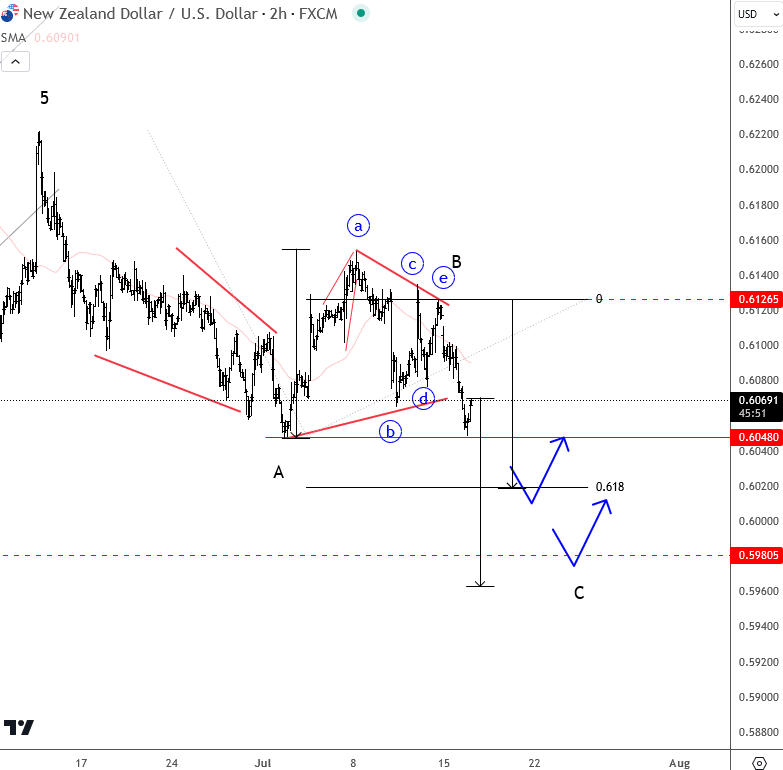

Kiwi is coming into strong support ahead of inflation data

NZDUSD is coming out of consolidation, suggesting that the price action since the start of July was a triangle in wave B. Therefore, the whole retracement from June 12th is much more complex and deeper but still has a corrective shape. It looks like we are just breaking down into wave C, which has key support levels at 0.6020, with the second at 0.5980 area, which can be a very important swing zone going into the inflation report from New Zealand later today. Not only Elliott Wave structure, but also H&S pattern shows potential bullish formaiton, if we see support soon for right shoulder.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.