JPY consolidates gains

USD/JPY breaks major support

The Japanese yen soared after the BoJ unexpectedly relaxed its yield cap. The previous rebound quickly had turned into a bull trap at 137.80 under the 20-day moving average. The sharp fall below 134.50 is a sign of liquidation, invalidating the recovery attempt. The August low of 130.50 is a critical floor to test the bulls’ resolve and its breach may pave the way for a bearish reversal in the new year. As the RSI sank into oversold territory, the former demand zone next to 135.00 has turned into a supply one.

NZD/USD struggles for support

The New Zealand dollar edges lower over a larger-than-expected trade deficit in November. The bears have faded last week’s bullish momentum and pushed the kiwi back below 0.6400. This level has since become a fresh resistance which suggests strong pressure ahead. Previous lows around 0.6300 coincide with the 20-day moving average and an attempt to break below puts the pair at the risk of a deeper correction, with 0.6200 as a possible target. A close back above 0.6400 would keep buyers in the game.

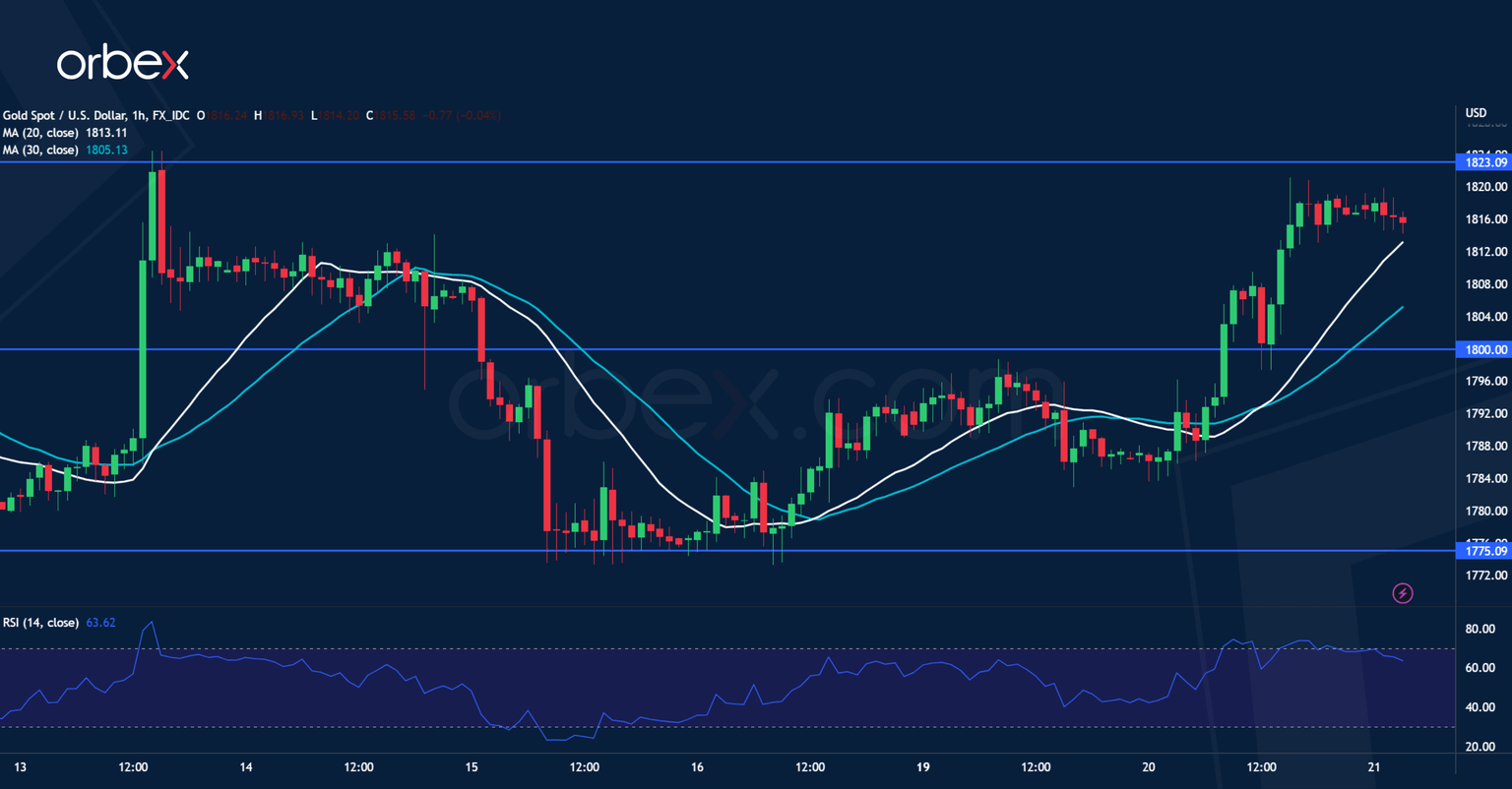

XAU/USD grinds resistance

A retreating US dollar boosted the appeal of bullion. Despite the metal’s choppy price action, the bulls have been looking to consolidate their gains above August’s high of 1805. With sentiment shifting to a brighter side, more buyers may place follow-up bids as the RSI drops back to the neutral area on the daily chart. This could be confirmed by the price bouncing off the 20-day moving average (1775) then the psychological tag of 1800. A close above the recent high of 1823 could attract momentum buyers and trigger a rally to 1860.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.

-638072051751665383.png&w=1536&q=95)

-638072051216720740.png&w=1536&q=95)