Japanese Yen improves to six-week high

- Japanese yen posts sharp gains on Monday.

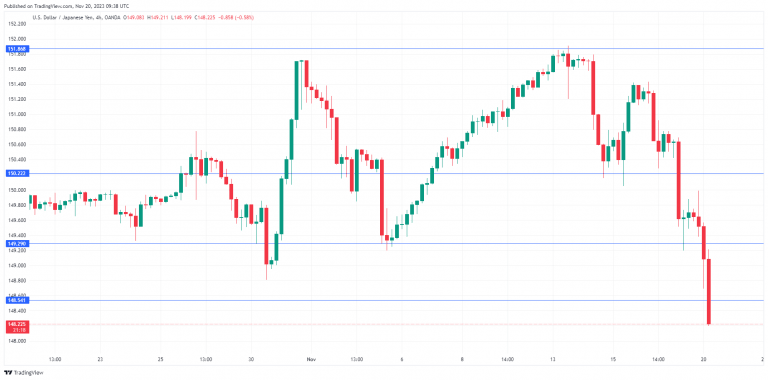

The Japanese yen is up for a third straight day on Monday and has climbed 2% against the US dollar in the current rally. In the European session, USD/JPY is trading at 148.40, down 0.84%.

After falling to a one-year low last week, the yen has rebounded and is trading at a six-week high. The swing in favour of the yen has been driven by expectations that Fed policy will be less restrictive in the first half of 2024. According to the CME’s FedWatch tool, there is a 100% likelihood of a pause in December, with a 30% chance of a rate cut in March 2024, followed by a 64% chance in May.

The yen has received a boost as the US/Japan rate differential has decreased. Just a month ago, 10-year US Treasuries were trading at 4.98%, but have fallen to 4.44% at present. The lower yields have made US Treasuries less attractive to investors and the yen has capitalized on this sentiment. The FOMC minutes will be released on Wednesday and could provide some insights into the Fed’s future rate path.

The recent strength of the yen has tempered talk of intervention by Japan’s Ministry of Finance, which threatened to step in after the USD/JPY fell close to 152 last week. The yen has been showing sharp swings of late, raising the question of whether the yen’s recent upswing is sustainable.

Investors are also looking for hints from the Bank of Japan about tightening policy. The central bank has tried to dampen expectations for a shift in monetary policy, but there have been some subtle signals that the BoJ will exit negative rates in 2024.

USD/JPY technical

-

USD/JPY has pushed below support at 149.29 and is testing support at 148.54.

-

There is resistance at 150.22 and 151.25.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.