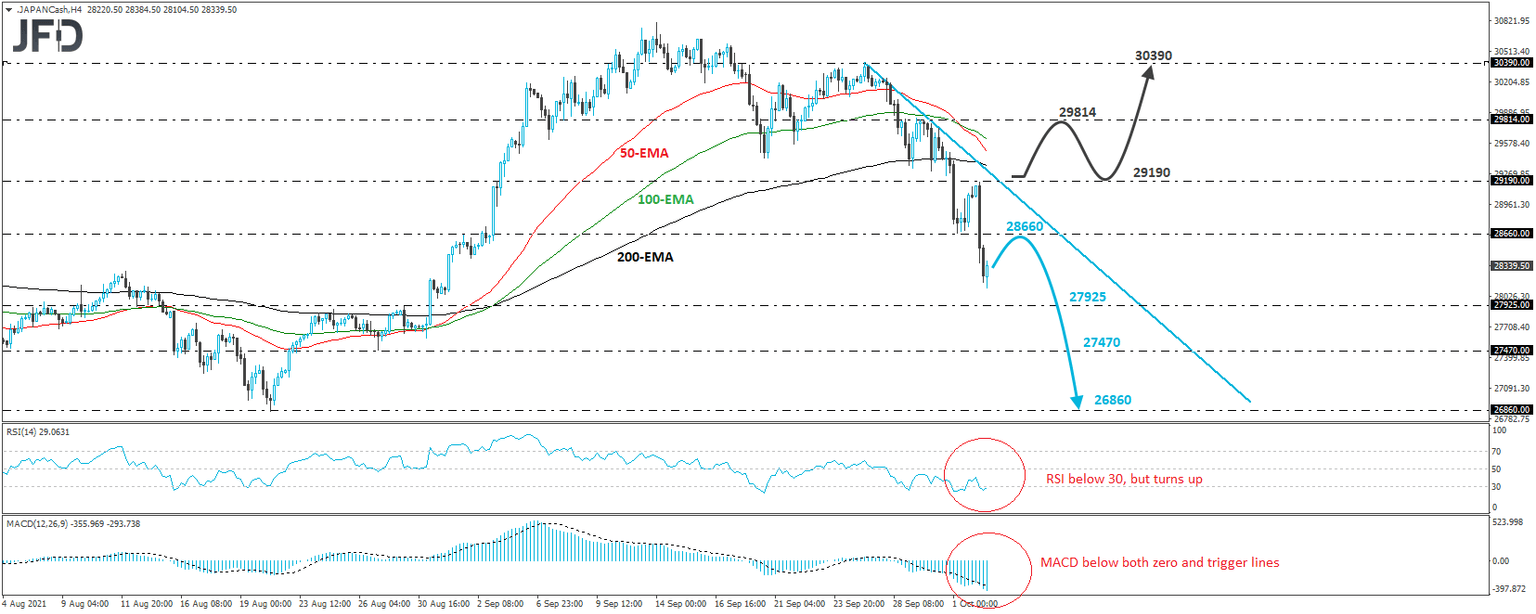

Japan’s Nikkei 225 falls below 28660

The Japanese Nikkei 225 cash index fell sharply on Monday, breaking below the 28660 barrier, marked by the low of October 1st, thereby confirming a forthcoming lower low. The price continues to print lower lows and lower highs below the downside resistance line drawn from the high of September 27th, and thus, we will consider the short-term outlook to be negative for now.

We see some signs that a small rebound may be looming, but as long as the price stays below the downside line, we would treat that as a corrective bounce. The bears may take charge from near the 28660 zone and push the action down to the 27925 barrier, marked by the inside swing high of August 30th. If they don’t stop there, we could see them aiming for the low of August 27th, at 27470, the break of which could extend the fall towards the low of August 20th, at 26860.

Shifting attention to our short-term oscillators, we see that the RSI lies below 30, and that the MACD runs below both its zero and trigger lines. Both indicators detect strong downside speed and support the notion for further declines. However, the RSI has just turned up, adding to our cautiousness over a small corrective bounce before the next leg south.

In order to abandon the bearish case, we would like to see a recovery above 29190. This will not only confirm the break above the downside resistance line, but it will also confirm a forthcoming higher high. The bulls may then climb towards the peak of September 29th, at 29814, where another break may carry more extensions, perhaps towards the peak of September 27th, at 30390.

Author

JFD Team

JFD