Key insights into this week's monetary policy meetings

It's a huge week ahead for investors and traders this week. Not only are there a large number of important companies posting their quarterly earnings, but there are also some major Monetary Policy Meetings taking place, including the Bank of Japan, the US Federal Reserve and the Bank of England.

Predictions of the past few months have been that there were still tightening moves left to make for both the Fed and the BoE, however more recently markets have tended towards both banks maintaining a pause this month.

Meanwhile, the Bank of Japan may continue to be the outlier of its peers, maintaining its ultra loose policy yet again despite inflation holding steady above the target rate.

Below we’ll take a look at what might influence the coming meetings and which way experts are leaning on the results.

Bank of Japan meeting

Tuesday 31st October, Decision Statement at 3:00 AM GMT, Quarterly Outlook Report at 3:00 AM GMT.

At its September policy meeting, the BOJ maintained its very low interest rates and reaffirmed its commitment to assist the economy until inflation persistently approaches its 2% objective, indicating that it was not pushing to wind down its stimulus program.

At its meeting this week, the central bank is anticipated to increase its projections for inflation, which would show prices above its 2% objective for two years in a row, and this would likely increase pressure on the bank to begin to normalize monetary policy sometime soon.

In September 2023, Japan's annual inflation rate decreased to 3.0% from 3.2% in the previous month, marking the lowest level since September 2022. In addition, while it slowed from a 3.1% gain in August, the core consumer price index, which includes fuel expenses but excludes fresh food, rose 2.8% from a year earlier in September.

Out of the 28 economists surveyed between last week by Reuters, 25 anticipate that there would be no policy changes at the meeting this week. However, around two-thirds of economists expect that the BoJ will discontinue its negative interest rate policy in the next year, suggesting that the central bank will carefully and gradually approach the phase-out of its very accommodating monetary policy.

USD/JPY & Nikkei 225 Cash index Daily Charts - Source: ActivTrader trading platform

Federal Reserve meeting

Wednesday 1st November, Decision Statement at 6:00 PM GMT, Press Conference at 6:30 PM GMT.

Not too long ago it was fair to assume that the Fed might look to raise rates again this month, however, more recently, the data and the market are in favour of a pause in the cycle of tightening again. In its September meeting, the Fed maintained the federal funds rate target range at a 22-year high of 5.25%–5.5%. The question will soon turn to when officials will call for a cut, but many believe it wont be for a while yet.

Fed Chair Powell, who spoke at the Economic Club of New York recently, suggested that the Fed is still moving cautiously and that the FOMC will be making their decisions based on the entirety of incoming data, the changing outlook, and the relative weight of risks.

The bank is apparently confident that current strict policy is driving inflation down and economic activity is also softening. However, if there is further proof of consistently above-trend growth or proof that labour market tightness is no longer decreasing, it might mean there are calls for further tightening of policy to get back on track.

Powell also pointed out that the rate of inflation is still too high and that additional loosening of labor market conditions and a period of below-trend growth would probably be necessary to achieve a sustained return to the 2% inflation target.

Last week, one of the Federal Reserve's favored inflation indicators, the Core PCE price index, was published. The indicator climbed by 3.7% in September, the lowest annual increase since May 2021. The outcome was in line with market forecasts, however it was only a slight decrease from the 3.8% recorded in the previous month. Core PCE prices increased by 0.3% month-over-month in September, which was faster than the 0.1% rise seen in August.

GDP figures were also released last week. Above market expectations and the 2.1% increase in Q2, the advance estimate revealed that the US economy grew by an annualised 4.9% in the third quarter of 2023. This was the highest quarterly expansion since the fourth quarter of 2021, and will be a highly relevant stat for this meeting.

Meanwhile, Unemployment claims jumped 10,000 to 210,000 in the week ended October 21, above market forecasts of 208,000. Despite rising above the market's median forecast, the result remained close to the nine-month low from the previous week, confirming the Federal Reserve's view that interest rates will likely remain higher for longer.

Nonfarm Payrolls are due out during the week, but following the meeting on the 3rd of November, however, the forecast is for a similar addition of jobs of around 188,000 compared to the previous month’s 190,000.

The central bank will maintain its benchmark interest rate on November 1st and may wait longer than previously believed before dropping it, according to 80% of over 100 analysts polled by Reuters.

S&P 500 Cash index & Dollar Index December Daily Charts - Source: ActivTrader trading platform

Bank of England meeting

Thursday 2nd November, Decision Statement at 12:00 PM GMT, Meeting Minutes at 12:00 PM GMT.

The BoE still faces a fairly different set of circumstances to the Fed. Inflation is still running very hot, the labour market is showing some signs of slowing but is still resilient and the country’s economy is just barely recording growth.

In September, the UK inflation rate held steady at 6.7%, maintaining August's 18-month low, while core consumer prices rose 6.1% annually in September compared to 6.2% the month prior.

Fresh GDP data is due the week following this upcoming meeting, with forecasters seeing a dip in activity being probable. However, up from an initial estimate of 0.4% and after an upwardly revised 0.5% increase in the previous period, the UK’s GDP still rose by 0.6% year-on-year in the second quarter of 2023.

The majority of economists surveyed by Reuters predicted that the Bank of England will cease tightening policy and maintain the bank rate at 5.25% on November 2nd. They did, however, warn that there was a good probability another hike would occur this year, especially if inflation.

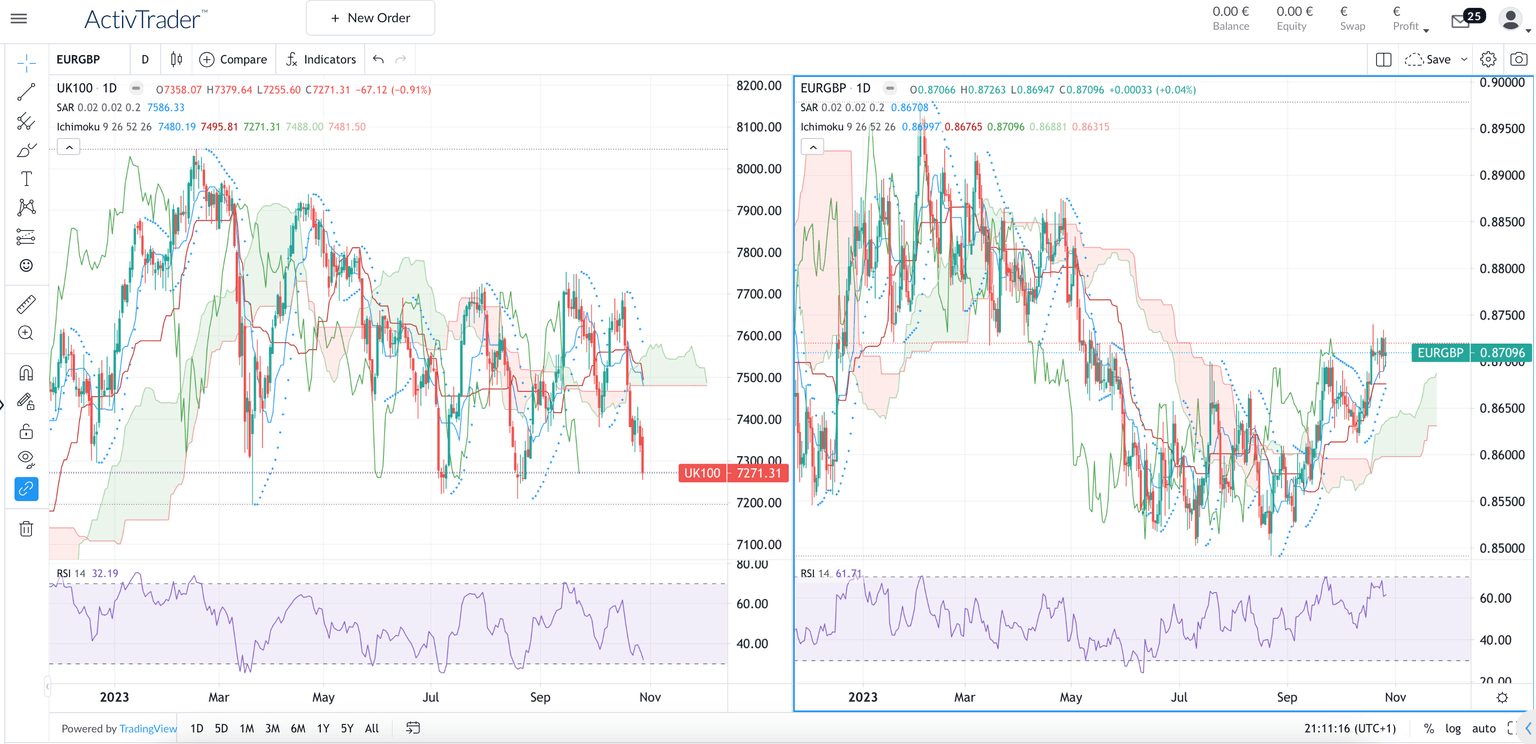

FTSE 100 Cash index & EUR/GBP Daily Charts - Source: ActivTrader trading platform

Stay up to date with what's moving and shaking on the world's markets and never miss another important headline again! Check ActivTrades daily news and analyses here.

Author

Carolane de Palmas

ActivTrades

Carolane graduated with a Masters in Corporate Finance & Financial Markets and got the AMF Certification (Financial Markets Regulator in France). Afterward, she became an independent trader, investing mostly in European and American stocks/indices.