Latin America central bank preview

Summary

Many Latin American central banks will decide monetary policy over the next two weeks. While near-term rate decisions should be straight-forward in Brazil, Colombia and Chile, longer-term outlooks for each central bank are less certain. But in our view, Brazilian central bankers will keep rates unchanged for the foreseeable future as fiscal policy dominates monetary policy, BanRep policymakers in Colombia are likely to keep the current pace of easing well into 2025, while the Chilean Central Bank is approaching the end of the easing cycle. Mexico's central bank is where monetary policy views arguably diverge the most. For now, we believe peso depreciation and renewed inflationary pressures will keep Banxico on hold in August. In addition, local and external political uncertainties should contribute an extra layer of caution for policymakers considering resuming the easing cycle.

Fiscal dominance creates Selic rate uncertainties in Brazil

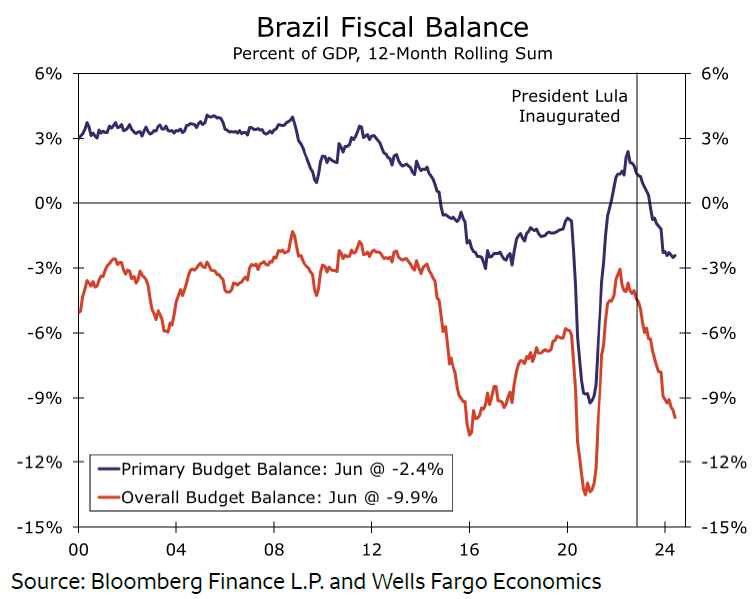

Brazilian Central Bank (BCB) policymakers are in a difficult position. Real interest rates are elevated, which despite activity remaining resilient, are contributing to restrained growth across Brazil's economy. At the same time, inflationary pressures are starting to rebuild as fiscal responsibility remains elusive under the Lula administration (Figure 1). As a result, a fiscal dominance scenario is starting to materialize, which is also generating depreciation pressures on Brazil's currency given the already precarious state of government finances. Imported inflation via FX depreciation is now a risk, and a risk that, in combination with looser fiscal policy, is contributing to upward pressure on local inflation expectations. Against this backdrop, BCB policymakers will meet this week to decide monetary policy. In our view, rising inflation expectations are likely to outweigh sluggish growth prospects, and we expect the Brazilian Central Bank to hold interest rates steady at 10.50%. Our outlook for the BCB's July meeting is not out of consensus or different from financial market pricing; however, the longer-term view for Brazilian policy rates is where more diverging views are found. To that point, we believe BCB policymakers will keep interest rates steady at 10.50% through the end of 2025, select peer economists believe a restarting the easing cycle will be delivered early next year, while at the same time, financial markets are priced for the BCB to raise rates in the near future. This kind of divergence makes forward guidance the most critical component of the July BCB meeting. Last meeting, policymakers communicated a relatively hawkish stance, but with recent inflation data firming as well as Lula suggesting a wider budget deficit than originally anticipated, BCB language could shift more hawkish at the upcoming meeting. Despite an expectation for more hawkish language, at this time we do not believe policymakers will restart the tightening cycle. We will, however, be focused on how concerned policymakers are in regard to new budget forecasts and whether additional upward pressure on inflation is now expected.

Author

Wells Fargo Research Team

Wells Fargo