JPY continues to recover

USD/JPY tests critical floor

The Japanese yen rallies as the BOJ considers raising its inflation forecast. The dollar’s rebound came to a halt at a previous low (134.50) from early December, which has turned into resistance. Sentiment remains downbeat after the greenback gave up all the gains. 130.50 is a major level to see whether the buy side will be strong enough to contain the fall. A bearish breakout would pave the way for a slide to 127.00. The RSI’s oversold condition may attract some bargain hunters and 133.00 would be the first hurdle to test.

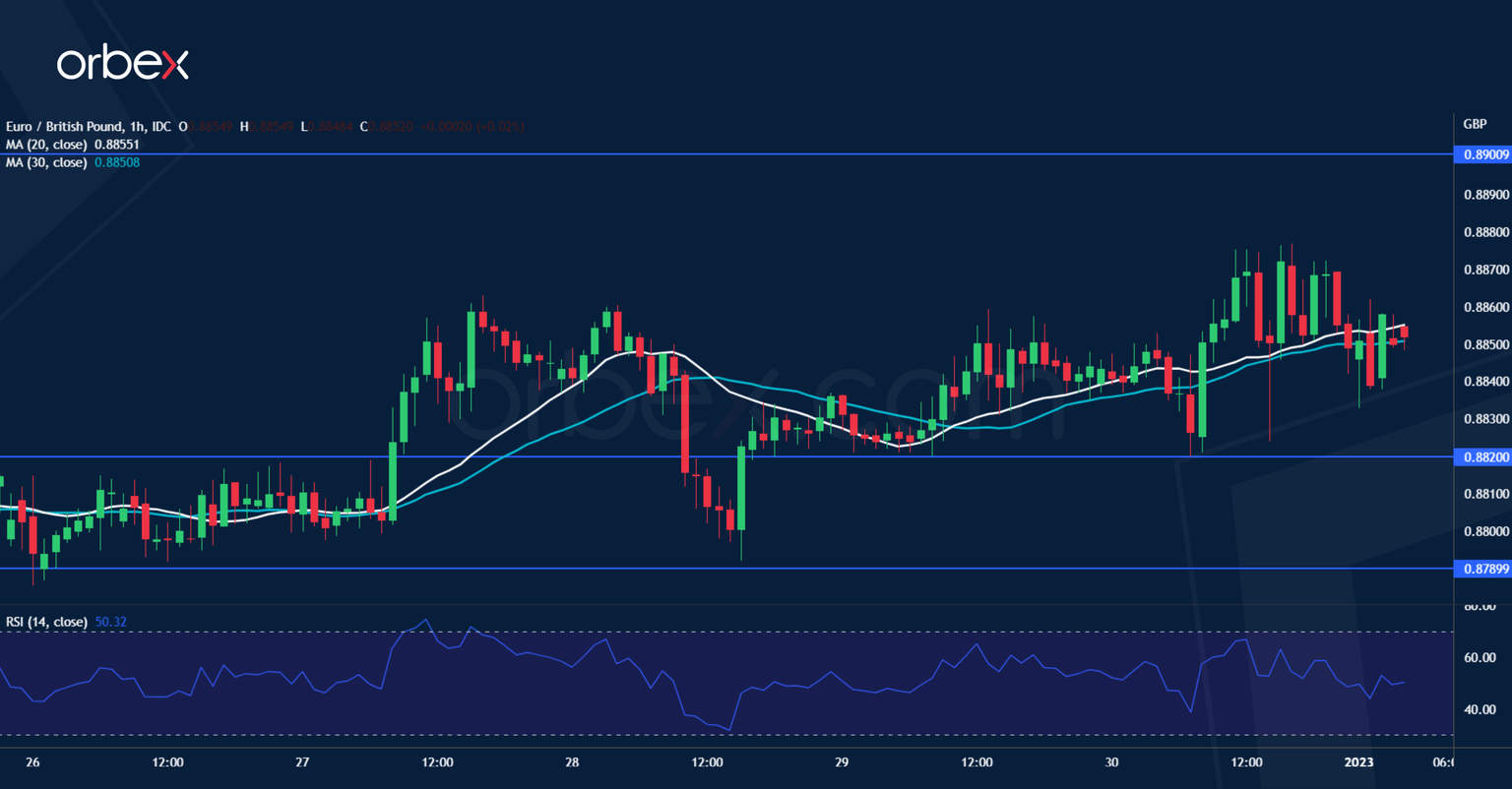

EUR/GBP breaks higher

The euro strengthened after ECB President Lagarde hinted at more tightening to cap wage growth. A bullish MA cross on the daily chart confirms the pair's recovery. A break above October’s high of 0.8860 might have put the euro on a fast track towards this year’s high above 0.9100. 0.8900 is the next resistance and 0.8970 at the start of a sell-off in September the last obstacle. An overbought RSI may trigger a limited pullback which could attract bids from trend-followers. Between 0.8820 and 0.8790 lies an important demand zone.

DAX 40 remains under pressure

The Dax 40 drifts lower as investors dread more aggressive moves from central banks. On the daily chart, after hitting last June’s peak of 14700, a bearish MA cross could foreshadow a deeper correction. Zooming into the hourly chart, the horizontal consolidation is a sign of momentary hesitation. 14150 at the top of the latest bounce coincides with the 20-day moving average and a failure to break higher by the bulls would mean that the path of least resistance would be down. 13850 is the immediate support.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.