially towards nickel pig iron. This level of independence is starting to subsequently impact demand for commodity imports.

The question remains as to which country will fill the Asian powerhouse’s void and step up to become the next “China” within the EM. India certainly has the underlying growth and population to support the strong demand for capex and the requisite building of productive capacity. As likely a candidate as India is, it will have to remain to be seen which country is to fill the exceedingly large shoes that China will leave behind.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.