Lower US yields can keep us Dollar bearish [Video]

![Lower US yields can keep us Dollar bearish [Video]](https://editorial.fxsstatic.com/images/i/tariffs-usa-01_XtraLarge.jpg)

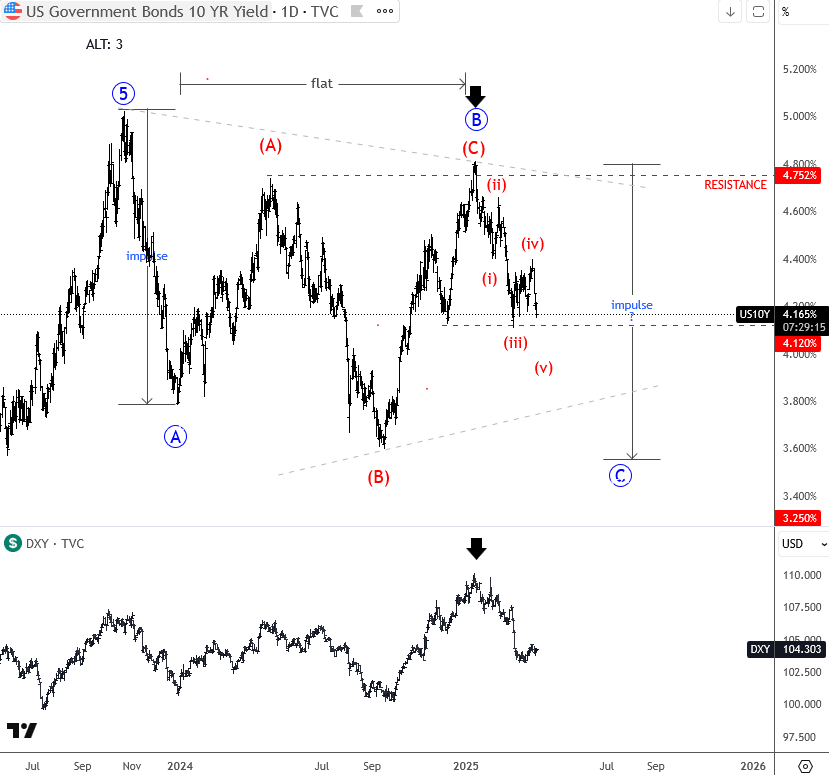

From an Elliott wave perspective the price of 10Y US Yield chart is coming lower after an irregular flat correction in wave B, so wave C can be now in progress, especially if we get a lower degree five-wave drop from 4.8%, which can keep USdollar Index – DXY under bearish pressure.

For more analysis like this, you may want to watch below our latest recording of a live webinar streamed on March 31 2025:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.