Japan GDP Preview: Economy is expected to lose momentum in Q1

- The Japanese Gross Domestic Product is seen contracting at an annualized rate of 1.5% in Q1.

- The Japanese economy avoided a technical recession in Q4 2023.

- Investors expect the BoJ to hike rates by 50 bps in the next 12 months.

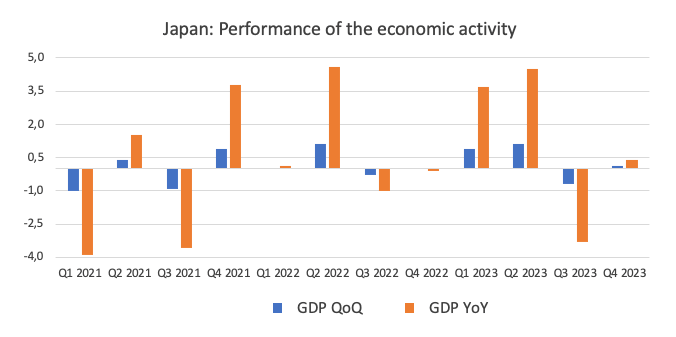

Japan’s Cabinet Office will publish the first estimate of the domestic Gross Domestic Product (GDP) for the January-March period on Thursday. The report is expected to show an annualized economic contraction of 1.5% after growing at an annualized pace of 0.4% during the previous quarter.

Forecasting Japan's Gross Domestic Product

Thursday's economic agenda in Japan features the unveiling of the initial estimate of the GDP report for the January-March period, set to be disclosed at 23:50 GMT on May 15.

Analysts anticipate that the first assessment will reveal a 1.5% drop for the world's fourth-largest economy during the January–March period, a reversal of the robust performance recorded in the last quarter of 2023, when the economy expanded at an annualized 0.4% after avoiding a technical recession in the same period.

On the latter, it is worth recalling that the economy expanded by 0.1% QoQ in the October-December period following a 0.7% decline observed in the previous quarter.

When is the GDP print released, and how can it affect JPY?

The Japanese GDP report will be published at 23:50 GMT on Wednesday. Meanwhile, the depreciation of the Japanese currency remains well in place, as USD/JPY already recovered around the 61.8% Fibonacci retracement level of the post-suspected FX intervention by the Japanese Ministry of Finance (MoF) that dragged spot to the sub-152.00 region between April 29 and May 3.

Results of the GDP readings in line with expectations could well play against the BoJ’s intentions to hike its policy rate in the medium term, and hence favour the continuation of the current accommodative stance. Investors are currently pricing in that the Bank of Japan (BoJ) will hike rates by 50 bps in the next 12 months.

Such a scenario appears favourable to the continuation of the selling pressure in the Japanese yen and underpins extra upside in USD/JPY.

Techs on USD/JPY

Pablo Piovano, Senior Analyst at FXStreet, notes: “Additional increases could prompt USD/JPY to revisit its peak of 160.20 reached on April 29, ahead of the 1990 high of 160.40 recorded on April 2.”

Pablo adds: “Conversely, occasional weakness could drag the pair to its provisional 55-day SMA of 152.40 ahead of the May bottom of 151.85 seen on May 3.”

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

FXStreet Team

FXStreet