Let’s just ignore yields

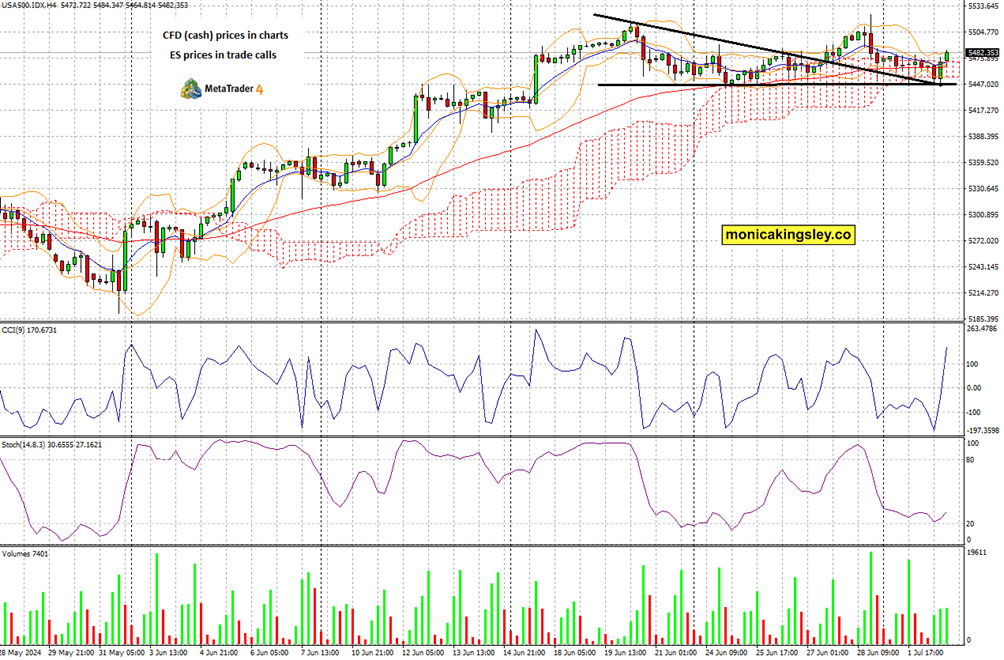

S&P 500 didn‘t break below the support line of 5,508 even though yields kept biting. Then, Powell wasn‘t hawkish, and a rally within the range (for now within the range) testing twice the declining support line shown below (chart posted to our channel, then to Twitter) first, was what followed. For good measure, JOLTS above expected, were ignored.

Out of the two points of contention (#1 will stocks catch to the downside pressure made by rising yields, and #2 what to make of the no risk-off sectoral view Monday), stocks chose to squeeze the bears – and by bears I mean also those like me thinking that such data as lately (manufacturing PMI were good for bulls, but were sold into Monday) call for more of a sideways move till Friday‘s NFPs).

To top it off, leadership nicely broadened from tech outside of semis, NVDA into XLF and XLY beyond the TSLA less bad deliveries than feared rally called in our channel.

Apart from the latest change in oil trading pattern (aka there is something more to the sideways recovery), important daily change is underway in precious metals – here is how I summed it up in the Trading Signals Telegram channel (the silver chart reserved for clients makes clearer sense as to the potential return to the declining channel / wedge formed since failing to cementing the failure to break above the second silver top above $32).

Let‘s mve right into the charts – today‘s full scale article contains 4 more of them, with commentaries.

Tired of seeing those red boxes instead of way more valuable information? Try the premium services based on what and how you trade.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.