ISM Manufacturing: Still weak but future may be bright

Summary

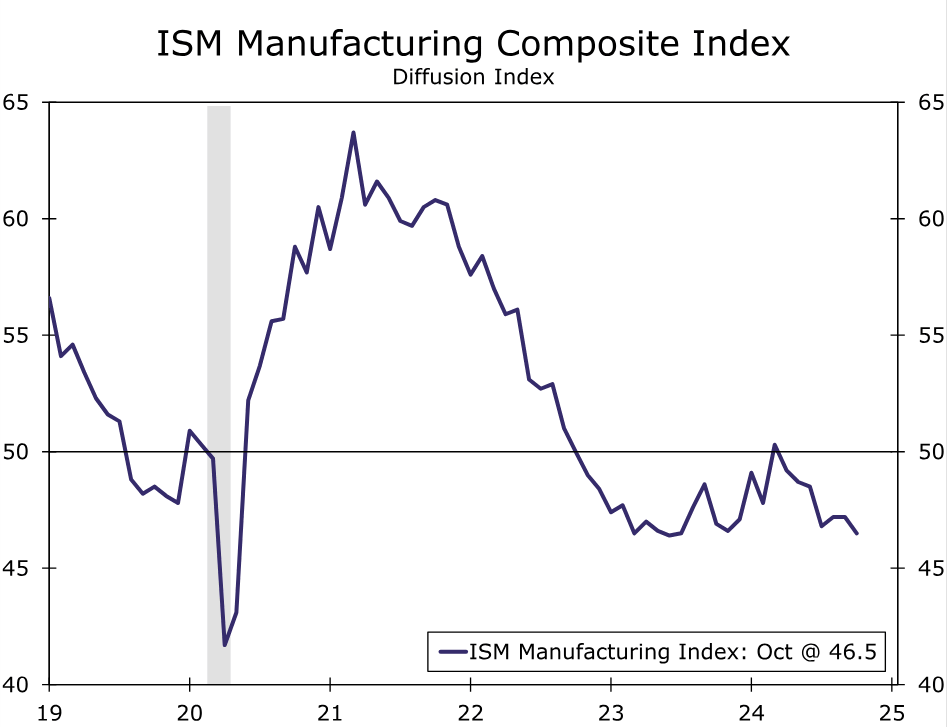

The ISM manufacturing index fell in October and has now signaled contraction in activity for practically two-straight years. But the simple need to replace equipment combined with some clarity in the post-election environment should be supportive of coming capex plans.

Manufacturers sitting, waiting, wishing

The ISM manufacturing index pulled back to 46.5 in October, the lowest reading in over a year (chart). A decline in current production and inventories triggered the drop, but it wasn't all bad as there was a slight gain in new orders.

The selected industry comments continue to be the most interesting part of these releases as they offer anecdotal support to the notion that businesses are in a wait-and-see stance ahead of the election and further monetary easing. A respondent from the fabricated metal products said as much: “It feels like a ‘wait and see’ environment regarding where the economy is heading...” Others mentioned contingency plans and risk analysis to prepare for the various election outcomes. We've broadly emphasized in recent months that uncertainty is the largest constraint on capex, and that was evident in the October data.

The largest gain in the underlying ISM components came from prices paid, which pushed 6.5 points higher to 54.8. That is consistent with an expansion in prices, but as the nearby chart shows, is mostly a reversal of the sharp commodity-related drop in September and is still a reading well-below the index level reported at the worst of the post-pandemic inflation battle.

Source: Institute for Supply Management and Wells Fargo Economics

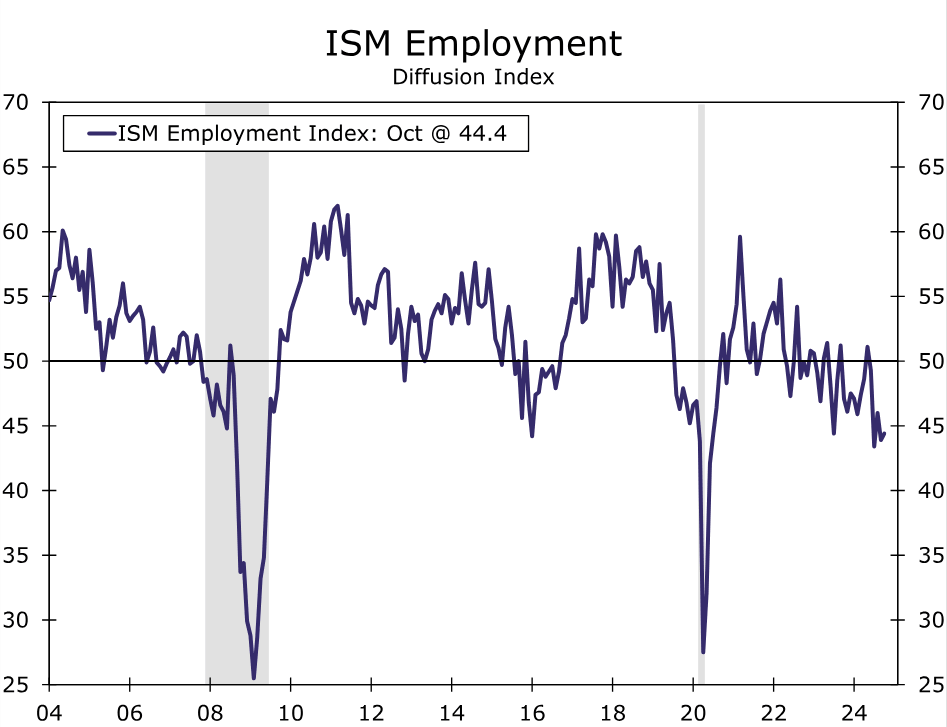

Manufacturing hiring is still struggling. The employment index rose a half a point last month, but at 44.4 remains consistent with a broad contraction in manufacturing hiring (chart). This is little surprise in an environment where activity has done little more than tread water. Hurricanes and strike activity at Boeing could also be weighing on the figures in the last month.

Separately released data this morning showed employers added just 12,000 net new jobs in October. The hiring figures were depressed by Hurricanes Helene and Milton as well as strike activity, and we expect the true pace of hiring is not nearly as weak. One way to gauge this was by the unemployment rate, which is based on the household survey of employment and counts those not working due to a strike or bad weather as employed. The unemployment rate held steady at 4.1% last month. The jobs data broadly suggest that while hiring is slowing the jobs market is not collapsing.

The October ISM broadly showed more of the same for manufacturing. Yet we are optimistic on a coming recovery. A respondent from the machinery industry said: “...We are hearing directly from customers that they need to order equipment to satisfy their requirements but are going to keep projects as long as possible before pulling the trigger.” We too continue to hear a similar narrative from clients. While durable goods last for many years, they do not last forever and some equipment simply needs replacing. Combine that with some policy clarity in the wake of the election and a further reduction in rates over the course of the next year, and we expect to see capital spending budgets favor new investment in the coming months.

Author

Wells Fargo Research Team

Wells Fargo