Japanese Yen eyes potential intervention amid rising USD/JPY

The USD/JPY currency pair, after almost breaching the significant 150.00 threshold, retreated slightly. As of Monday morning, the pair stands close to this pivotal mark at 149.93.

This temporary pullback is hinged on the anticipation that the US Federal Reserve might uphold the prevailing interest rates for an extended duration at its upcoming meeting.

However, the immediate circumstances are what truly grip the market's attention. A leap beyond the 150.00 mark in the USD/JPY might be interpreted as a cue for Japanese monetary authorities to step in with an intervention. Notably, on 3 October, the greenback soared to 150.16 but experienced a swift descent. The financial fraternity remains in the dark about whether this drop was an outcome of market jitters or a sequence of automated trading orders being triggered.

The decision to implement currency interventions rests upon the perspectives of the Central Bank and the Ministry of Finance.

Technical Analysis: USD/JPY

On this timeframe, USD/JPY managed to hit the predicted peak of its bullish wave at 149.81 before initiating a mild correction to 148.72. Presently, the bullish structure is expanding, targeting 150.77. A recent bullish leg concluded at 149.92, with a consolidation pattern emerging underneath. A bearish adjustment to 149.33 seems plausible before a surge towards 150.15. From this juncture, the upward trajectory might continue to 150.77. The MACD lends technical validation to this forecast. Its signal line, positioned comfortably above the zero benchmark, points definitively northwards, suggesting further elevation.

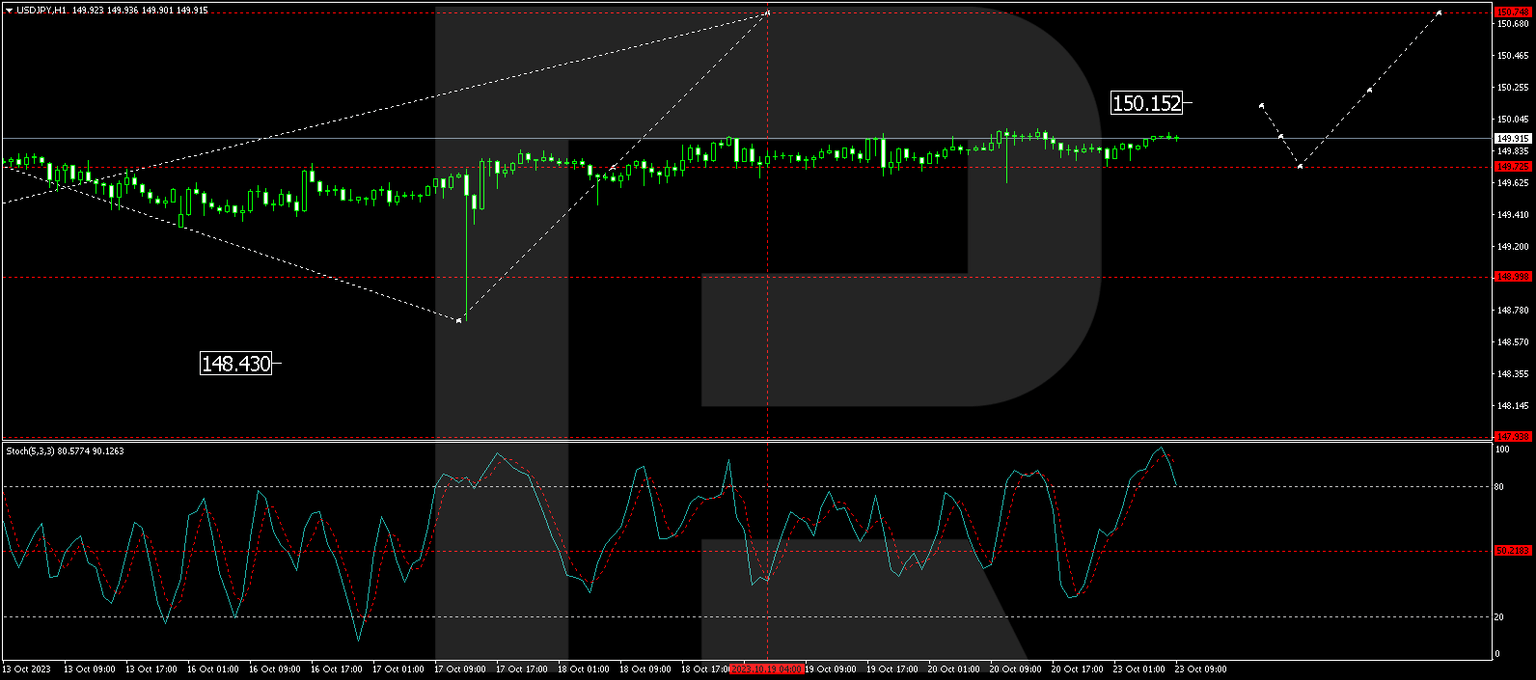

In the H1 outlook, a consolidation pattern is noticeable around the 149.73 region. The market currently depicts an upward movement towards 149.90. Subsequent movements might see a dip to 149.72 and then a rally to 150.15, potentially leading to 150.77. The Stochastic oscillator backs this analysis. Its signal line, presently above the 80 level, is oriented southwards, targeting the 50 benchmark. An anticipated rebound from this point, followed by an ascent to 80, seems likely.

Conclusion

The USD/JPY continues to flirt with the crucial 150.00 level, inciting speculation about potential intervention by Japanese financial authorities. While recent price movements suggest bullish momentum, traders should remain vigilant and consider both fundamental catalysts and technical signals before making trading decisions.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.