EUR/USD witnessed a bullish descending triangle breakout on Monday, but is struggling to extend gains beyond 1.1830 levels as many in the markets are expecting hawkish sound bites from Fed’s Yellen.

As discussed here, Trump’s dismal performance so far and the resulting USD weakness has created enough room for the Fed to begin tapering its balance sheet/normalize the policy. Yellen is also likely to reiterate the scope for one more rate hike later this year. The central bank intends to get ready for the next round of recession, thus policy normalization process is less data [inflation] dependent.

Keep an eye on the yield curve

- USD loves a steeper yield curve [spread between the 10-year yield and the 2-year yield] and vice versa.

- The spread currently stands at 86 basis points.

- Hawkish comments from Yellen could see the spread widen to the falling trend line hurdle of 96 basis points.

- A break above 96 bps could signal a trend reversal in the US dollar. Such a move looks likely if Yellen's comments hint at a faster balance sheet unwind.

EUR vulnerable to jawboning

ECB President Draghi won’t be talking about the monetary policy at the Symposium; however, the doors are still open for EUR jawboning. The ECB minutes released earlier this month showed the policymakers aren’t comfortable with the sharp appreciation in the EUR. Thus, the odds are low that Draghi would say anything that would lift the EUR. If anything, the risks are skewed to the downside.

EUR/USD Technical Outlook

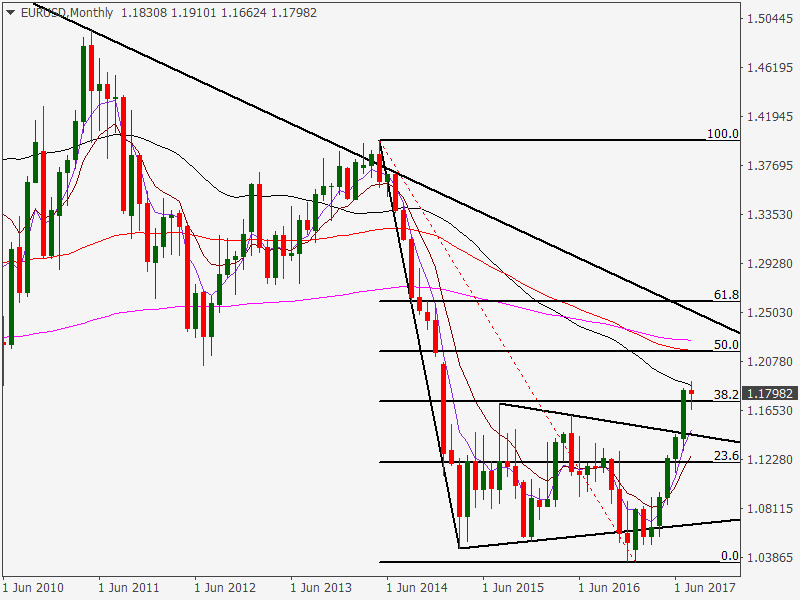

Monthly Chart

- The bullish move appears to have run out of steam the downward sloping 50-MA, while the downside is being capped around 1.1736 [38.2% Fib R of May 2014 high - Jan 2017 low] this month.

- The sideways channel was breached on the higher side last month. So the immediate downside appears capped around 1.1480 [flag support + monthly 5-MA].

- On the higher side, key resistance levels are 1.2042 [July 2012 low] and 1.2262 [monthly 200-MA] and 1.2528 [falling trend line drawn from July 2008 high and May 2011 high]. Note that the bearish reversal seen back in May 2014 was preceded by a failure to capitalize on the trend line break.

Daily chart

- A bullish descending triangle breakout on the chart above is hardly encouraging given it was a sideways breach and the trend line hurdle is still intact.

- Multiple candles with long tails earlier this month have established 1.1660-1.1730 as a strong support zone.

- A downside break would open doors for 1.1633 [upward sloping 50-MA] and 1.16 handle. On the higher side, breach of the trend line hurdle would expose 1.20 [key psychological hurdle + big resistance as per options markets].

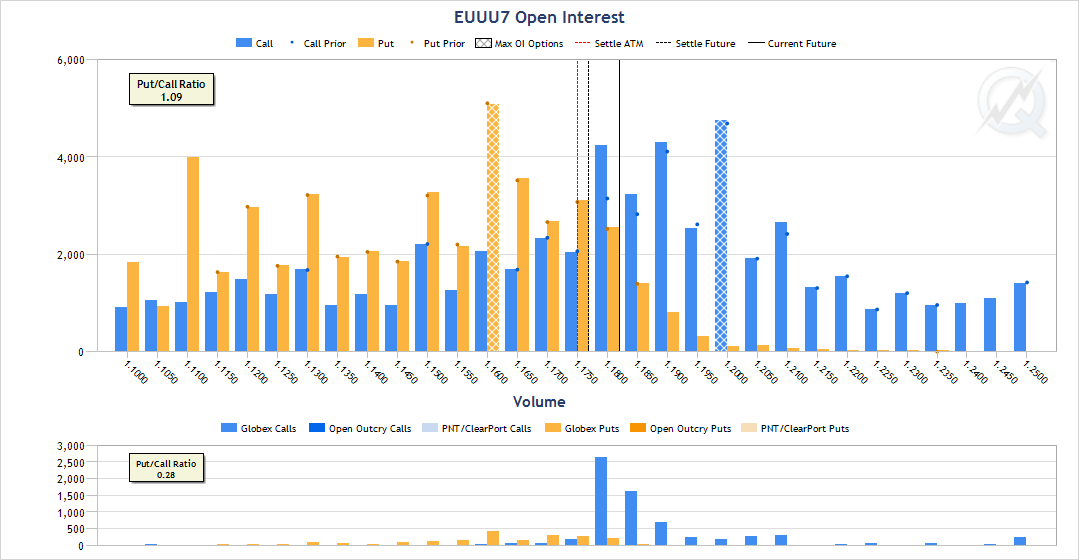

Key levels to watch out for - 1.16 and 1.20

Chart Source: CME

The CME data for EUR/USD Sep expiry options shows 1.16 Put and 1.20 Call carry the highest cumulative OI. Thus, both levels are likely to act as make/break levels. This is because a dip below 1.16 would force Put writers to unwind their positions, leading to a big sell-off to 1.15-1.1480 region. On the higher side, a breach of 1.20 would force Call writers to unwind their shorts, thus opening doors for a big descending trend line hurdle seen at 1.2528.

View:

- Watch out for a break below 1.16 if Yellen comes out hawkish. Dip demand is likely around 1.15 handle. Dips below 50-DMA are likely to be short lived.

- On the other hand, dovish comments from Yellen could easily push EUR/USD above 1.20. Persistent dip demand below 1.20 following a break higher and a multiple end of the day close above the key psychological hurdle would open doors for 1.25 levels.

- A Neutral Yellen would allow short-term bullish technicals to take over, in which case a re-test of 1.1910 [recent highs] appears likely.

GBP/USD - Limited scope for rally

GBP/USD dropped to 1.2778; the lowest level since June 27. The pair has been steadily losing altitude following a rally to 1.3268 in late July. As discussed here, the sell-off is largely a result of BOE no longer facing the policy dilemma.

As of now, the spot is chipping away at the support offered by the trend line sloping upwards from April 10 low and June 21 low.

GBP/USD Technical Outlook

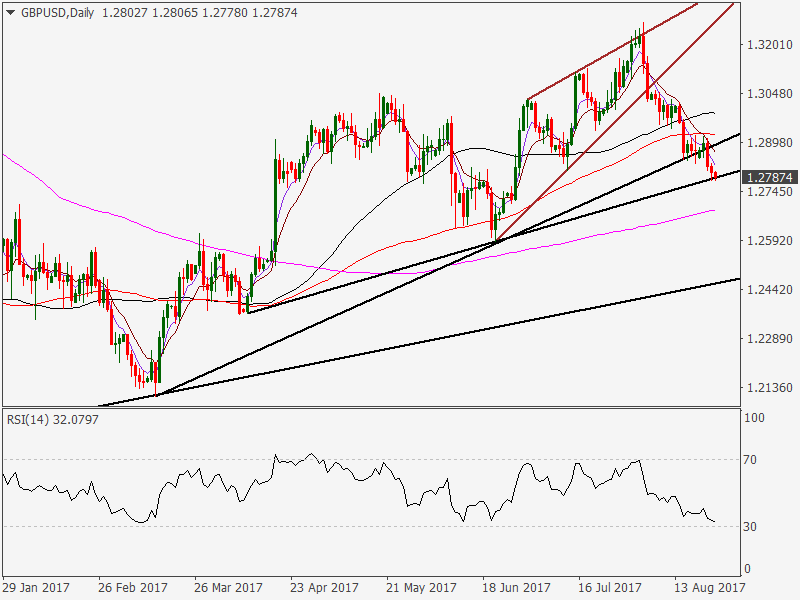

Daily chart

- A weekly close below 1.2788 would open doors for 1.2633 [weekly 50-MA].

- Such a move would push the 14-day RSI into the oversold territory, thus a technical correction could follow.

- On the higher side, any move above the downward sloping 10-DMA is likely to be short lived as the BOE is no longer under pressure to raise rates.

View:

- Dovish Yellen may boost GBP/USD, although gains are likely to be capped around 1.2920. Moreover, the Fed is still the most hawkish central bank out there and the BOE is not seen raising rates before 2019.

- Hawkish Yellen could yield a sell-off to the weekly 50-MA level of 1.2633.

- A dud Jackson Hole event would allow the bearish technicals to take over.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD stays firm near 0.6300 amid modest risk appetite

AUD/USD is posting small gains near 0.6300 in early Asian trades on Monday, opening the week on the front foot. Risk sentiment remains in a sweeter spot following the weekend's news of lower US tariffs on Chinese electronic supply chain. Tariffs talks will remain on the radar.

USD/JPY faces intense supply, falls back to 142.50

USD/JPY has erased early gains to trade deep in the red near 142.50 in Monday's Asian trading. The US Dollar resumes its downside toward multi-year troughs, digesting Trump's tariff news from the weekend. The Fed-BoJ policy divergence expectations underpin the Japanese Yen, weighing on the pair.

Gold retreats from record highs of $3,245 as US Dollar finds its feet

Gold is rereating from record highs of $3,245 early Monday, extending Friday's late pullback. Reducded demand for safe-havens and a broad US Dollar rebound undermine the yellow metal amid the news of not-so-steep US tariffs on China's semiconductors and electronics.

Week ahead: ECB set to cut, BoC might pause as Trump U-turns on tariffs

ECB is expected to trim rates, but the BoC might pause this time. CPI data also in the spotlight; due in UK, Canada, New Zealand and Japan. Retail sales the main release in the United States. China GDP eyed as Beijing not spared by Trump.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.