Japanese Yen slips as Powell signals small cuts

USD/JPY is calm on Tuesday after the US dollar jumped 1.03% a day earlier. In the European session, the yen is trading at 143.76 at the time of writing, up 0.10%.

Japan’s parliament elects Ishiba prime minister

Japan’s political drama continued on Tuesday with the election of a new prime minister, Shigeru Ishiba. The ruling Liberal Democratic Party chose Ishiba as its new leader on Friday and parliament has elected him as prime minister, replacing Fumio Kishida.

Ishiba has supported the Bank of Japan tightening its monetary policy. In August, Ishiba said that the Bank of Japan was “on the right policy track” by gradually raising interest rates and the yen surged 2.1% on Friday after the news that Ishiba would become prime minister.

Has Ishiba changed his tune? He sounded much more dovish on Friday, saying that Japan’s monetary policy will remain loose and that he would not request the BoJ to tighten policy, but was not opposed to further rate hikes. It remains to be seen if Ishiba has changed his stance on monetary policy or is this a case of an experienced politician avoiding controversial positions as he begins his prime ministership.

The yen declined sharply on Monday as Federal Reserve Chair Powell signaled that he was not planning further oversized rate cuts, saying the economy was in “solid shape”. Powell said the Fed was not in a hurry to cut rates quickly and his remarks have dampened expectations for a 50-basis point cut at the November meeting.

The markets have priced in a 50-bps cut at 38%, down sharply from 58% just one week ago, according to the FedWatch tool. The Fed delivered its first rate cut in over four years last month and with inflation largely beaten, is expected to aggressively cut rates in the coming months.

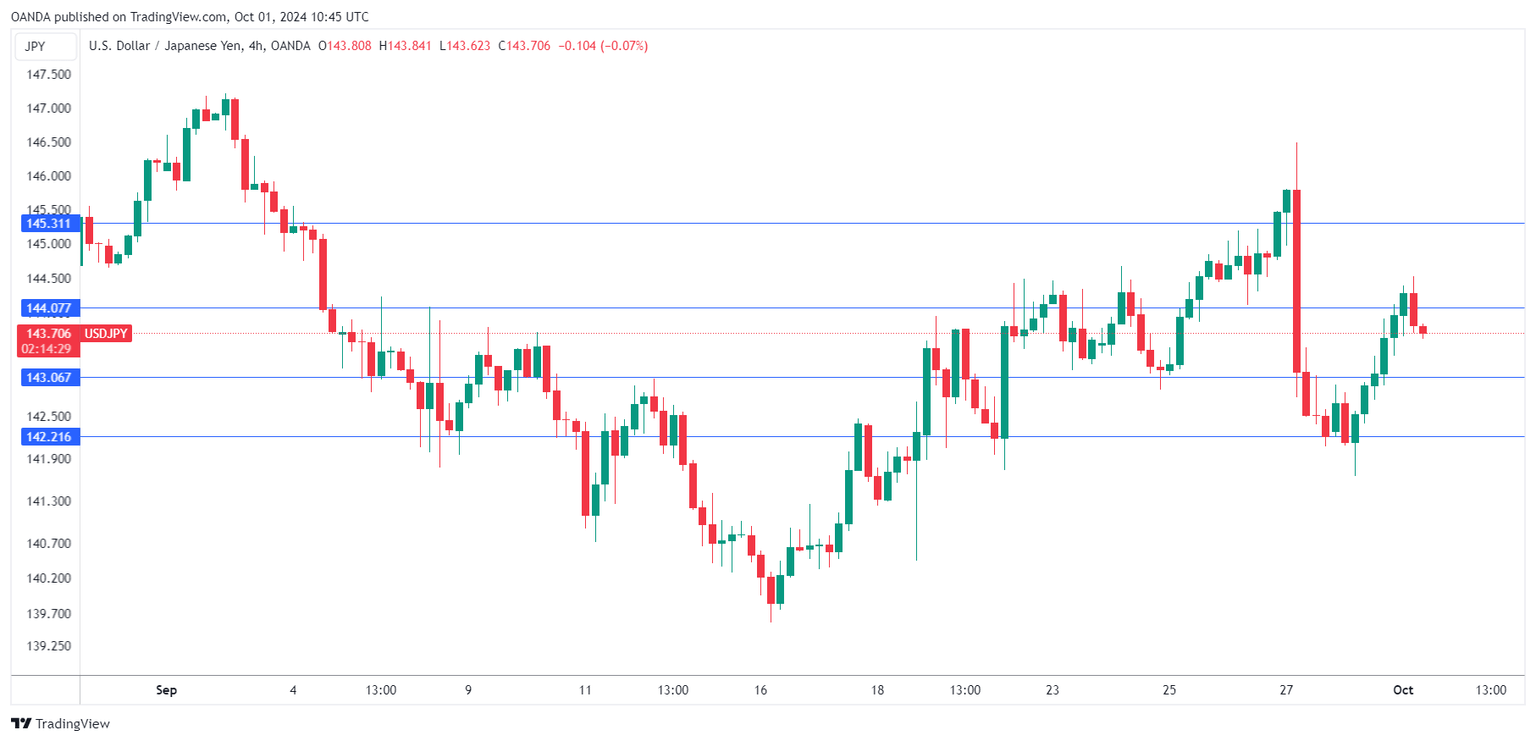

USD/JPY technical

-

USD/JPY tested resistance at 144.08 earlier. Above, there is resistance at 145.34.

-

There is support at 143.07 and 142.21.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.