Job openings decline by over a million, but what does it mean?

Job openings decline but from record levels. Let's discuss the implications.

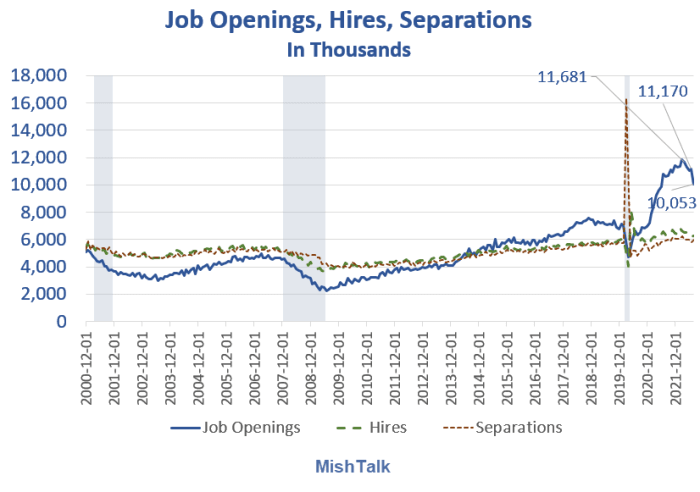

The BLS Job Openings and Labor Turnover (JOLTS) report for August shows a record decline in openings.

Job openings

- On the last business day of August, the number and rate of job openings decreased to 10.1 million (-1.1 million) and 6.2 percent, respectively.

- The largest decreases in job openings were in health care and social assistance (-236,000), other services (-183,000), and retail trade (-143,000).

Hires

- In August, the number of hires was little changed at 6.3 million, and the rate was unchanged at 4.1 percent.

- Hires decreased in federal government (-8,000).

Separations

- The number and rate of total separations were little changed at 6.0 million and 3.9 percent, respectively. Total separations increased in accommodation and food services (+175,000).

- The number of quits was little changed at 4.2 million, and the rate was unchanged at 2.7 percent. Quits increased in accommodation and food services (+119,000) but decreased in professional and business services (-94,000).

- The number and rate of layoffs and discharges were little changed at 1.5 million and 1.0 percent, respectively. Layoffs and discharges were little changed in all industries.

- The number of other separations was little changed at 358,000. Other separations decreased in information (-6,000) and in federal government (-3,000).

Separation categories

Total separations includes quits, layoffs and discharges, and other separations. Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. Layoffs and discharges are involuntary separations initiated by the employer. Other separations includes separations due to retirement, death, disability, and transfers to other locations of the same firm.

An opening for the Fed?

The Wall Street Journal says Job Market Gives Fed an Opening

Finding a job has gotten a tiny bit harder. Will that be enough to keep the Federal Reserve from slamming the brakes on the economy?

Maybe with a bit less competition for workers, the wage pressures that Fed policy makers worry will lead to entrenched inflation will abate some. That in turn could lead to an outcome in which the Fed doesn’t feel compelled to raise rates to the point that the economy is rapidly shedding jobs and in a clear recession.

Such a scenario is, in fact, what the Fed seems to be banking on. In his news conference following the central bank’s July rate-setting meeting, Fed Chairman Jerome Powell said that he and his fellow policy makers believe “that the labor market can adjust because of the huge overhang of job openings.” In other words, businesses might shelve openings rather than lay off workers. Shortly thereafter, Fed governor Chris Waller and Fed associate director Andrew Figura published a note arguing that a significant drop in the vacancy rate—the number of job openings divided by the size of the labor force—might bring with it only a relatively slight increase in the unemployment rate.

This view isn’t without controversy: Economists Olivier Blanchard, Alex Domash and Lawrence Summers wrote that they found Messrs. Waller’s and Figura’s argument “entirely unconvincing as support for ‘the soft landing’ idea.” Rather, they concluded that a sharp drop in vacancies to historically normal levels is unlikely to occur without a corresponding major increase in unemployment.

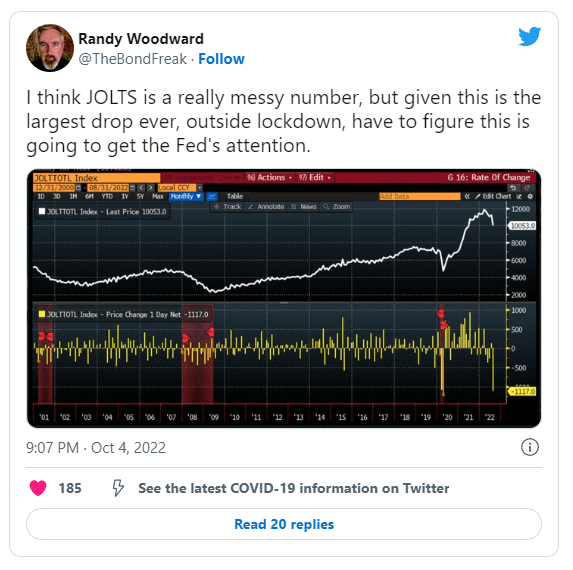

Getting the Fed's attention

Q&A on getting attention

Q. Will this get the Fed's attention?

A: Yes, but not for what I believe is the reason for the question.

The Fed will not pivot on this news. Indeed, it is pleased if not outright thrilled with the report.

The Fed wants labor market slack to go away to reduce pressure on wages. And as long as the unemployment rate does not soar to unacceptable levels, the Fed will keep on hiking until there is a credit market event.

What about soft landing theory?

The soft landing theory is nonsense.

Blanchard, Domash and Summers say The Fed is wrong: Lower Inflation is Unlikely Without Raising Unemployment

I agree with that statement as it sits. But as it sits does not imply the magnitude of an unemployment rise.

Beveridge curve silliness

The trio use a Beveridge Curve analysis, another questionable economic model.

All recessions are different and so are initial conditions heading into them.

This is not 2008. Nor is it 2020. Both of those recessions had huge rises in unemployment for different reasons.

Importantly, the economy lost the most jobs on record in 2020 and those jobs never fully recovered.

If job losses are not fully recovered, unless the shock is huge, it stands to figure the rise in the unemployment rate will be below average.

I suggest the rise in unemployment will be way below average because we are coming off the largest rise in unemployment in history, by far.

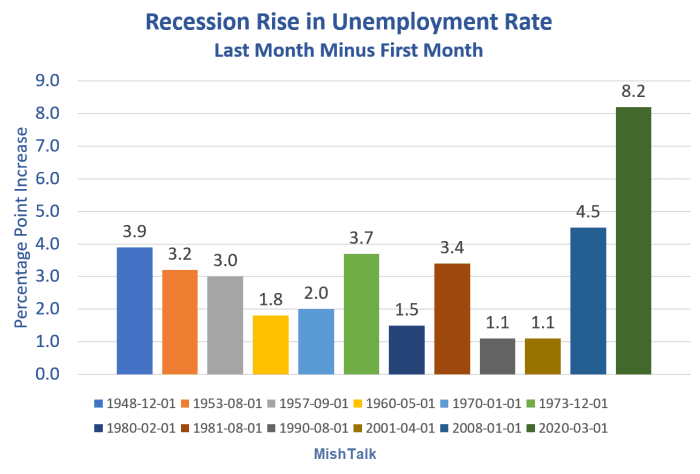

Rise in unemployment vs recessions

Unemployment data from the BLS, chart by Mish

In the brief 2020 recession, the unemployment rate shot up by 8.2 percentage points. And the BLS acknowledges the number is understated.

In 2008, the unemployment rate shot up by then the most in history, at 4.5 percentage points.

In contrast, unemployment only rose by 1.1 percentage points in 2001 and 1990.

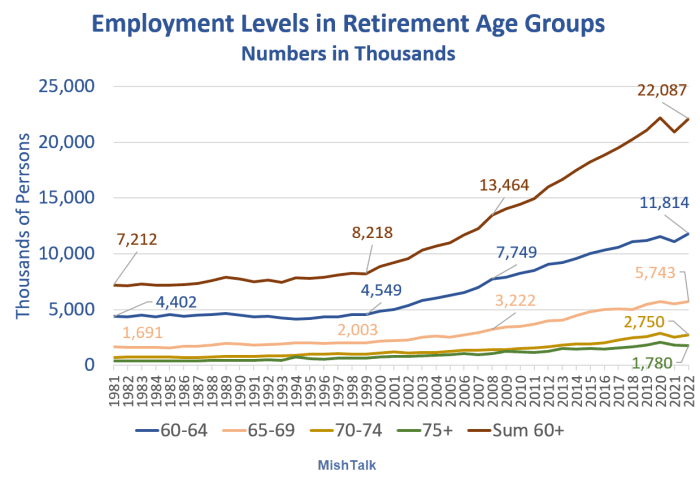

What about demographics?

Employment levels from the BLS, chart by Mish

As of January there were over 22 million workers age 60 or over. Many millions of them are likely to soon retire.

This puts upward pressure on hiring and it is yet another reason to throw standard economic models out the window.

I have not looked at the Beveridge Curve to comment in detail but the amount of nonsense spewed over the Phillips Curve and Inflation Expectations is staggering.

Economists rely on questionable, even disproved models because they cannot think.

Inflation expectations are crashing. So what? It doesn't matter

For discussion of inflation expectations and the Phillips Curve, please see Inflation Expectations are Crashing. So What? It Doesn't Matter.

Fed studies and common sense debunk the inflation expectation theory. See the above link for details.

And now, instead of thinking, economists are debating the Beveridge Curve.

Soft landing out and so is massive rise in unemployment

Add it all up and the soft landing theory of the Fed is laughable. There will be a recession.

But also toss out the idea of a huge rise in unemployment.

Put the pieces together and you get to my position: Expect a Long But Shallow Recession With Minimal Job Losses

Substitute very weak growth for years rather than recession if it suits your fancy. We are at the mercy of how the NBER defines recession.

My view is the exact opposite of the Covid recession for reasons explained. Models not necessary, just a bit of common sense.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc