JPY still under pressure

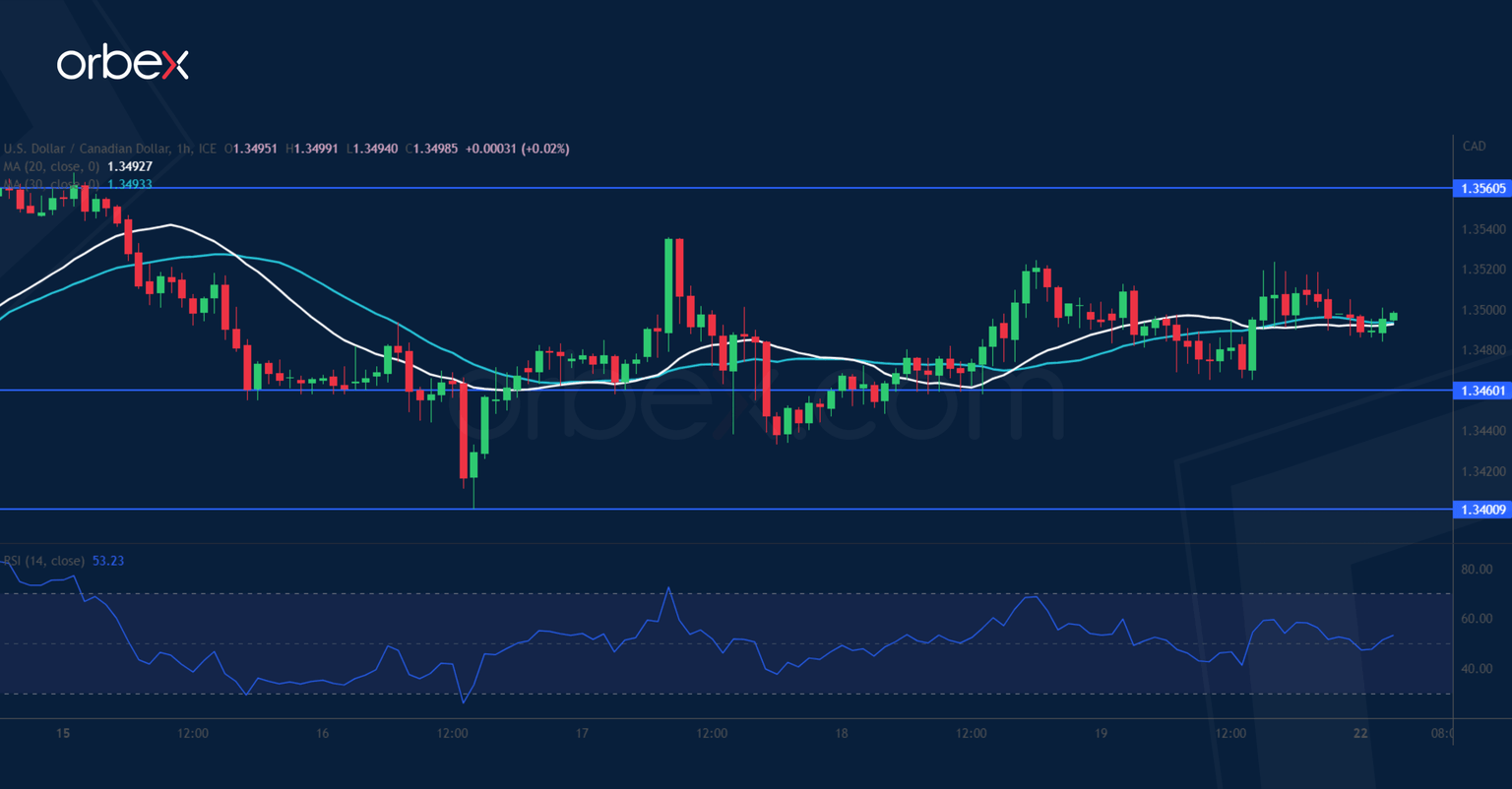

USD/CAD bounces back

The Canadian dollar held as the March retail sales showed a smaller-than-expected contraction. The pair is in a narrowing consolidation between 1.3400 and 1.3560. A bullish breakout would be a decisive signal that the upside has prevailed and the greenback may enjoy an extended recovery to this year’s high of 1.3850 where a follow-through breakout would resume the uptrend in the medium-term. 1.3460 is the first support in case of prolonged hesitation and 1.3400 an effective floor to maintain the upward skew.

EUR/JPY consolidates gains

Improved risk appetite continues to depress the Japanese yen. Sentiment has remained upbeat after the pair bounced off the 30-day SMA (146.50). A close above the previous swing high of 149.20 has forced short-term sellers out, leaving the door open to a potential broader rebound with the round number of 150.00 as the next hurdle. Its breach would carry the euro back to the recent peak of 151.50. 148.30 at the base of the bullish breakout is the first support in case the bulls need to consolidate their gains.

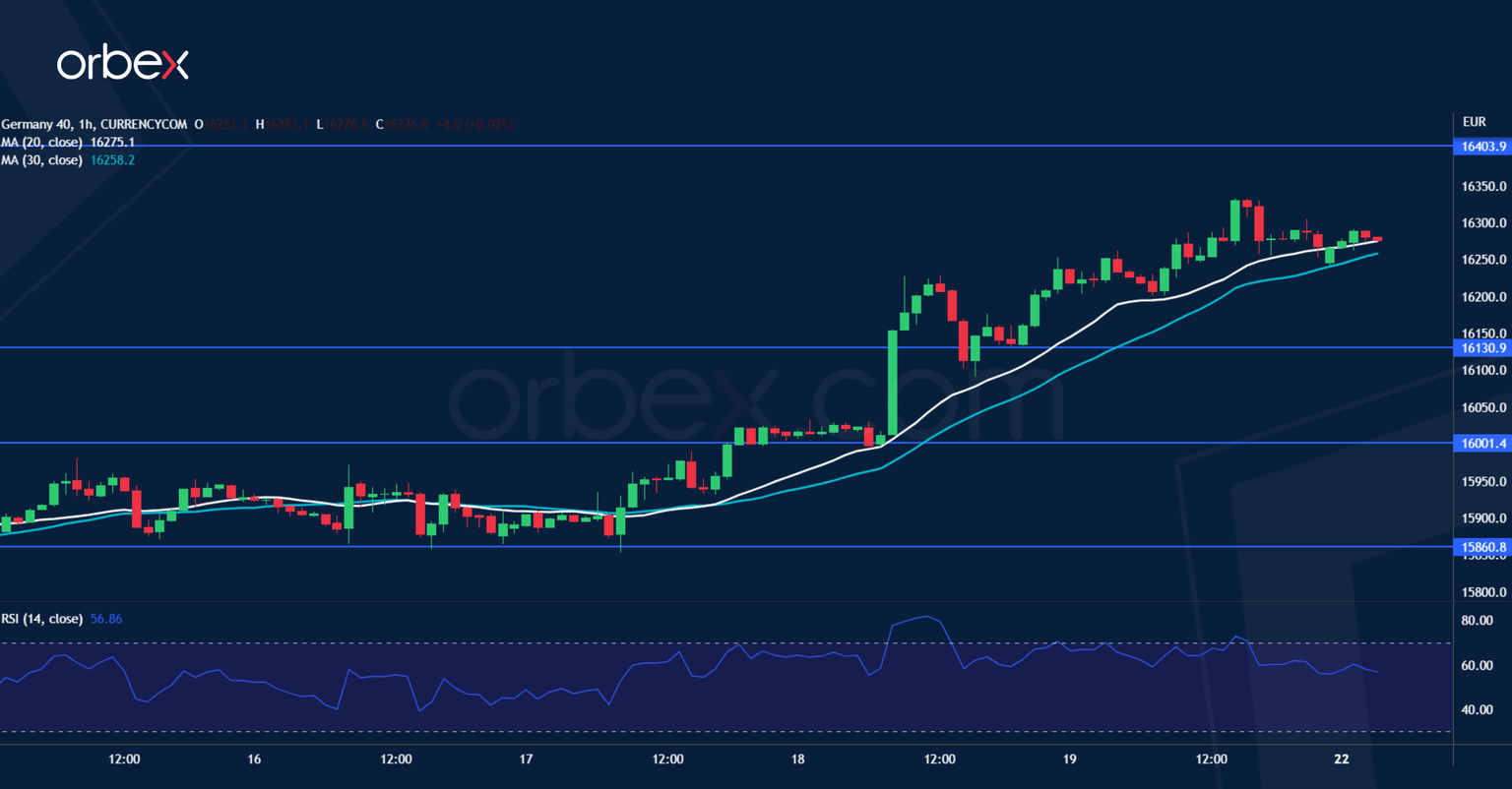

GER 40 rises to all-time high

The Dax 40 reached a fresh peak after a strong earnings season from European companies. The index has recovered back to its all-time high of 16290 which suggests a relentless bullish drive. 16400 is the next target ahead. Though the RSI’s overbought condition in this significant supply area may lead to a fallback if buyers start to bag some of their profits. 16130 is the closest support while the psychological level and resistance-turned-support of 16000 would be a second layer of defence in case of a deeper retreat.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.