JPY: Three-way pressure piling up

Key points

-

The Japanese yen is under increasing pressure, with USDJPY approaching the psychological 160-level.

-

Japan's inclusion on the US Treasury's monitoring list for currency manipulators limits its ability to intervene directly in the FX market, while dollar strength and a resurgence of yen-funded carry trades in Latam FX are contributing to the yen's challenges.

-

Japan's Consumer Price Index (CPI) data, released this morning, missed expectations, highlighting the need for gradual and modest policy normalization by the Bank of Japan (BOJ), suggesting limited potential for BOJ-driven yen strength.

The Japanese yen continues to face mounting pressure. USDJPY is now back near 159-level and approaching the psychological 160.

Three-way pressures are piling up:

Japan's inclusion on the US Treasury's monitoring list for currency manipulators limits its ability to directly intervene in the FX market. While authorities may resort to jawboning, past attempts have not yielded significant yen appreciation.

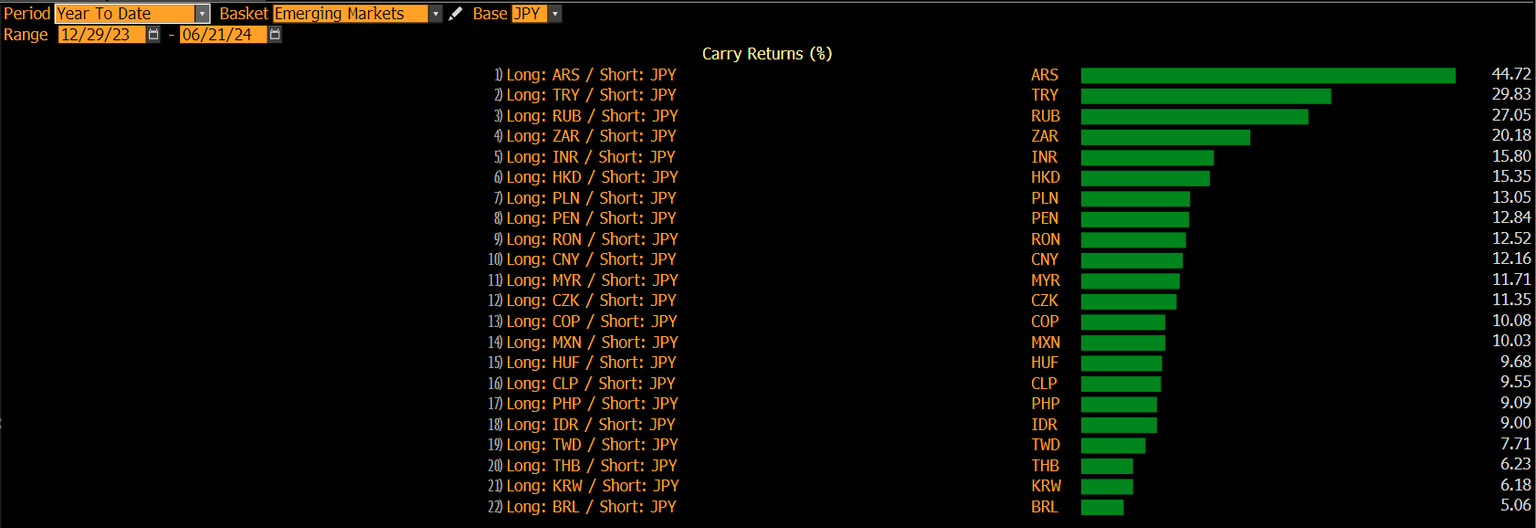

Dollar strength is widespread, and yen-funded carry trades in Latam FX are resurging following a brief pullback earlier in the month. Improved conditions in Mexico and South Africa post-election and a slowdown in easing cycles in Chile and Brazil are contributing to this trend. The low volatility during the summer months may prompt further carry trading interest in the markets.

Japan's Consumer Price Index (CPI) data, released this morning, fell short of expectations. While the May inflation print was higher than the previous month's, it highlights the need for gradual and modest policy normalization by the Bank of Japan (BOJ), suggesting limited potential for BOJ-driven yen strength.

Key levels

For the USDJPY pair, which is nearing the 159-level, intervention risks are a dominant consideration. Potential intervention levels are indicated by preconditions set by key Japanese policymakers, as below:

-

A 10 yen/USD move within one month: With the recent low in USDJPY at 154.55, that puts intervention risks at levels closer to 164+.

-

A 4% depreciation in the yen over two weeks: That will put intervention threat closer to 161 level in USDJPY.

On the downside, the 157-level may act as initial support, followed by the 50-day moving average support at 156.13.

Source: Bloomberg. Disclaimer: Past performance does not indicate future performance.

AUD/JPY close to 106-level is at a record high again, and above the 105-level in April when intervention was triggered.

MXN/JPY reversed from lows at 8.2129 and now back at 8.65+. The test of 200-day moving average at 8.7273 comes next and pre-election May high was at 9.4552.

Carry returns in ZARJPY have been close to 20% year-to-date, and South Africa’s post-election sentiment is running high on favourable fiscal and economic outlook.

Source: Bloomberg. Note: Past performance does not indicate future performance.

Read the original analysis: JPY: Three-way pressure piling up

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.