As we head into the Greek elections on Sunday, the anti-austerity party Syriza remains in the lead in the polls – a position it has occupied since May. However, an absolute majority by Syriza is far from a foregone conclusion.

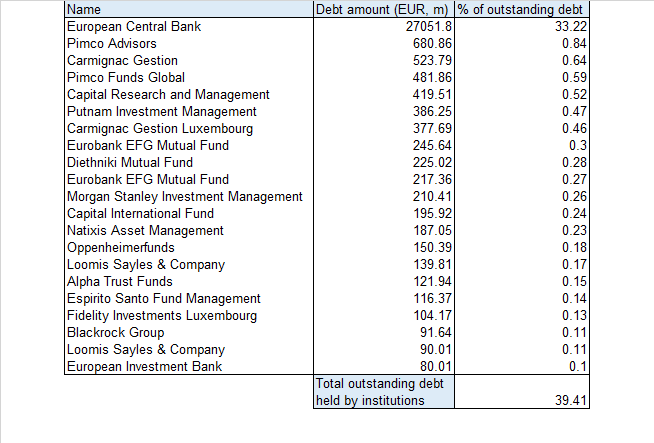

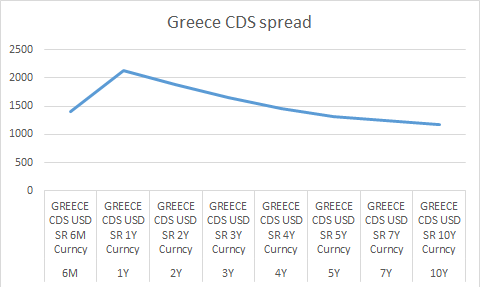

Under the Greek electoral system, the party with the highest votes in the popular elections is granted a 50-seat bonus in the 300-seat Greek parliament. But even with this bonus allocation, Syriza needs to gain at least 35 percent of the vote. According to a survey for the University of Macedonia conducted for Greece's SKAI Television, the latest poll puts Syriza in a 6.5 point lead over Prime Minister Antonis Samaras' New Democracy party. That lead translates to 33.5 percent of the vote – just short of the 35 percent needed to secure an absolute majority for the party that has pledged to renegotiate Greek debt, pushing for a 50 percent haircut on Greek obligations. Greek public debt currently stands at around EUR315bn.

Under the Troika agreement, Greece has been part of a EUR240bn bailout agreement since 2010. This agreement would have to be renegotiated by the new government.

On its website, Syrizia demands:

Immediate parliamentary elections and a strong negotiation mandate with the goal to:

• Write-off the greater part of public debt’s nominal value so that it becomes sustainable in the context of a«European Debt Conference». It happened for Germany in 1953. It can also happen for the South of Europe and Greece.

• Include a «growth clause» in the repayment of the remaining part so that it is growth-financed and not budget-financed.

• Include a significant grace period («moratorium») in debt servicing to save funds for growth.

• Exclude public investment from the restrictions of the Stability and Growth Pact.

• A «European New Deal» of public investment financed by the European Investment Bank.

• Quantitative easing by the European Central Bank with direct purchases of sovereign bonds.

• Finally, we declare once again that the issue of the Nazi Occupation forced loan from the Bank of Greece is open for us. Our partners know it. It will become the country’s official position from our first days in power.

However, the incoming government will face EUR7bn of repayment obligation in March – a sum that Greece’s current government coffers are unable to fulfil meaning that Syrizia – the self-styled anti-austerity party – would have to find a way of meeting these obligations or fall into default. This would put their demands for a “significant grace period in debt servicing to save funds for growth” up to an early test.

There is a possibility that the Troika would acquiesce to these demands, at least in the short term, granting credit through the European Stability Mechanism (ESM) to meet its obligations.

Coalition stability

Should Syrizia fall short of its 35 percent threshold, it would be forced to seek coalition partners with To Potami being the most likely candidates given their shared policy of pressure to give Greece a holiday on its debt repayments. A Syrizia-To Potomi coalition would probably be the most stable outcome in the eyes of the markets, with the less radical To Potomi moderating Syrizia’s more extreme demands over drastic restructuring of Greek debt.

2012 re-run

A third possibility is a re-run of the 2012 general elections when Antonis Samaras' New Democracy party scraped a victory with 19 percent of the popular vote compared with 18 percent for Syrizia. After a failure to secure a coalition agreement within 9 days, in accordance with Greek law a second vote saw New Democracy take 30 percent of the vote and form a coalition government with centre-left party PASOK. Such a situation would be extremely volatile falling so close to the end of the current bailout agreement.

New Democracy surprise

There is an outside chance that the electorate takes a look at what Syrizia is offering on voting day, looks at the drastic demands, and vote for a return of Antonis Samaras' New Democracy party. But that outcome is highly unlikely. Opinion polls show a Greek electorate highly in favour of public debt restructuring – something front and centre of Syrizia’s manifesto.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.