ISM liquidity bets

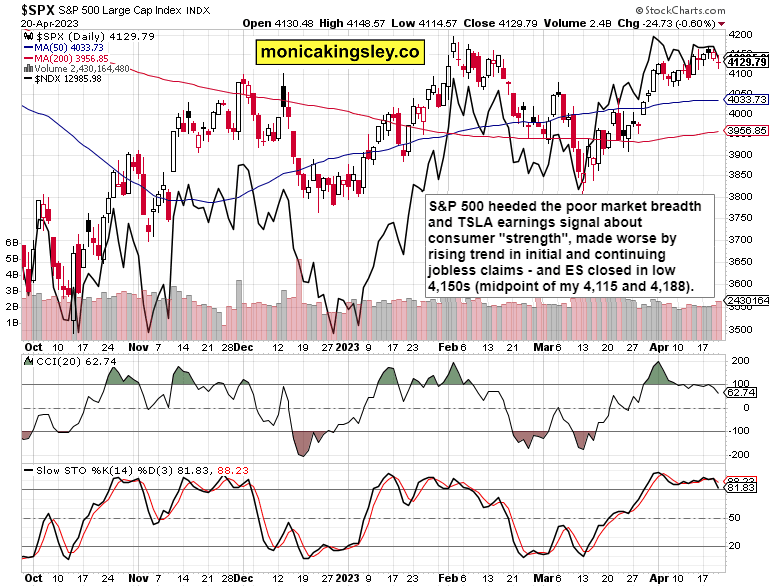

This time, S&P 500 bears couldn‘t close the bearish opening gap, and on deteriorating market breadth hitting tech and value alike, ES closed at my 4,150s midpoint of the no-man‘s land. No matter how tiring the back and forth with all the traps, the big picture is clear – either a convincing break of 4,209, or 4,115 to paint the short-term outlook bullish or bearish.

And I maintain the call that the buyers are getting too tired, too extended here – 4,136 is today‘s bearish objective as much as it was yesterday. No matter how uneventful slash trappy today‘s premarket is so far, watch the moves under the surface – in real assets and USD. Here is what I expect from the upcoming PMIs – similar to the eurozone data, services would keep doing better than manufacturing, and it would be obvious that LEIs hadn‘t yet bottomed.

At the same time, the results would likely feed into the Fed remaining restrictive, i.e. decreasing liquidity equals headwinds for risk assets. Don‘t forget the latest inflation surprise from the UK, and Waller or Bullard talking lately the inflation fight or terminal Fed funds rate… while the Treasury General Account would need to get replenished, Fed balance sheet is shrinking, and deposits still leaving the system for money market funds and similar.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

The downside move is one for starters only, and unless 4,115 convincingly breaks, the tug of war between the bulls and bears would continue. The buy the dippers hesitated only yesterday, and for all the selling kicking in in NVDA and AAPL, this isn‘t yet enough. I‘m waiting for a green light from XLF, XLI and XLB, which should start following XLC and XLU lower – we aren‘t yet there at this maximum bearish constellation, and it‘s doubtful whether the internals picture would be this ideal next week when all the headwinds post options expiry intensify. Still, the outlook for next week is bearish.

Oil has to grapple with approaching recession and demand jitters that are however a bit overblown considering the solid China upswing (no, SPR releases aren‘t enough to overpower the market). $77.50 first serious support could mark most of the downside as in (I wrote yesterday), but the fact it had been already reached today, shows that the sellers are getting a little ahead of themselves on a very short-term basis – I‘m expecting prices to stay here at $78 through today and tomorrow. Of course, broader risk-off sending copper towards $3.90 would change medium-term oil price projection as much as gold and silver breaking with ease below $1,970 and $24.10 respectively (the metals don‘t show willingness to do that, not even on entering the next week).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.