June 2024 CPI: Surprising drop sparks market moves

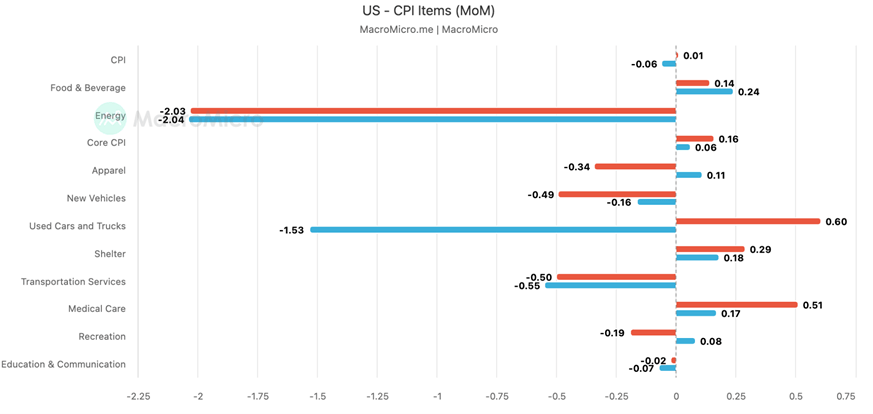

The June 2024 Consumer Price Index (CPI) decreased by 0.1% month-over-month (MoM) and increased by 3.0% year-over-year (YoY). Inflation eased across categories such as shelter, gasoline, and airline fares. The decline in consumer prices was mainly due to a significant drop in gas prices and reduced pressure on shelter prices. Shelter, including rent, constitutes 34% of the CPI, serving as a key indicator of inflation.

Source: Macromicro

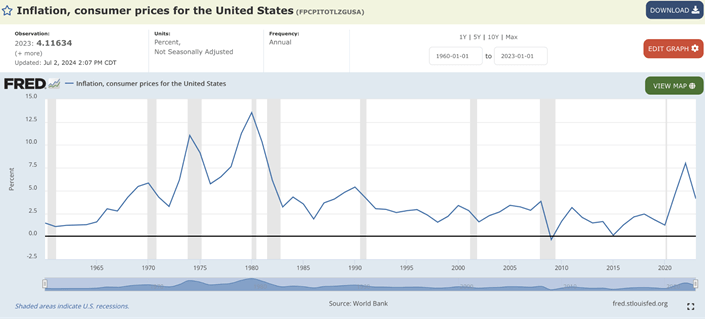

The chart indicates that a rapid rise and subsequent fall in inflation signals an impending recession. Fed Chair Jerome Powell noted that the Fed now faces two-sided risks and cannot focus solely on inflation. The labour market is balanced. The Fed is expected to cut rates, with the market estimating an 87.6% chance of a 0.25% rate cut in September.

Source: FRED

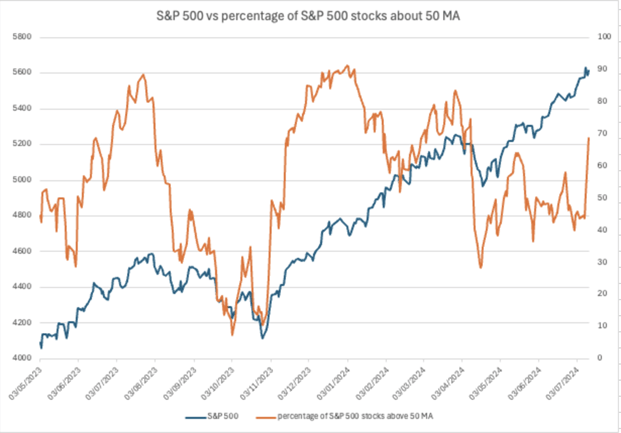

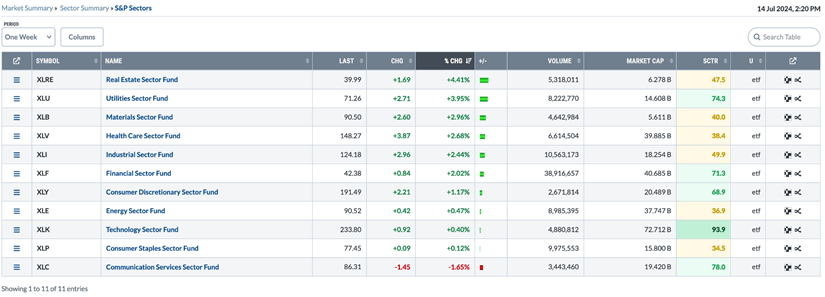

The increasing unemployment rate currently at 4.1% for June (The unemployment triggered Sahm Rule: Is a recession on the horizon?), and easing inflation are seen as a risk-off opportunity by the market. The percentage of S$P 500 stocks above the 50-day moving average is rebounding, likely leading to a broader rise in S&P 500 stocks rather than just large-cap companies. Interest rate-sensitive sectors, such as real estate, healthcare, and industrials, performed well last week.

Source: Adopted from Reuters

Source: Stockcharts

The market is taking advantage of risk-off opportunities to buy stocks. Meanwhile, the Bank of Japan intervened to support the yen amid easing US inflation. According to Bloomberg, Japan likely intervened in currency markets for the third time this year, with an estimated intervention of ¥3.5 trillion ($22 billion).

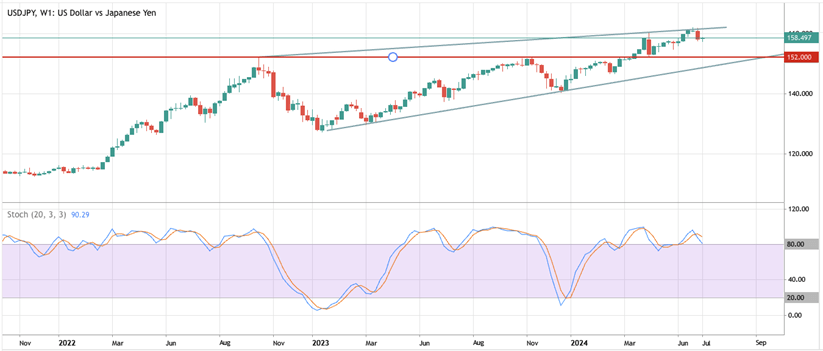

Source: Deriv MT5

The USD/JPY tested and rejected the upper resistance level. With the stochastic indicator in the overbought zone, it may test the support level at 152, which was the resistance level in October 2023 and the support level in April 2024.

Source:Deriv MT5

Gold is testing resistance at 2430. If it breaks above this level, it could test 2700. Global physically-backed gold ETFs saw a second consecutive month of inflows in June, driven by additions from Europe- and Asia-listed funds, according to the World Gold Council (WGC).

Conclusion

The June 2024 CPI decrease and easing inflation indicate a shifting economic landscape. The Federal Reserve's balanced approach to managing inflation and stability is crucial, with a potential rate cut expected. Market activities show strategic shifts, particularly in interest rate-sensitive sectors and broader stock rebounds. Japan's currency intervention and the bullish outlook for gold highlight significant global economic movements.

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.