- Economists expect the US ISM Services PMI to have declined from 55.2 to 54.4 points in February.

- Robust data from the labor market, manufacturing sector and others point to a better outcome.

- After a period of consolidation, the US Dollar has room for further gains.

- The reaction in stock markets depends on the components of the report.

Consolidation or extension? That is the question for many forex traders when they see prices nearing the limits – and also for the leading indicator for America's largest sector. The Institute for Supply Management (ISM) publishes its Purchasing Managers' Index (PMI) for the services sector, and markets are watching.

ISM Services PMI could stay on the rise

The ISM Services PMI used to work solely as a hint toward the Nonfarm Payrolls (NFP) report, focusing on its Employment component. Yet when inflation began picking up, the Federal Reserve (Fed) and markets shifted their attention toward the Prices Paid component, which reflects inflation.

The headline remains highly important, as the central bank wants a cooler economy. ISM's snapshot report for the sector is roughly 70% of the world's largest economy, therefore, it is critical for markets.

For February, economists expect the ISM Services PMI to fall to 54.4 from 55.2 points recorded in January, a consolidation of the bounce this indicator had experienced after a sharp fall in December. I expect an extension of the gains, rather than stability. Here's why.

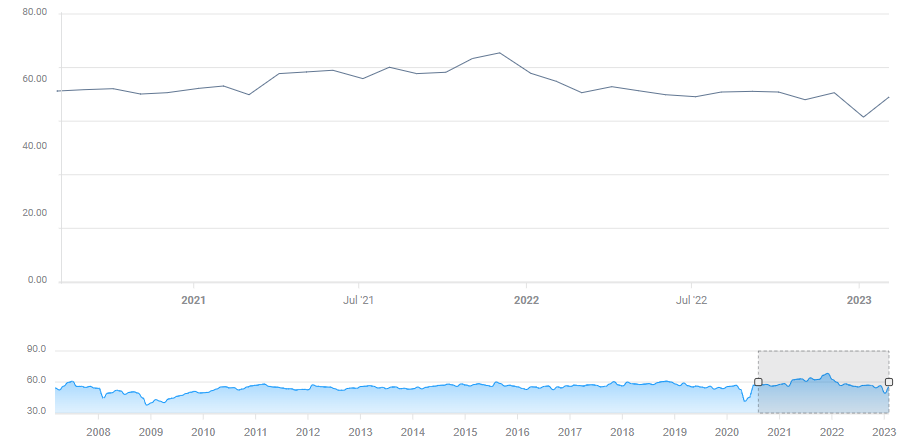

ISM Services PMI:

Source: FXStreet

The main reason to have a bullish bias on this report is the heating US economy. Nonfarm Payrolls showed a leap of 517,000 jobs in January, Retail Sales figures topped all estimates, and Durable Goods Orders showed an increase in long-term investment.

Higher demand from China and stable energy prices have also left more money in Americans' pockets for services such as restaurants, hotels, hairdressers, and others. The post-pandemic recovery triggered a growing demand for services and a drop in the consumption of goods.

More importantly, inflation remains elevated, with the Core Consumer Price Index (Core CPI) advancing by 0.4% in January, the highest in several months. Despite the drop in goods consumption mentioned above, the parallel ISM Manufacturing PMI surprised with an increase in its Prices Paid component.

All in all, there are good reasons to expect an increase in the headline ISM Services PMI – and also in its Prices Paid component.

ISM Services PMI set to boost US Dollar, stocks depend on components

Any beat on the headline would show the US economy is heating and that the Fed needs to raise rates further. That is positive for the US Dollar – and so is an increase in the Prices Paid component.

The picture is more complicated for stock markets. On the one hand, higher inflation and elevated rates are undoubtedly adverse for equities, especially tech ones. On the other hand, a strong economy means higher company profits.

Stock investors will be eyeing the headline ISM Services PMI, and also the New Orders component, which is a forward-looking one. Any increase in this indicator would balance an unwelcome rise in the Prices Paid one.

Final thoughts

The US economy is doing well and the ISM Services PMI is set to reflect this strength. The US Dollar has been consolidating its gains and a robust figure may fuel the next leg of the rally.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

ECB reduces rates by 25 bps as largely expected – LIVE

On Thursday, the ECB delivered the 25 bps cut everyone expected, trimming the Deposit Facility Rate to 2.25%. EUR/USD remained within its daily sideline theme around the 1.1350-1.1360 band in the wake of the release. Now, all eyes are on Christine Lagarde’s live press conference as investors hang on her every word for clues about what comes next.

GBP/USD trades in an inconclusive fashion around 1.3230

GBP/USD is stuck in the 1.3250–1.3260 corridor on Thursday, maintaining a rangebound mood in response to the acceptable bounce in the Greenback and the generalised offered bias in the broad risk-linked galaxy.

Gold remains affered, recedes to the $3,340 area post-ECB

Gold powered to a fresh record, flirting with the $3,360 area per troy ounce, before embarking on a correction to the current $3,340 zone, always on the back of the decent rebound in the US Dollar and the recovery in US Treasury yields across the curve.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.