ADP Employment Change and NFP: Omicron or ominous?

- Private payrolls from ADP shed 301,000 instead of gaining 200,000.

- ADP blames layoffs on the spread of the Omicron virus.

- Markets are nervously looking ahead to Friday’s NFP report.

American firms laid off employees for the first time in over a year in January, and did so in the greatest numbers since the lockdown collapse of April 2020.

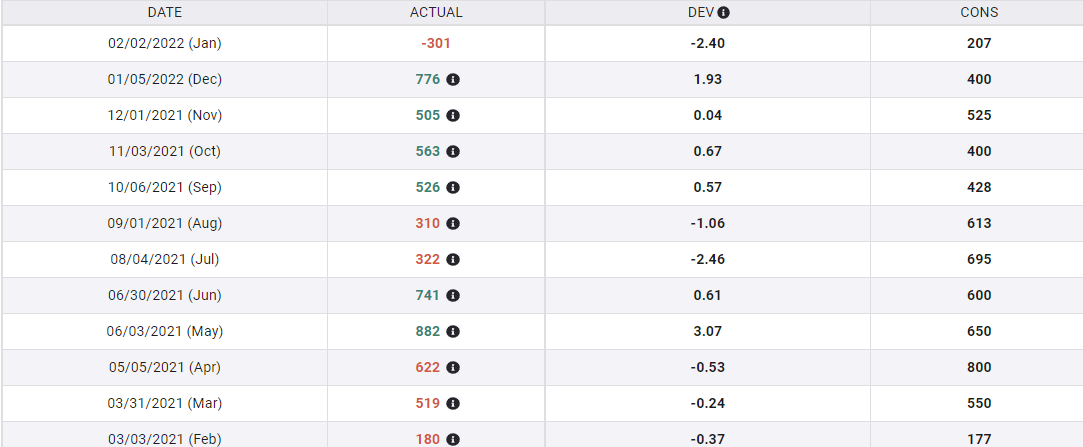

Clients of the payroll company Automatic Data Processing (ADP) reported 301,000 workers lost their jobs, far worse than the Reuters forecast for 200,000 hires and more than a million below December’s negatively revised 776,000. It was the first monthly loss for ADP since a drop of 75,000 in December 2020 and only the second decline after 19.4 million positions vanished in April 2020.

ADP

FXStreet

Omicron and job losses

The fast spreading Omicron virus received the blame from Nela Richardson, the chief economist of ADP. “The labor market recovery took a step back at the start of 2022 due to the effect of the Omicron variant and its significant, though likely temporary, impact to job growth.”

Convenient as that explanation is, there are several factors that belie its accuracy.

Omicron itself is a mild affliction for the vast majority of people, more akin to a moderate cold than a debilitating illness. Most folks recover quickly and without complications, and the only employment effect is a few days sick leave. Missing work for illness is not an infraction and with the present widespread labor shortage no company is going to fire a worker for a few extra and very believable sick days.

A far more likely pandemic related reason for the unexpected job losses are the vaccine mandates still on order in some states, private companies and the Federal government.

Washington initially imposed a mandate on all US firms with over 100 employees but that was ruled unconstitutional by the Supreme Court and has been rescinded. It is unknown how many firms are still insisting on vaccines for employees and firing those who do not comply. The US military, under administration instructions, is beginning to release soldiers, sailors and airmen who refuse to be vaccinated. Whatever the number of people let go because of medical policy, those fired could collect unemployment and would be counted as involuntary job losses, that is, as layoffs.

Labor market and job losses

Several labor market indicators have been suggesting employment trouble in January.

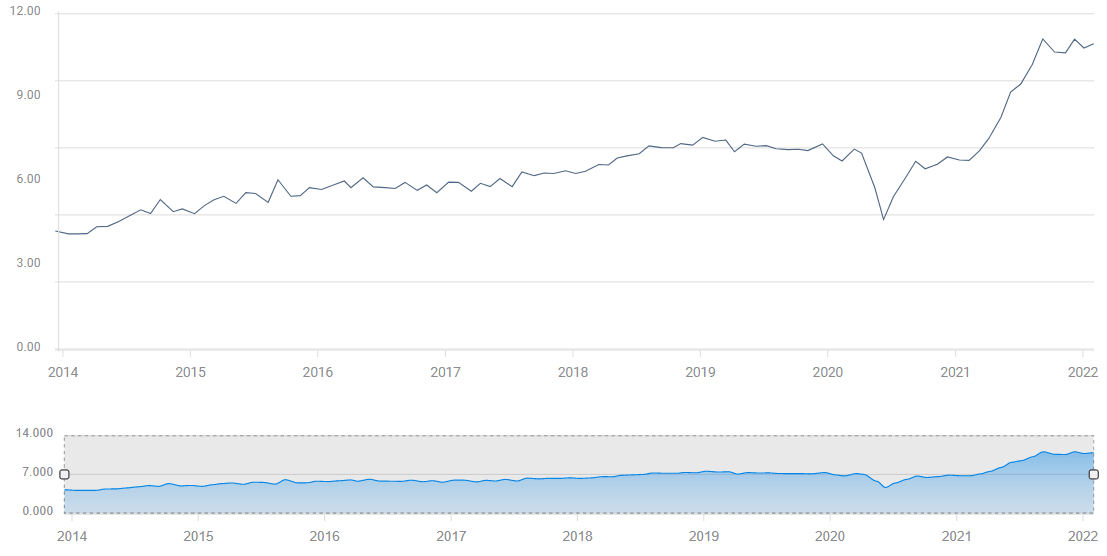

Initial Jobless Claims have been rising for more than a month. The four-week moving average has climbed from 199,750 on December 24 to 255,000 on January 28.

Initial Jobless Claims, 4-week average

FXStreet

Nonfarm Payrolls enrolled just 448,000 workers in November and December. This was less than half the 950,000 expected. January estimates are even weaker with 150,000 expected, providing a very small margin over a negative report.

The US job force is still 3.5 million short of the number of employed workers in January 2020.

The Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics rose to 10.925 million in December. Unfilled jobs have averaged 10.758 million for seven months. If people were leaving their jobs for higher paid positions elsewhere there should be a reduction in the number of vacant spots.

FXStreet

Jobless claims were the telltale in the early stages of the pandemic, work availability is at a historic high and NFP hiring itself has been slowing for three months, these presage trouble ahead for the labor market.

Markets

Equites ignored the ADP data on Wednesday after the release, preferring profit hunting in the many securities battered by a rough January. Treasury yields were mildly lower on the day with the 2-year, 5-year 10-year, and 30-year notes all losing points. The US dollar slipped in all the major pairs as Treasury rates fell.

2-year Treasury yield (Wednesday)

CNBC

Conclusion

The January job signs are poor. Though correlation between ADP and NFP is not impressive, when private payroll losses are combined with the labor market indicators, the odds of a negative month rise considerably.

The Federal Reserve’s newly minted inflation policy and its promised rate increase in March will not be deterred by one month of job losses. Treasury yields were sharply higher on Thursday.

Has a much weaker economy and job market already started?

If it has, then Fed policy is not assured. How much would the economy have to slow for the Fed to pause its rate tightening is unknown but surely a negative quarter would do the trick. However, first quarter GDP will not be reported until April 27. Until then speculation centers on NFP, Retail Sales, Initial Jobless Claims and other large-scale national indicators.

January's equity losses are not solely based on interest rate fears, more basic economic concerns have reached the surface.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.