January flashlight for the FOMC blackout period

Summary

We share the near-universally held view that the FOMC will leave the fed funds rate and pace of quantitative tightening (QT) unchanged at the conclusion of its upcoming meeting on January 31.

The FOMC's decision last month to leave the fed funds rate unchanged for a third consecutive meeting made it increasingly clear that the most aggressive tightening cycle since the 1980s has come to an end. Consequentially, overall financial conditions have eased considerably since the last policy meeting.

We also look for the FOMC to remain in a holding pattern in terms of its policy guidance, and we expect only minor changes to the post-meeting statement relative to December. A change to the statement we would not be surprised to see at this meeting is the removal of the paragraph on the U.S. banking system and financial conditions.

Overall, we view this meeting as one where the Committee will buy time to discern if inflation is indeed on a sustainable path back to 2% and serve as an opportunity to build consensus around the conditions for eventual policy easing.

Market chatter about changes to the existing pace of QT has picked up recently, and we expect the meeting will include a discussion about the path forward for the Federal Reserve's balance sheet.

Our base case is that the FOMC will announce a plan to slow the pace of QT at its June meeting, although we would not be shocked if the Committee decided to do so one meeting earlier in May.

Specifically, we expect the runoff caps for Treasury securities to be reduced to $30 billion while MBS caps are dropped to $20 billion starting on July 1. We anticipate this slower pace of QT running until year-end 2024. Under this scenario, the Fed's balance sheet would reach a trough of $6.8 trillion or so at year-end 2024 and begin growing gradually again thereafter.

The less said the better?

We share the near-universally held view that the FOMC will leave the fed funds rate and pace of quantitative tightening (QT) unchanged at the conclusion of its upcoming meeting on January 31. The FOMC's decision last month to leave the fed funds rate unchanged for a third consecutive meeting made it increasingly clear that the most aggressive tightening cycle since the 1980s has come to an end. The December post-meeting statement continued to signal that, in the near term, any adjustment to the policy rate is still more likely to be up than down. However, a small tweak sent a big signal that the Committee believes additional tightening is increasingly less likely. Specifically, the insertion of "any" to the sentence "In determining the extent of any additional policy firming that may be appropriate..." indicated that the Committee is more confident that the current policy setting is sufficient to return inflation to 2% on a sustained basis.

Moreover, in the post-meeting press conference, Chair Powell underscored the Committee's shifting focus away from potential further hikes and toward eventual policy easing. Not only did the FOMC continue to discuss how long the fed funds rate may need to remain restrictive, but the Committee discussed when it may be appropriate to remove current policy restraint—a discussion that is the first step on the road to eventually easing,

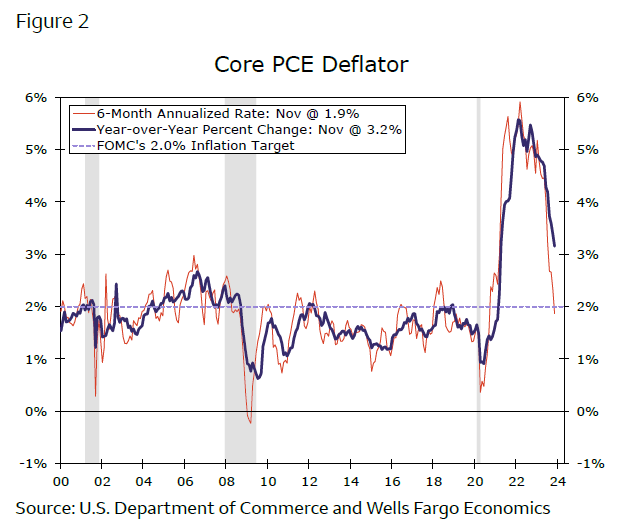

With Powell sharing that the topic of rate cuts had been broached, financial conditions loosened further over the inter-meeting period. At present, indices of financial conditions are sitting near the most accommodative levels since the FOMC began its current tightening cycle (Figure 1). That easing in financial conditions has caused some consternation about premature policy easing given that they are the channel through which the Fed's policy settings impact the real economy. Inflation has fallen sharply in recent months (Figure 2), with the rise in the core PCE deflator slowing to a six-month annualized rate of 2.0% through December by our estimates. However, Chair Powell and other FOMC members have indicated they need to see progress continue in the coming months to be convinced inflation can return to 2% for the long-haul. Meanwhile, economic growth continues to hold up well. Employment increased more than expected in December, the unemployment rate remained unchanged at 3.7% and layoffs remain near record lows. GDP in the final quarter of the year looks to have risen close to a trend-like 2% annualized rate.

Author

Wells Fargo Research Team

Wells Fargo