Making sense of sharp turns

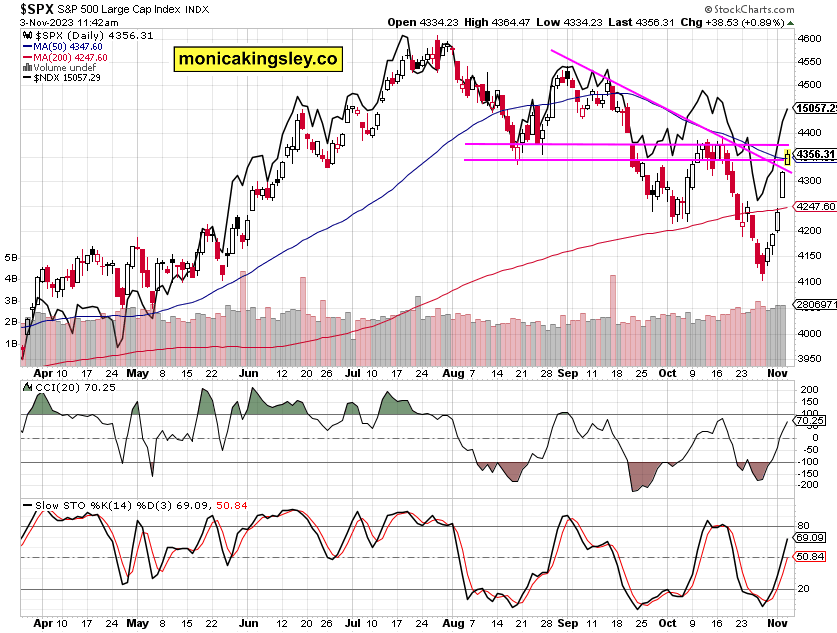

S&P 500 broke out of its declining resistance line, and ran into the heavy resistance zone. While I don‘t doubt about the rally continuing and taking S&P 500 hundreds of points higher, a decent pullback would be most healthy here. The series of daily gaps though speaks as to the budding trend‘s strength – and I‘m bringing you a couple of interest rate sentivive picks in today‘s analysis.

Let‘s recount the key turning points this week, reversing the bearish trend in place:

- Powell delivering hawkish pause, but not showing resolve to hike more

- The Fed prefers to keep rates where they are even if inflation got sticky and trends up

- Sharp dialing back of manufacturing PMI, bolstering hard landing trades

- NFPs and continuing claims showing we‘re indeed in latter innings of goldilocks

- USDJPY move confirming the top in yields as in

- USDJPY serving as harbinger of BoJ policy change (upcoming YCC exit)

That‘s the big picture view – before getting carried away, keep in mind that soft landing hopes will prove not to have been vanquished – just look at rising job openings, construction growth, still strong consumer balance sheets and wage growth. The Treasury debt issuance Q4 projections so embraced by the markets is but one helpful tool to calm bond markets… Just wait for upcoming CPI mid Nov to prove my sticky inflation point as the effect of rising oil prices has far from played out.

This is the chart I posted late Friday on our intraday channel for stocks – more levels and picks follow in the chart section – as you can see, we‘re at a pretty congested area.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale article contains 7 of them.

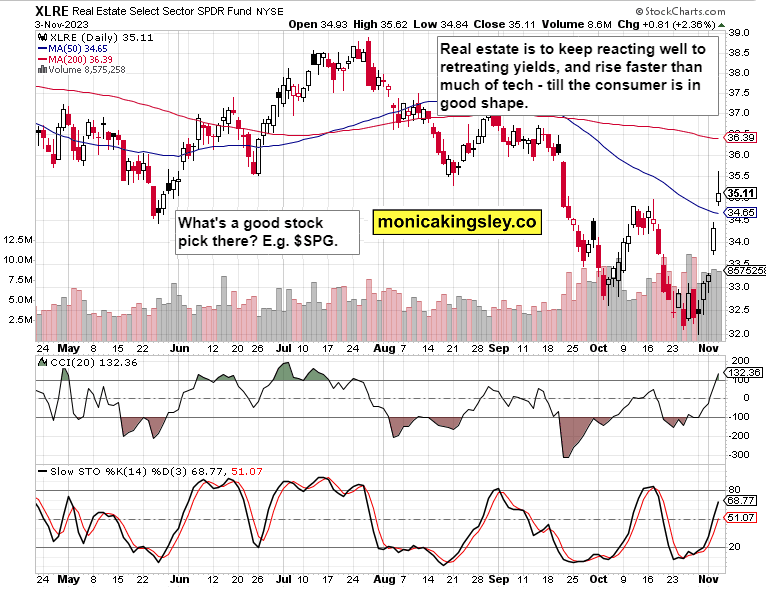

Sectors and Stocks

First surprising winner of this week‘s turn, is real estate waking up – SPG would be a good candidate in better shape than this industry chart is. As long as the consumer isn‘t retrenching (to be seen in retail sales and personal income), real estate is going to do well.

How about sectors – would it compare against tech or semiconductors? Yes, those interest rate sensitive ones would outperform in the current paradigm shift. XLE isn‘t staging a breakdown here, and together with XLK and select financials, would form a good portfolio part for the Q4 rally unfolding.

KRE is another pick that would benefit from retreating yields, and a perceived top in within this business cycle.

Credit Markets

Yields have sharply retreated, but the normalization (steepening of yield curve) would go on – term premium is to keep rising.

Gold, Silver and Miners

Precious metals are still subdued, and even if miners keep underperforming, these metals will be the place to be in, especially given the USD turn south (yes, the dollar top I talked weeks ago as one in the making, is here).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.