ISM Manufacturing PMI January Preview: Fed policy counts on a continuing US expansion

- Purchasing Managers’ Index forecast to slip to 57.5 from 58.7.

- New Orders PMI expected to rise to 61 from 60.4.

- Initial claims and Retail Sales cast doubts on first quarter.

- Treasury yields and the dollar could fall with weak PMI.

The Federal Reserve’s new anti-inflation rate policy has an unstated condition: The US must maintain a healthy expansion. Fed governors might find it difficult or impossible to raise interest rates in an economy with weak or stagnant growth.

Purchasing Managers Indexes (PMI) for January from the Institute for Supply Management (ISM) will provide a first glance at the outlook for the manufacturing sector in the New Year.

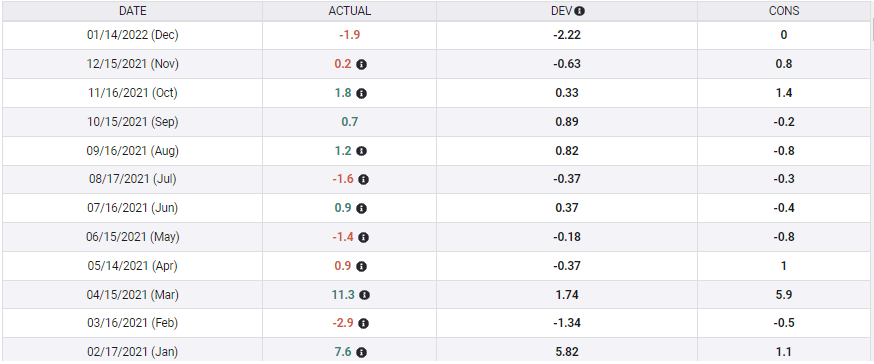

Overall PMI is forecast to drop to 57.5 in January from 58.7 in December. The New Orders Index is expected to rise to 61 from 60.4 and the Employment Index is projected to decrease to 53.8 from 54.2.

FXStreet

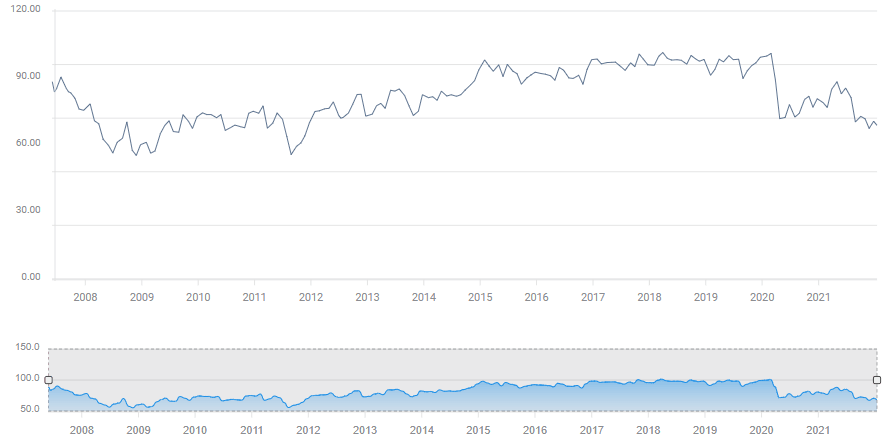

The manufacturing sector is considered a leading indicator for the performance of the entire US economy. The long range planning needed for complex manufacturing processes, the estimates of consumer demand months and years ahead and the global sourcing of material, make factory managers, by necessity, among the preeminent economic forecasters.

December’s PMI was the weakest in 12 months since the identical score last January. The decline from the 61 average in September, October and November was likely due to the combined impact of the Omicron strain on employment, absences rather than layoffs, and weak holiday sales.

Manufacturing orders were one of the economic bright spots in 2021 averaging 64.6 for the 11 months to November. For many factory managers orders were a source of frustration as it became increasingly difficult for many businesses to find enough workers to maintain full production.

New Orders

FXStreet

The outlook in employment was strongest at the beginning of 2021 with a four-month average of 55.4 in April. Labor shortages more than anything else brought the index to 49 in August, just below the 50 division between expansion and contraction. December’s 54.2 reading was the strongest since 55.1 in April.

Let us look at the data relevant for January’s manufacturing outlook.

Economic indicators

Manufacturing sentiment depends on incoming orders. Though the new business index is expected to rise, its precursors and the entire US holiday season were poor. Retail Sales dropped 1.9% in December and were just 0.1% higher for the three months from October. Consumers spent heavily in October's promotions and may have done so in the traditional January white sales, but we will not know unitl the month's figures are issued on February 16. General demand is still expected to be high after two years of denial and scarcity but soaring inflation, 7% in December, may be cutting into family budgets and draining consumption.

Retail Sales

FXStreet

Employment has been poor. American firms hired 488,000 workers to Nonfarm Payrolls in November and December, barely half the 950,000 expected. What is of more more concern, Initial Jobless Claims have been rising, sharply by percentage though still low by absolute standards. The four-week moving average for claims has jumped 24% from 199,750 on December 24 to 247,000 on January 21. The US economy is still several million short of the number of employed workers in January 2020.

Consumers are not happy. The Michigan Consumer Sentiment Index fell to 67.2 in January, the weakest of the pandemic era and the lowest reading since November 2011. The 70.0 average of the last six months is likewise the least positive in over a decade.

Michigan Consumer Sentiment

FXStreet

Until November and December Retail Sales had held up reasonably well. It may be that price increases especially for gasoline and food, the seemingly endless Omicron restrictions in some places and the dismal political news have driven the normally irrepressible American consumer into winter hibernation.

Federal Reserve policy

Federal Reserve policy depends on a robust US recovery. Current fed funds projections from the bank itself posit three 0.25% rate hikes by December. Estimates from the futures markets predict four. An initial increase at the March 16 Federal Open Market Committee (FOMC) meeting was, for all intents and purposes, confirmed by Chair Jerome Powell at his January 26 press conference.

The US economy expanded at a 6.9% annualized rate in the fourth quarter of 2021. That pace should easily bear the rate increases planned for this year. It will be far more difficult for the FOMC to justify a rate increase if the US expansion drops back to the third quarter speed of 2.3%. The governors do not want to have to choose between quelling inflation and promoting growth.

Market conclusion

The US economy is a consumer economy, 70% of economic activity is tied to consumption.

The PMI indexes are the first indication of business reality at US manufacturing firms. If PMI optimism, particularly orders, remains firm markets will assume the Fed will win its gamble on the continuing health of the consumer and the US economy.

If weakness surfaces in the purchasing indexes, markets could begin to reverse the strengthening dollar and Treasury yields that have defined the New Year. Equity traders may be conflicted, pleased that higher interest rates could be forestalled but worried over the direction of the economy.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.