Last week, China introduced aggressive stimulus measures to support its economy, most notably 500 billion yuan ($71.3 billion) in liquidity aimed at stock markets. Key actions include:

-

A 20bps cut to the 7-day reverse repo rate, now at 1.5%, exceeding market expectations for smaller cuts.

-

A 0.5% reduction in the reserve requirement ratio (RRR), releasing 1 trillion yuan ($142 billion) in liquidity, with potential for further cuts this year.

-

A 30bps cut to the 1-year MLF rate to stimulate credit and investment.

-

Lower mortgage rates for existing loans, addressing household pressure and boosting consumption.

-

A reduction in the down payment ratio for second homes from 25% to 15%, targeting the property market despite weak sentiment.

-

Loan prime and deposit rate cuts to support bank liquidity and margins.

-

500 billion yuan liquidity support for stock markets, enabling funds and brokers to access PBOC funds for market stability.

These measures reflect significant intervention to stabilise the economy and capital markets.

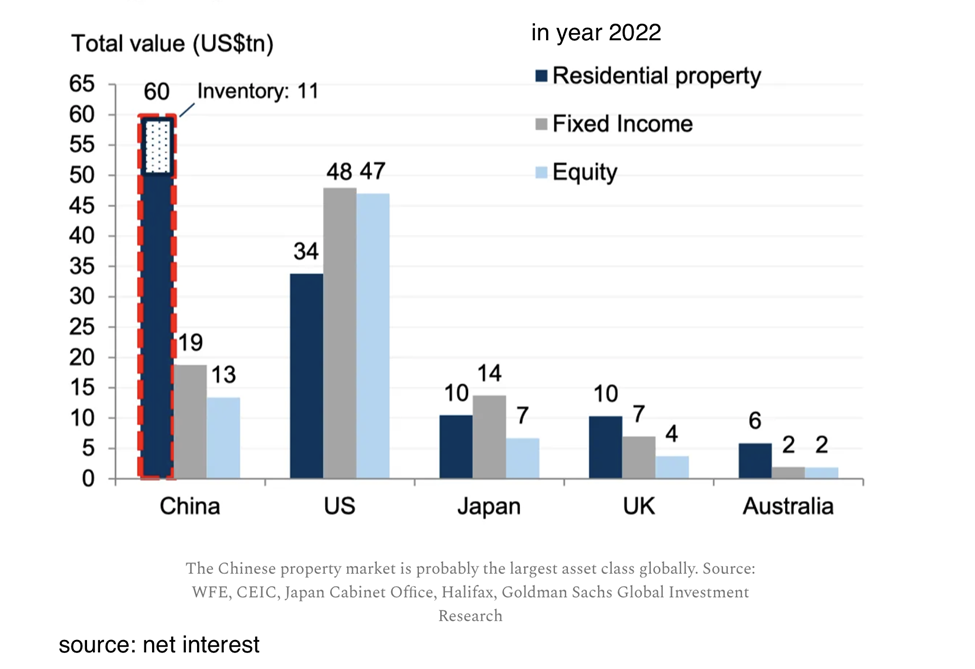

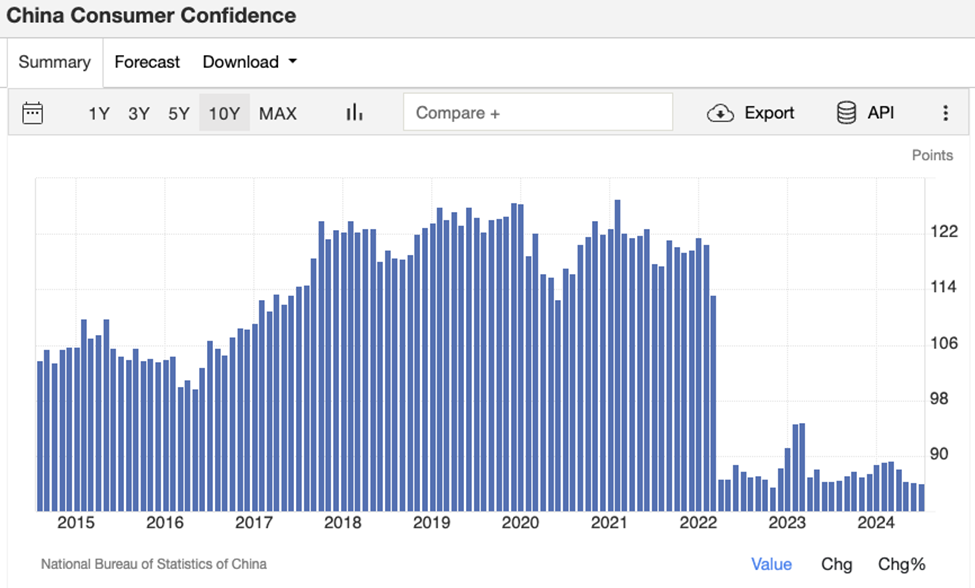

China's residential property market holds significant value compared to other asset classes. A 15% drop in property value could result in a loss of $7.5 trillion, severely impacting consumer confidence. Without revitalising the property market, full economic recovery remains challenging. While the equity market is more responsive to liquidity and surged last week, its wealth effect is less impactful than property recovery. For sustained economic revitalisation, China will need further monetary and fiscal stimulus.

Source: tradingeconomics

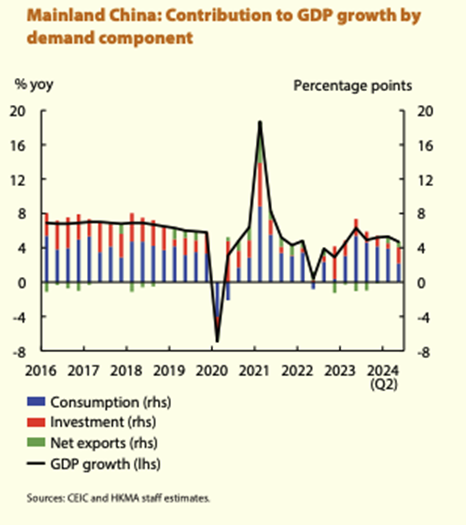

Mainland China's GDP growth is projected to slow, with consumption expected to halve in 2024.

Souce: HKMA

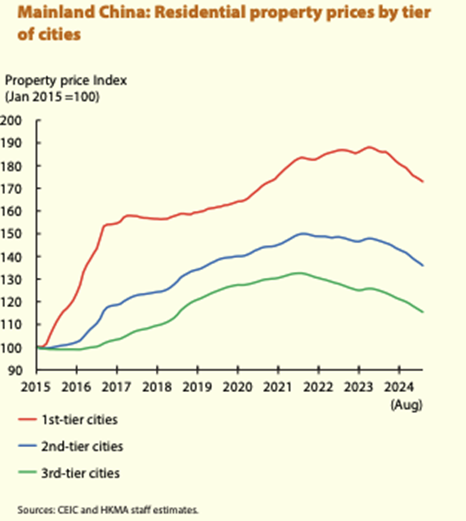

Mainland China’s residential property prices have been declining at an accelerated pace since 2023.

Source: HKMA

Technical analysis

Source: Deriv MT5

The Hang Seng Index (HSI) has been rising since the Federal Reserve cut interest rates, with the 20- and 50-day moving averages forming a golden cross, indicating an upward trend. The HSI established a double bottom at 16,800 in August and 17,219 in September, with positive news from China pushing it past the first target of 19,526. The next targets are 21,473 and 22,868, with major support at 19,424.

China maintains tight capital controls, with separate markets for onshore and offshore RMB. Hong Kong handles 75% of offshore RMB transactions and is the largest financial hub for offshore RMB, helping to stabilise the currency.

Source: Deriv MT5

The USD/CNH daily stochastic is in the oversold region, indicating a potential rebound. Major support stands at 6.9282, with resistance at 7.1540.

Conclusion

While liquidity support has temporarily boosted the equity market, its long-term impact remains limited. Given the property market's greater influence on wealth effects, further stimulus will be essential to sustain economic recovery.

The information contained within this article is for educational purposes only and is not intended as financial or investment advice. It is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information. The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance. No representation or warranty is given as to the accuracy or completeness of this information. Do your own research before making any trading decisions.

Recommended Content

Editors’ Picks

EUR/USD struggles to hold above 1.0400 as mood sours

EUR/USD stays on the back foot and trades near 1.0400 following the earlier recovery attempt. The holiday mood kicked in, keeping action limited across the FX board, while a cautious risk mood helped the US Dollar hold its ground and forced the pair to stretch lower.

GBP/USD approaches 1.2500 on renewed USD strength

GBP/USD loses its traction and trades near 1.2500 in the second half of the day on Monday. The US Dollar (USD) benefits from safe-haven flows and weighs on the pair as trading conditions remain thin heading into the Christmas holiday.

Gold hovers around $2,610 in quiet pre-holiday trading

Gold struggles to build on Friday's gains and trades modestly lower on the day near $2,620. The benchmark 10-year US Treasury bond yield edges slightly higher above 4.5%, making it difficult for XAU/USD to gather bullish momentum.

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin hovers around $95,000 on Monday after losing the progress made during Friday’s relief rally. The largest cryptocurrency hit a new all-time high at $108,353 on Tuesday but this was followed by a steep correction after the US Fed signaled fewer interest-rate cuts than previously anticipated for 2025.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.