The USD/JPY pair climbed to 153.77 on Monday, reaching a three-week high. This movement reflects growing investor sentiment that the Bank of Japan (BoJ) will maintain its current interest rate level and continue its pause on monetary policy tightening at this week's meeting. Recent statements from the BoJ have indicated a need for more evidence to substantiate wage increases before considering rate changes.

Expectations of a BoJ rate hike had previously supported the yen, mitigating external pressures. However, confidence in the BoJ's commitment to tightening seems to wane as time progresses.

Despite this, Japan's domestic economic indicators appear positive. October's primary machinery and equipment orders surpassed expectations, and recent reports have shown improvement in both manufacturing and service sector activity in December.

BoJ policymakers are increasingly unconcerned about the weakening yen's potential to accelerate inflation, which is already at desirable levels. However, further yen depreciation could push inflation higher, a scenario that remains on the central bank's radar.

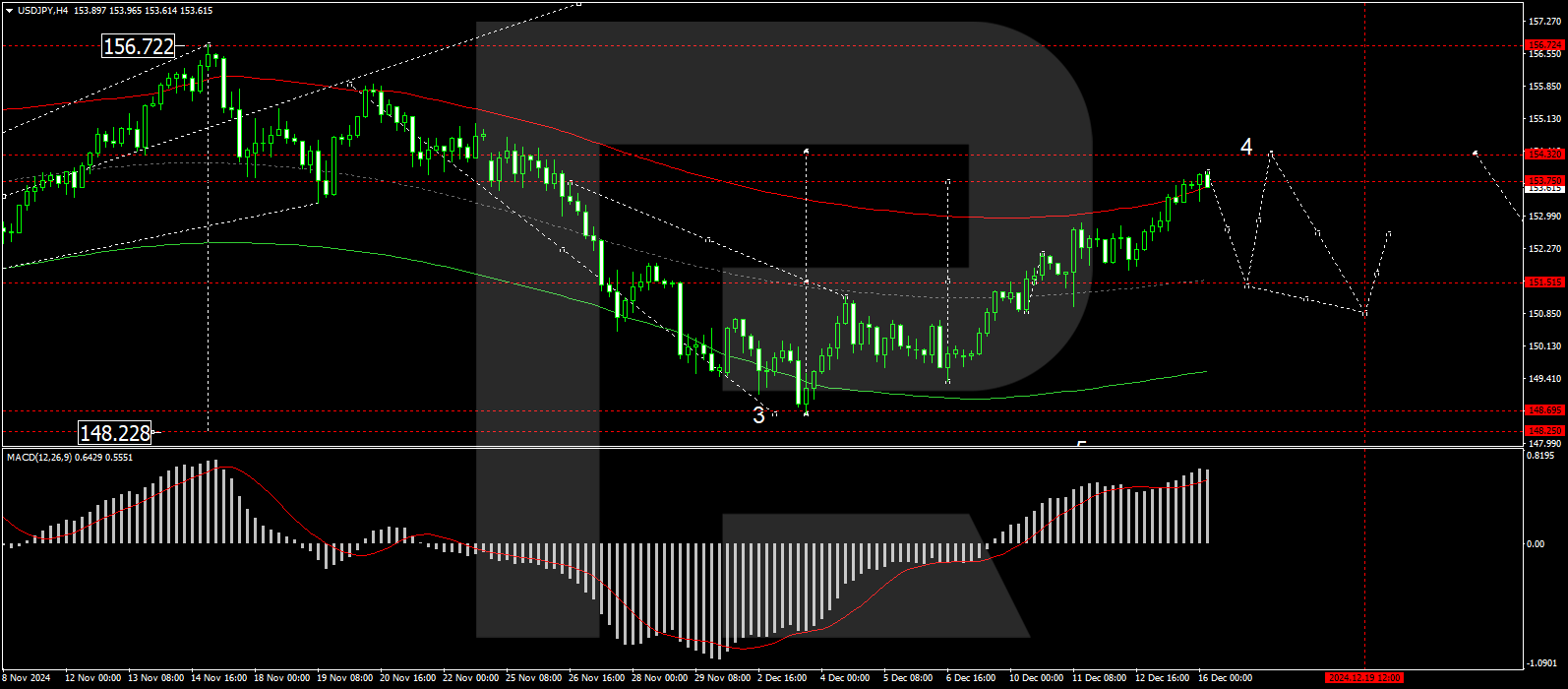

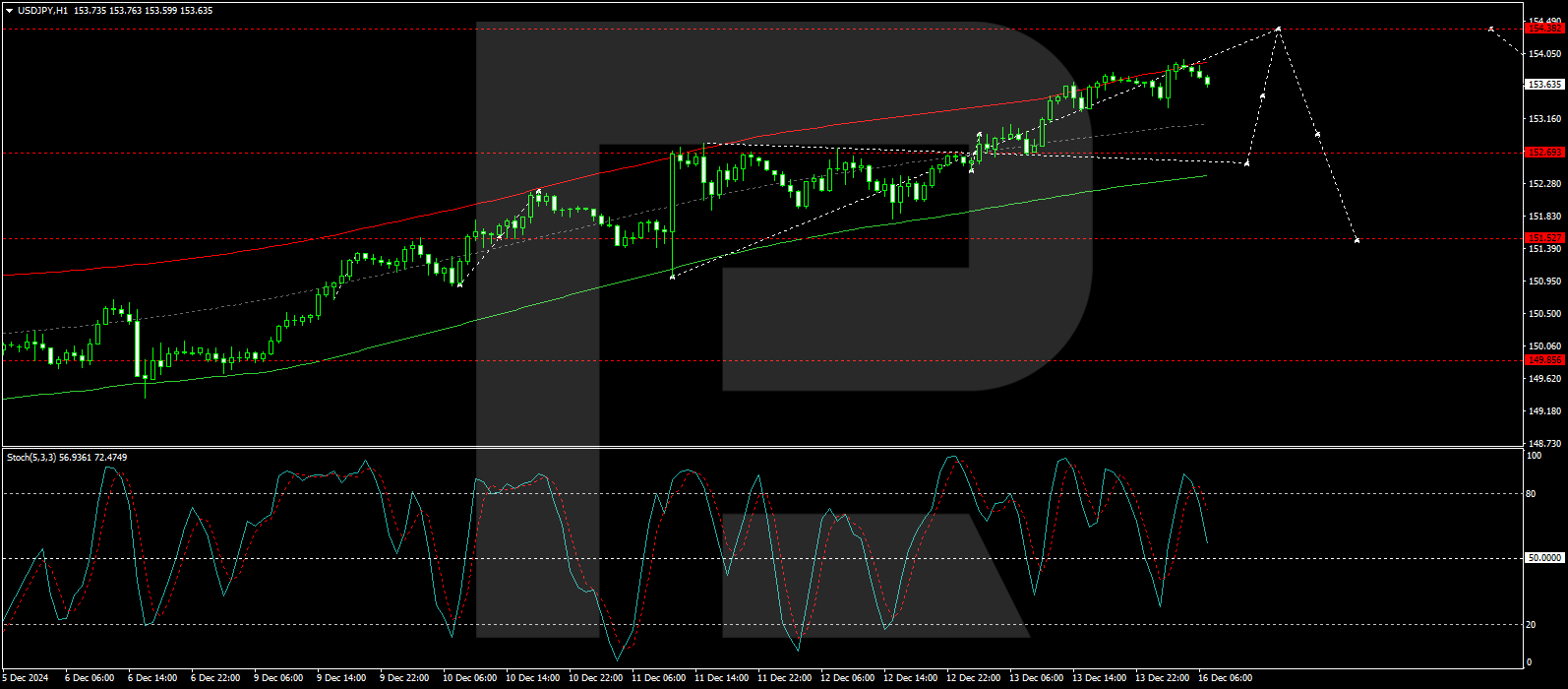

Technical analysis of USD/JPY

H4 chart: USD/JPY has established a consolidation range around the 151.51 level, from which it has continued its upward trajectory. The pair recently touched 153.93, and current technical setups suggest a potential consolidation below this peak. Should the price break downward, a corrective movement to retest 151.51 is possible, followed by another potential rise towards 154.40. The MACD indicator supports this view, with its signal line well above zero but indicating readiness for a downward correction.

H1 chart: The shorter-term H1 chart shows the USD/JPY forming a growth structure aimed at 154.40. After completing a consolidation around 152.70 and achieving a local high at 153.93, a correction back to at least 152.70 is anticipated. Following this correction, the market may initiate a new growth phase targeting 154.40. The Stochastic oscillator aligns with this analysis. It is currently positioned below 80 and poised to move down towards 20, suggesting an impending correction before further upward movement.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds near 1.0500 after EU PMI data

EUR/USD fluctuates in a narrow channel at around 1.0500 on Monday after EU PMI data came in better than expected. ECB President Lagarde reiterated that they will continue to cut rates if data confirm disinflation is on track. Market focus shifts to US PMI data.

Bitcoin breaks all-time high above $106,000, triggers nearly $120 million in liquidations

Bitcoin hit a record high above $106,000 on Monday, after recent developments on President-elect Donald Trump’s strategic Bitcoin reserve and demand from institutional traders.

GBP/USD extends recovery beyond 1.2650 ahead of US data

GBP/USD gathers recovery momentum and trades above 1.2650 on Monday, supported by the UK PMI data that showed that the private sector continued to grow in early December. The US economic docket will feature flash PMI readings for December.

Gold price sticks to modest intraday gains above $2,650 amid mixed cues

Gold price stages a modest recovery from a one-week trough touched earlier this Monday, albeit it lacks follow-through buying and currently trades around the $2,655 region.

Can markets keep conquering record highs?

Equity markets are charging to new record highs, with the S&P 500 up 28% year-to-date and the NASDAQ Composite crossing the key 20,000 mark, up 34% this year. The rally is underpinned by a potent mix of drivers.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.