JPY keeps falling

USD/JPY grinds rising trendline

The Japanese yen slips over rumours of an intervention once again by the authorities. The pair has been climbing along a rising trendline after it broke above the previous high at 145.80. As the price clears the psychological level of 150.00, the bullish continuation could carry the greenback to August 1990’s high at 151.20. Though the overextension may have prompted some buyers to take chips off the table. 149.50 on the trendline is the first level to gauge buyers’ interest in case of a pullback.

EUR/GBP tests resistance

The pound whipsawed after Truss announced her resignation as Britain’s prime minister. The euro has found support at the base (0.8580) of a bullish breakout in early September. The support-turned-resistance at 0.8760 is the first obstacle and its breach would lift offers to 0.8850, a major resistance before a full-blown recovery could materialise. The RSI’s overbought condition has limited the buying pressure, and 0.8650 is a fresh zone for accumulation. Further down, a fall below 0.8580 would invalidate the month-long rally.

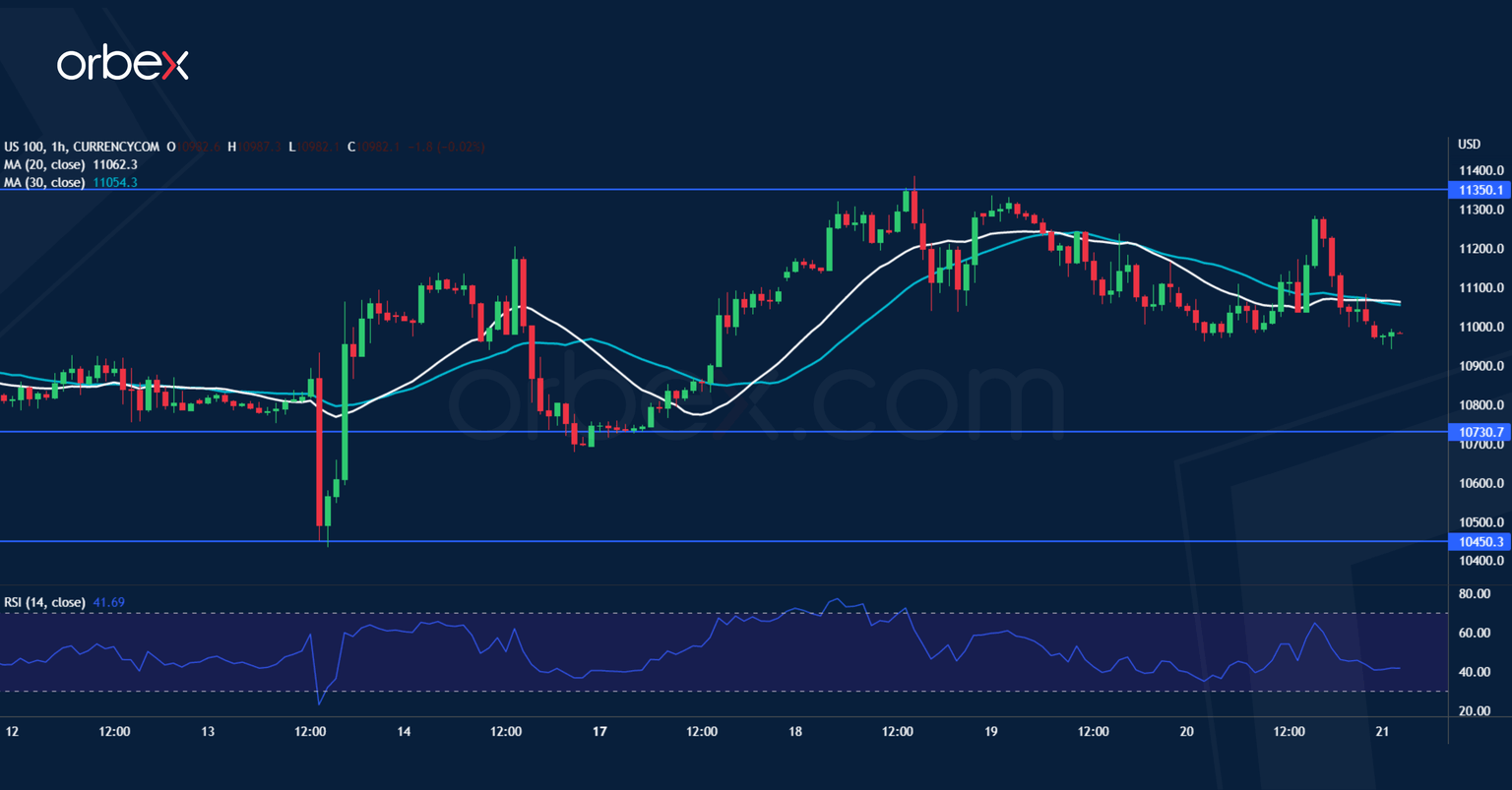

Nasdaq 100 seeks support

The Nasdaq 100 softened after Fed officials said the central bank would keep raising rates. The price action is struggling to claw back its previous losses. The latest bounce has met stiff selling pressure in the supply zone around 11350 next to the 30-day moving average. 10730 is an important support to keep the current rebounce relevant. 11650 would be the target should the bulls manage to hold onto their gains, putting an extended recovery within reach. However, a bearish breakout could trigger a sell-off below 10450.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.