-

Trump’s election invites gold bears into the game.

-

Bets of slower rate cuts by the Fed may be the main driver.

-

PBoC pauses purchases, but strategy likely not changed.

-

Speculation around geopolitics may also be weighing.

Trump wins but Gold loses

After hitting a record high of around $2,790 on October 30, gold entered a corrective phase due to US data suggesting that the Fed may need to slow down the pace of its future interest rate reductions.

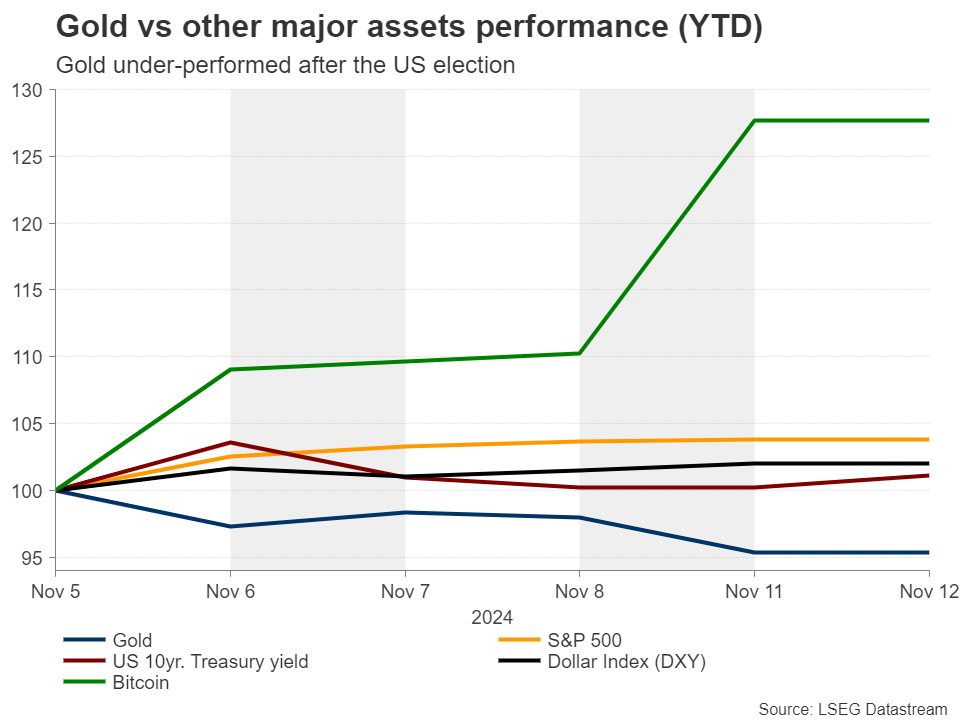

The correction of the precious metal accelerated on the first signs that Donald Trump will be the 47th president of the US, with the bears staying in charge as the financial world continued to pile into the so-called ‘Trump Trade.’

But is the pullback in gold actually part of the ‘Trump trade’? Because ahead of the election, the precious metal was benefiting whenever the chances of Trump returning to the White House were increasing, perhaps due to the uncertainty surrounding a Trump presidency.

Yet, currently, gold seems to be surrendering to the stronger dollar, which is likely benefiting from speculation that Trump’s tax cut and tariff policies will fuel inflation and thereby prompt the Fed to proceed with even slower rate reductions.

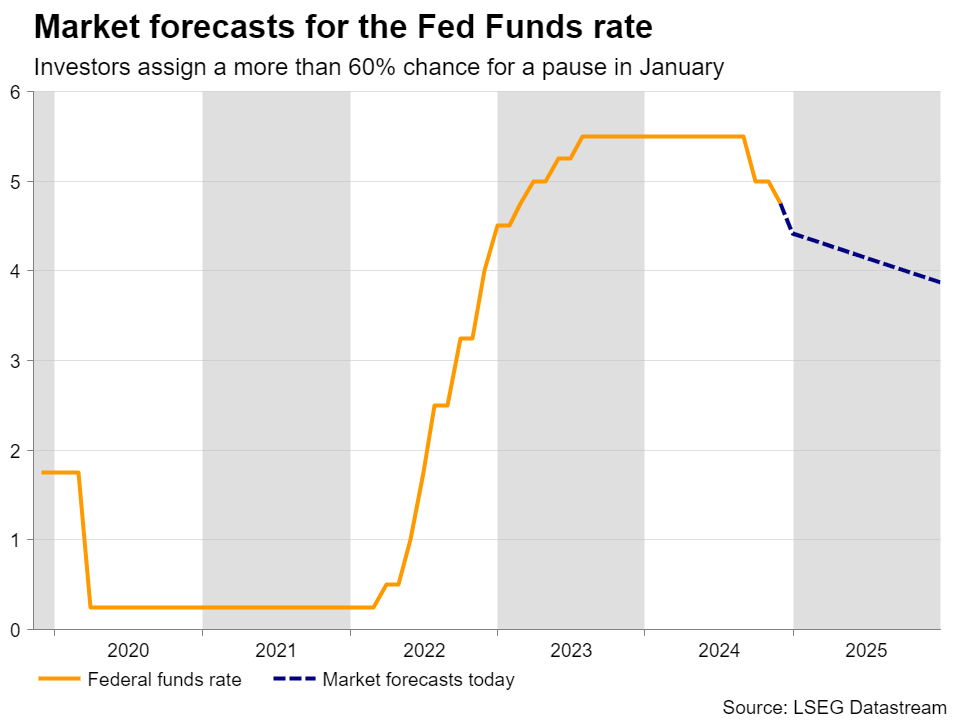

Just after the election, the probability for policymakers stepping to the sidelines in December rose to slightly above 30%. Now, it rests at around 15%, with the probability of taking a pause in January rising to around 63%.

Besides Fed, China and geopolitics are also eyed

Before the US election even started being a theme for financial markets, gold’s main drivers were elevated purchases by major central banks, especially the People’s Bank of China, safe-haven inflows due to geopolitical tensions in the Middle East, as well as speculation of aggressive rate cuts by the Fed.

It is worth mentioning that just after September’s 50bps reduction, investors were assigning a strong chance for a back-to-back double cut in November, although this changed later due to the better-than-expected US data and the increasing chances of Trump winning the election.

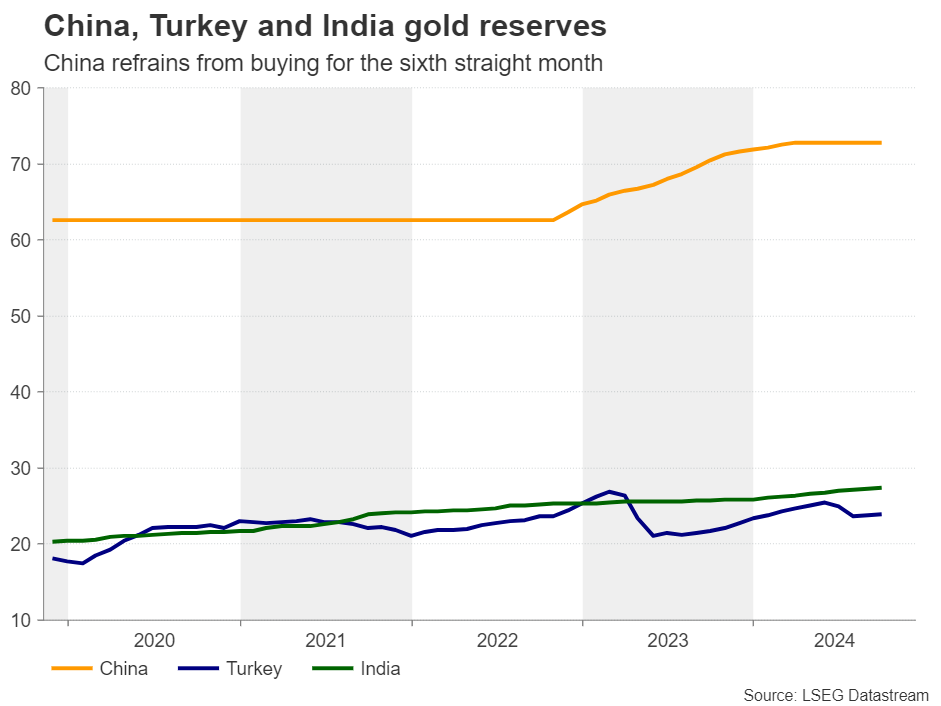

China refrains from buying for the sixth straight month

According to the World Gold Council, central bank purchases of the precious metal may be set to slow further due to a six-month abstain by the Chinese central bank. Its holdings held steady at 72.8mn troy ounces, although the Bank’s value of gold reserves rose to $199bn from $191bn.

But Trump’s return to the White House is likely adding to the chances of China resuming its purchases. After all, the central bank of the world’s second-largest economy has been piling up gold so that it loosens its dependence on the US dollar in case tensions between the US and China escalate. And with Trump pledging to impose massive tariffs on Chinese goods, a Trade War 2.0 seems increasingly likely.

So, China is unlikely to have changed its strategy. They may prefer to wait and buy more gold at more favorable prices.

Can Trump restore peace in Europe and the Middle East?

In terms of geopolitics, some investors may have started unwinding their safe-haven holdings in hopes that as the new US president, Donald Trump will try to resolve the conflicts in the Middle East and Ukraine. However, anything suggesting that a truce may not be so easily achievable, could very well refuel the yellow metal’s prevailing uptrend.

Broader uptrend remains intact

From a technical standpoint, gold corrected sharply lower this month, but it is still holding above the uptrend line drawn from the low of October 6, 2023. This corroborates the view that the current retreat may be destined to stay limited and short lived.

The bulls may decide to jump back into the action from near the crossroads of the uptrend line and the $2,545 zone and perhaps aim for the high of September 26 at $2,685. Should they not stop there, they could aim once again, and even exceed, the record high of $2,790.

For the outlook to shift to bearish, the metal may need to slide below the crossroads of the $2,545 barrier and the aforementioned uptrend line. Such a technical dip may pave the way for the key pivot zone of $2,390, the break of which could carry extensions towards the $2,285 territory, which acted as a floor between April and June.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD recovers toward 1.0650 ahead of US inflation data

EUR/USD has found fresh demand and marches toward 1.0650 in European trading on Wednesday. The pair capitalizes on renewed US Dollar retreat but the further upside appears capped amid Germany's political instability and a cautiou market mood. Traders await US CPI data and Fedspeak for fresh directives.

GBP/USD struggles near 1.2750, awaits US CPI report

GBP/USD is struggling at around 1.2750 in the European session on Wednesday, unable to find any fresh impetus. Traders turn risk-averse and refrain from placing fresh bets on the pair ahead of the critical US CPI data and speeches from several Fed policymakers.

Gold price holds above $2,600 mark, bulls seem non committed ahead of US CPI

Gold price staged a modest recovery from a nearly two-month low touched on Tuesday. Elevated US bond yields and bullish USD cap gains for the non-yielding XAU/USD. Traders now look forward to the key US Consumer Price Index report a fresh impetus.

US CPI data set to confirm inflation ramped up in October as traders pare back Fed rate cut bets

As measured by the CPI, inflation in the US is expected to increase at an annual rate of 2.6% in October, a tad higher than the 2.4% growth reported in September. The core annual CPI inflation, excluding volatile food and energy prices, will likely remain at 3.3% in the same period.

Forex: Trump 2.0 – A high-stakes economic rollercoaster for global markets

The "Trump trade" is back in full force, shaking up global markets in the aftermath of the November 5th U.S. election. This resurgence has led to substantial shifts in both currency and bond markets, with the U.S. dollar index (DXY) jumping 2.0% + since election day.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.