Kim Jong Un: The race to reopen

The buzz around the globe is about lifting the lockdown in a smart way. Looks like mid-May is going to be a busy period especially in Europe as many governments will experiment with opening schools, restaurants and essential service-oriented businesses.

In the US, there is also a political race against time to reopen American businesses. The sooner economies start opening, the weaker the case for the Democrat’s push for mail-in voting.

Rumours about the death of Kim Jong-Un may not be exaggerated but there is no official confirmation as yet. The lack of a designated heir could throw the country into real chaos. If true, China should be concerned about an overflow of refugees through their borders. It is expected that Kim Jong-Un’s younger sister Kim Yo-Jong could take over but we don’t know what politics can play out in a patriarchal culture.

As the work from home culture gains more momentum and companies see more of its hidden values, a new trend could accelerate for people to move away from megacities.

The big tech companies are in a race to gain share of the digital services employment. Innovation and ingenuity will thrive during hard times. More automation and better connectivity will accelerate. Governments will double down on broadband and 5G installations. We will all soon adapt to a new world order in many of our former activities. With that let’s look at the markets.

EQUITIES

On Friday, the major two indexes closed a little over 1% over the previous days close. But, the internals like breadth and up/down volume ratio was flat to slightly less. Volume has also contracted, and upward momentum is waning.

As explained in the previous reports, the high at 2879 on April 17 could be the counter trend rally high. Should it break above, we are still in a bearish rally and markets could test levels close to 2935 - 3000.

Bonds continued to trade in a sideways manner. It closed at 182^02 but will look for more price developments to gain more confidence in initiating a position.

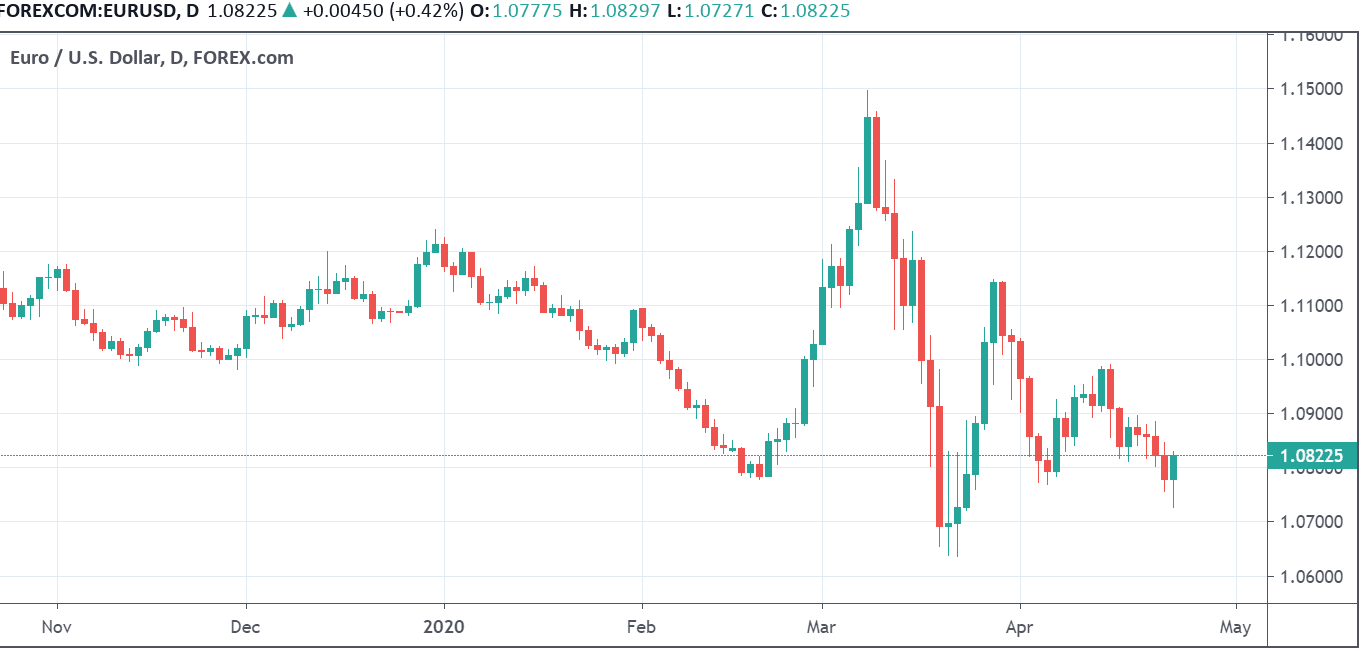

EURO

Though Euro dropped to its critical support level it could not clearly break below it. There is risk of a counter trend rally above 1.0990. So would wait for more price clarity.

GOLD

Gold has retraced a large percentage of its decline from the Apr 14 high. We believe we are in a bear market rally from the highs of 1921.50 in 2011 to the fall down to 1046.50 in 2015. So will wait for more price development.

Author

Abraham George

Breezy Briefings

Abraham George is a seasoned investment manager with more than 40 years of experience in trading & investment and portfolio management spanning diverse environments like banks (HSBC, ADCB), sovereign wealth fund (ADIA), a royal fa