Italy stages a recovery

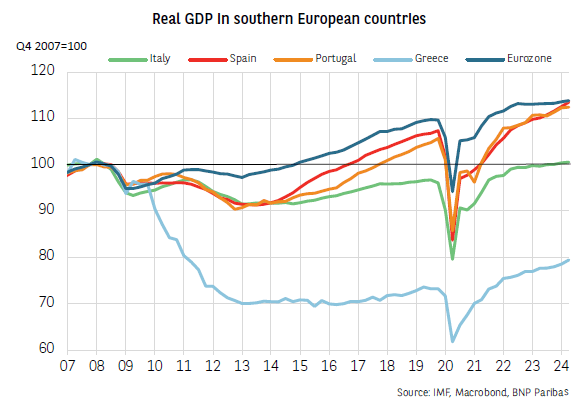

The Italian real GDP over the past three years is higher than previously estimated, thanks to the 2024 general revision of the national accounts. This revision, which is undertaken every five years and was published by the Italian National Institute of Statistics (Istat) on 23 September1, includes the basis change with reference year 2021. As a result, real GDP is finally, albeit only slightly, above the level posted before the 2008 financial crisis (0.6 pp higher in Q2 2024 than in Q4 2007).

Italy is thus the last of the four “major countries“ in the Eurozone to have returned, albeit very belatedly, to its pre-financial crisis level. Focusing on the southern European countries (PIGS), with the exception of Greece, Spain had recovered to this level by the end of 2016, followed by Portugal at the end of 2017.

During the post-sovereign debt crisis period, i.e. from 2014, Italy’s real GDP grew significantly more slowly than Spain’s and Portugal’s. In the end, it took until the post-Covid period for activity to finally take off, with average annual growth of 4.8% between 2021 and 20232, compared to 3.3% for the Eurozone. This recovery was driven by the rebound in private consumption and the Superbonus tax incentive scheme for energy-efficient building renovation, which has significantly stimulated construction investment3.

The simultaneous revision of the national accounts and public finance aggregates has also led to a slight improvement in the fiscal deficit for 2022 and 2023. In the end, the fiscal deficit stood at -8.1% and -7.2% of GDP for 2022 and 2023 (compared to the estimates of -8.6% and -7.4% from last April), which, nevertheless, is still far above the level set out in the SGP’s rules.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.