Forward guidance changed, but no change in policy intention, according to Yellen

Current policy stance appropriate and Fed patient in normalisation

Assessment of economic conditions largely similar: optimistic on economy

Declining inflation and inflation expectations downplayed

Three dissenters suggests views differ widely within FOMC

“Dots” somewhat lower than previously

FOMC sounds moderately dovish

The outcome of the FOMC meeting was definitely more dovish than many analysts had expected, especially after the quite hawkish October meeting and the progress the labour market had made since. However, while the FOMC is clearly in no hurry to tighten policy, it is moving at a snail’s pace in that direction. The FOMC changed the wording of the forward guidance, but chairwoman Yellen emphasized that it didn’t reflect in a change in policy intentions, which should have surprised many analysts. Other elements were mixed: the downplaying of inflation and inflation expectations is hawkish, while more dovish was the lower‐called “dots” (rate projections). We think the main objective yesterday was to calm markets and we believe Yellen nicely succeeded. Markets reacted constructive, but previous positioning certainly played a role too.

Forward guidance: patient

The most important change in the statement concerned the forward guidance. “Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy”. In October, the Committee said that it expected the zero rate to be appropriate for a considerable period of time after it stopped its asset purchases. From the start of her press conference, chair Yellen emphasized that some modification in the language had become needed (given the end of QE). Continuing to refer to the QE event as a reference point when it was finished was no longer appropriate. She however firmly stressed that the new guidance is “consistent” with its previous “considerable time” wording. In other words, nothing had really changed in the mind‐set of the FOMC regarding its policy‐setting. The new language reflects better economic conditions.

When hike rates: not before next couple of meetings

Yellen also specified that it was unlikely the Committee would start raising rates in the next couples of meetings. Asked what “couple” meant, Yellen said two. Taken literally this means that rates could go up from the April 28‐29, 2015 meeting onwards. Anyway, the so‐called “dots” for 2015 suggest that mid‐year might still be a good educated guess (explicitly suggested by a few FOMC members).

The new guidance is “consistent” with its previous “considerable time” wording, according to the FOMC, but as time passes this won’t be the case anymore. So, it creates more leeway for the FOMC going forward and as such it might be considered as a very small step further towards normalization. Needless to repeat the Fed stays completely data‐dependent and interpret its dual mandate symmetrically. Interestingly, Ms. Yellen stated that changes could not only be made at the meetings that are followed by a press conference, but at any meeting. At such eventuality an extra press conference could likely be organized.

On the economy Ms. Yellen was quite optimistic, while she rather convincingly downplayed the possibility of low inflation. Lower energy (and import) prices exercised downward pressure on inflation, but the Fed sees its as transitory, as it always did in the past. Lower oil was a positive for the economy via more spending power. On the decline of inflation expectations, Ms. Yellen was quite relaxed as special factors (risk premia, liquidity,…) might explain the decline. Nevertheless she hedged that relaxed attitude by stating that the FOMC monitors these price developments closely. Concluding; Yellen’s message was one of hope, which is might be what the economy needs at this juncture.

We think that global market tensions, the important Christmas shopping season and the inflation developments convinced the Fed that time was not ripe to take a major step to normalisation. The FOMC has the luxury of time and uses it. This should not hide that a further normalization is in store.

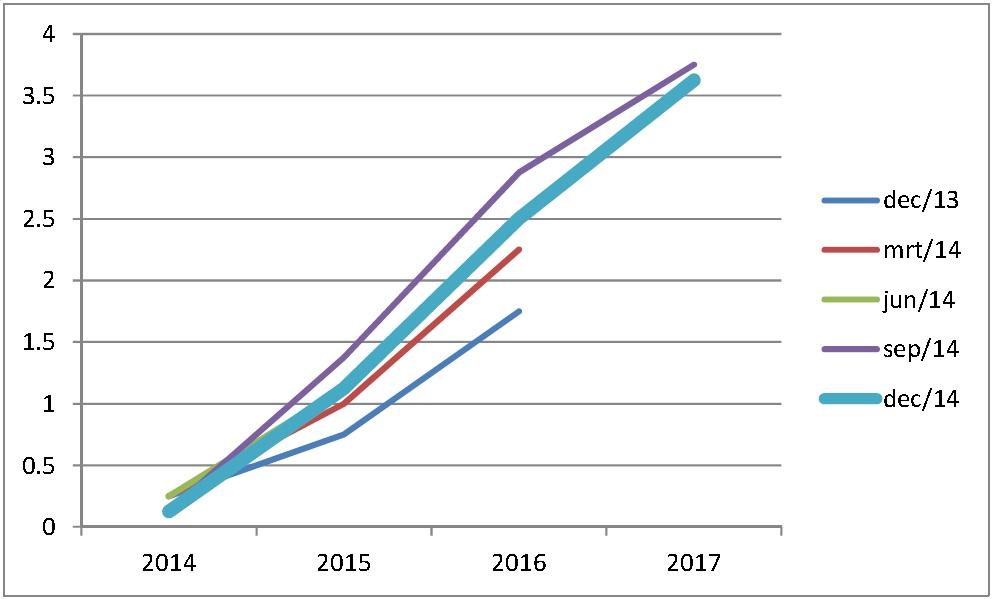

“Dots” revised lower.

For 2015, the average and median FF rate projection is 1.13% versus 1.27% and 1.38% in September. For end 2016, projections are 2.54% (versus 2.68% previously) for the average and 2.50% (versus 2.88%) for the median. For 2017; the average projected FF rate is 3.50%, the median one 3.63%. This is close to the long run rate that is 3.75% (median). Despite unchanged growth projections, governors lowered their own expectations, even if the changes shouldn’t be overstated. The dots had gone up surprisingly sharply in September. So, the slight retreat is on of modest importance. Nevertheless, the market expectations are still much lower. Yellen acknowledged the difference but could or would not give a lot of explanation of the reasons for it.

Three dissenters

It is quite unusual that three governors dissent. Fisher agreed to the “patient” phrase, but expected the Fed to move rather earlier than later. Kocherlakota dissented as the decision created undue downside risks to the credibility of the 2% inflation target. Finally Plosser dissented because he believed the statement should not stress the importance of the passage of time as a key element. We shouldn’t draw conclusions from the behaviour of the three dissenters.

None of the three (regional) governors will vote next year. It is normal that more discussion/dissents are likely when rates are zero and other tools like communication are used.

Yellen probably has a strong backing of the board and some regional governors, enough to stay in the driver’s seat.

Conclusion & market reaction

Equities gained, as did the dollar, while yields went up. The US yield curve shifted up by 3.7 to 9.1 basis points, the belly, as expected, hit the most. Markets were recently rather extremely positioned and that may explain the outspoken reactions afterwards. The still deep divide between the Fed and markets rate expectations might have contributed to the narrowing. The normalization continues, but markets consider they probably still have 6 months of zero rate policy.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.