Jobless Claims Analysis: At 6.648 million, this corona-carnage is here to stay, dollar implications

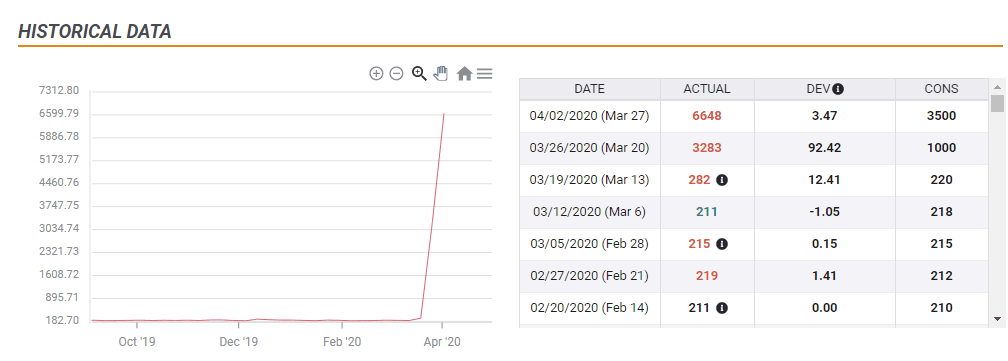

- US jobless claims are at 6.648 million in the week ending March 28.

- Devastating data is set to continue beyond April and cause long-term damage.

- The impact on the dollar depends on policymakers’ reactions.

Catastrophic data – no superlative is exaggerated for these horrendous weekly jobless claims figures. The number of claims doubled in comparison to the previous week, which already a historic record.

This comes on the background of reports claiming that various states are unable to process requests at a satisfactory pace.

The US economy has been put into an induced coma – social distancing to fight the virus – but may have a hard time waking up. Returning to pre-crisis output and employment may take a significant period of time.

President Donald Trump has extended the stay-at-home guidelines until the end of April, with most states already imposing shelter in place orders. However, it will take time until some restrictions are lifted – and only gradually. According to New York Governor Andrew Cuomo, the death toll from COVID-19 will likely remain high until the summer.

People that are temporarily out of work may find that staying at home is not an ephemeral phenomenon. And when the economy wakes up, the businesses that have employed these people may be out of business.

While the Federal Reserve seems to have prevented a financial crisis, the economic crisis continues unfolding. For stock markets, the terrible jobless claims statistics are bad news.

What about the dollar?

The answer depends on politicians. Congress has passed a $2.2 trillion fiscal package – a huge undertaking that may be insufficient. With such figures, additional help will likely be needed to keep the masses of the unemployed content and able to hold on. Expenditure would also be warranted to support businesses from shutting shop and from employers to fire workers.

The scale is proving gargantuan.

If Washington works toward a new package, it will help stem the tide and weigh on the safe-haven dollar. While politicians often move slowly, the crisis has accelerated their responses. Democrats are already pushing for a fourth stimulus deal, and President Donald Trump is touting a massive infrastructure bill.

However, Senate Republicans are reluctant to move forward. Without immediate help from the federal government, the pain to the economy and stocks would worsen. And for the greenback, it means more gains.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.