Jackson Hole positioning

More optimistic follow through yesterday brought additional gains to commodities while stocks and gold treaded water. Just as I wrote yesterday, the celebrations of the taper tough talk being just talk, were a little too powerful, and at least a modest daily consolidation arrived.

Credit markets point to the risk-on moves to continue, favoring the reflation trades as yields and inflation expectations would slowly but surely pick up. The dollar has gone on the defensive again but look for it to recover some ground as metals and cryptos are gently hinting at today. Are the commodities and precious metals bull runs in jeopardy though? Not in the least as the conditions haven‘t and won‘t change with the Fed taper plays that have rocked the boat last week quite well.

As stated yesterday:

(…) And with much of the tapering done through the repo market in a way already, the focus will shift to the balooning deficits and debt ceiling so as to confront the disappointment creeping in through Monday‘s PMIs and more. I‘m not looking though for a deterioration strong enough to derail the stock market and commodities bull runs. Let alone the precious metals one. A good signal thereof would be widening credit spreads on the long end as the short end has been flattened already.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

Daily pause is all we‘ve seen in stocks yesterday, with Nasdaq hit a little on account of the rising nominal yields. As even value found it hard to sustain gains, we‘re likely to see the consolidation to continue next as big moves before the Jackson Hole is over, are unlikely.

Credit markets

High yield corporate bonds continued the march higher, closing on a strong note again – the daily consolidation hasn‘t thus far arrived there. Overall positive turn in credit markets that‘s however leaving it a little extended for today and tomorrow unless the quality instruments rise modestly.

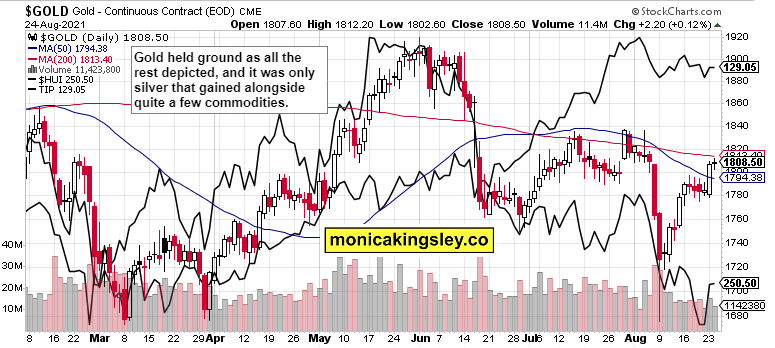

Gold, silver and miners

Not too much interesting has happened in the gold sector – only silver joined in the copper and oil upswings. Look for the sensitivity to the dollar moves to continue to a modest, yet decreasing degree as the taper suspense gets resolved – I say temporarily resolved as I don‘t believe in crystal clarity after Jackson Hole.

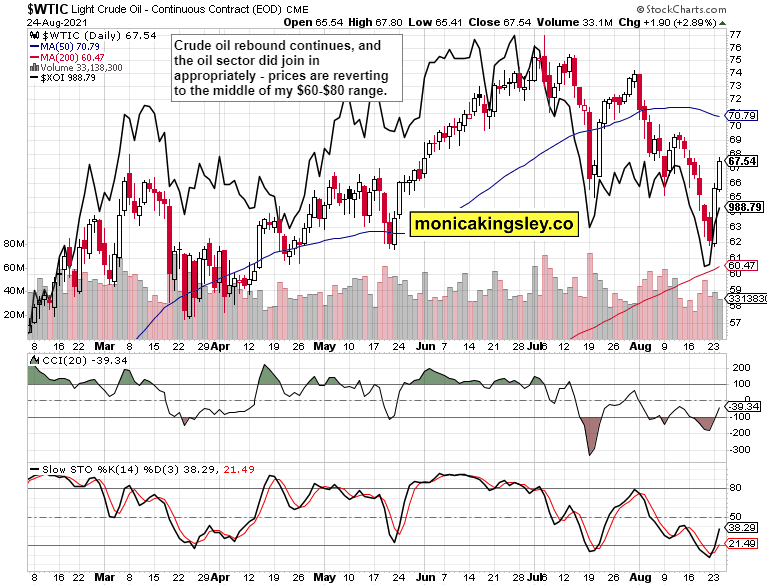

Crude oil

Crude oil rebound continues, and a little breather next wouldn‘t be unexpected. Reasonable prices have been reached, and the local bottom is in.

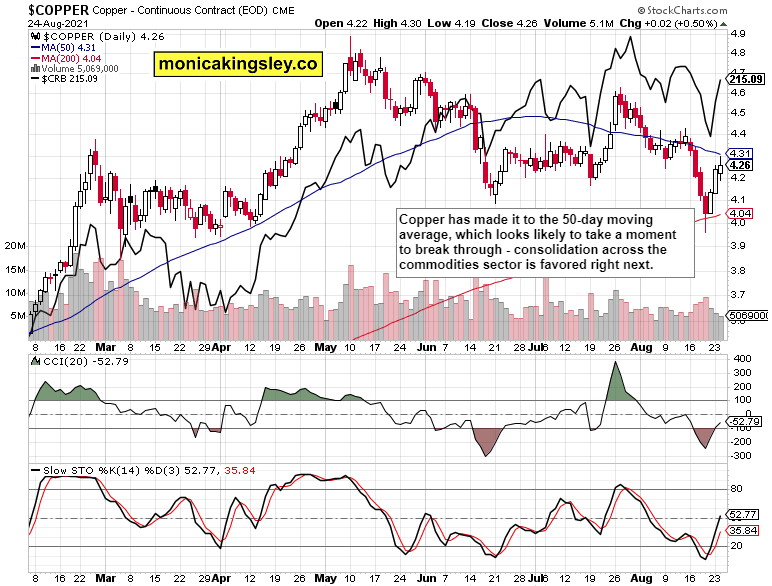

Copper

Copper rebound continues, and stabilization at around 4.25 is very constructive for the bulls – bullish chart and fundamentals even if we might go a little sideways first still (the red metal is slowing down a little vs. the CRB).

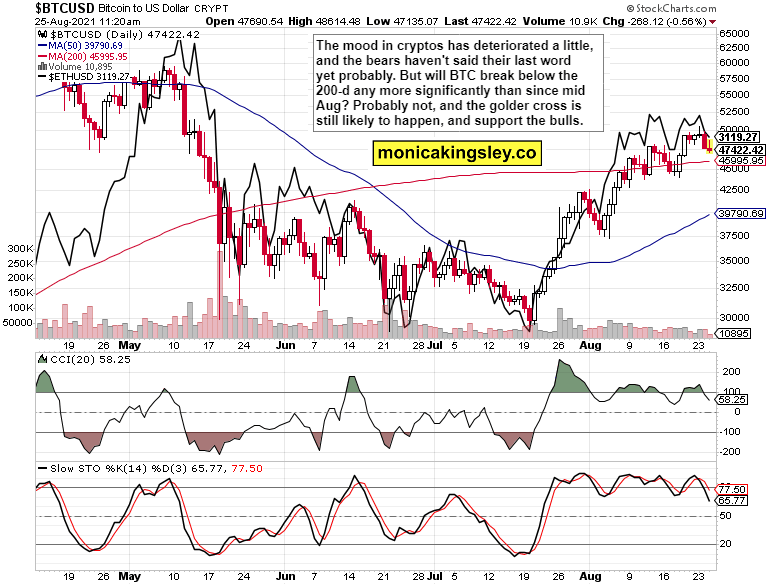

Bitcoin and Ethereum

Cryptos are bidding their time – haven‘t breached any important support just yet. As stated yesterday, backing and filling before another upswing wouldn‘t be at all surprising.

Summary

Before the Jackson Hole, I‘m not looking for extensive and sustainable moves one or the other way. Return of the risk-on trades should be the lens to watch the markets through even though a discreet liquidity tightening is going on under the surface as e.g. margin debt data show. And don‘t look for M2 movements to put a stop to inflation.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.