Japanese Yen eyes wage data

The yen has edged higher on Wednesday. In the European session, USD/JPY is trading at 158.33, up 0.19% on the day.

Japan’s consumer confidence for December data showed a slight decline, falling to 36.2 from 36.4 in November. This missed the market estimate of 36.4 as consumers remain in a pessimistic mood about economic conditions.

Japan’s wage growth expected to rise

Japan will release wage growth early on Thursday and Bank of Japan policy makers will be watching carefully. The market estimate for November stands at 2.7%, up from 2.6% a month earlier. Governor Ueda has repeatedly said that he won’t raise rates before wage growth approaches a level consistent with 2% inflation. Ueda has been mum about a time frame and the BoJ is hesitant to telegraph its rate plans ahead of time, in order to ward off yen speculators. This leaves investors with a great deal of uncertainty with regard to the timing of a rate hike. The BoJ meets next on Jan. 23-24 and could announce a rate hike, or remain on the sidelines until March or even later.

The BoJ is also concerned about the yen’s rapid descent. The Japanese currency plunged 10.3% against the dollar in 2024 and could face further headwinds, including an incoming Trump administration that has pledged trade tariffs. The government intervened in the currency markets last July after the yen fell to 160 against the dollar and the yen is closing in on that level.

The US posted strong data on Tuesday. The ISM Services PMI rose to 54.1 in December, up from 52.1 and above the market estimate of 53.3. JOLT Job Openings jumped to 8.09 million in November and 7.8 million in October. The market is looking ahead to Friday’s nonfarm payrolls, which is expected to drop to 154 thousand, compared to 227 thousand in November.

USD/JPY technical

-

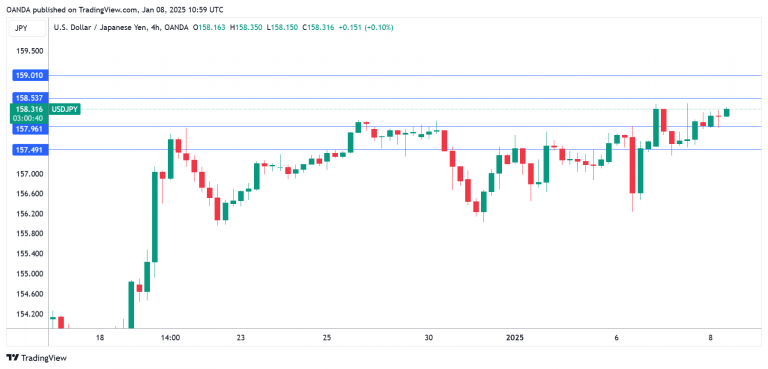

USD/JPY tested support at 157.96 earlier. Next, there is support at 157.49.

-

There is resistance at 158.54 and 159.01.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.