Is the krona a new safe-haven currency?

The Swedish krona is among the major currencies that are susceptible to the latest developments in East Europe alongside the Euro, and both have been a basis for market sentiment surrounding the conflict on markets and economies.

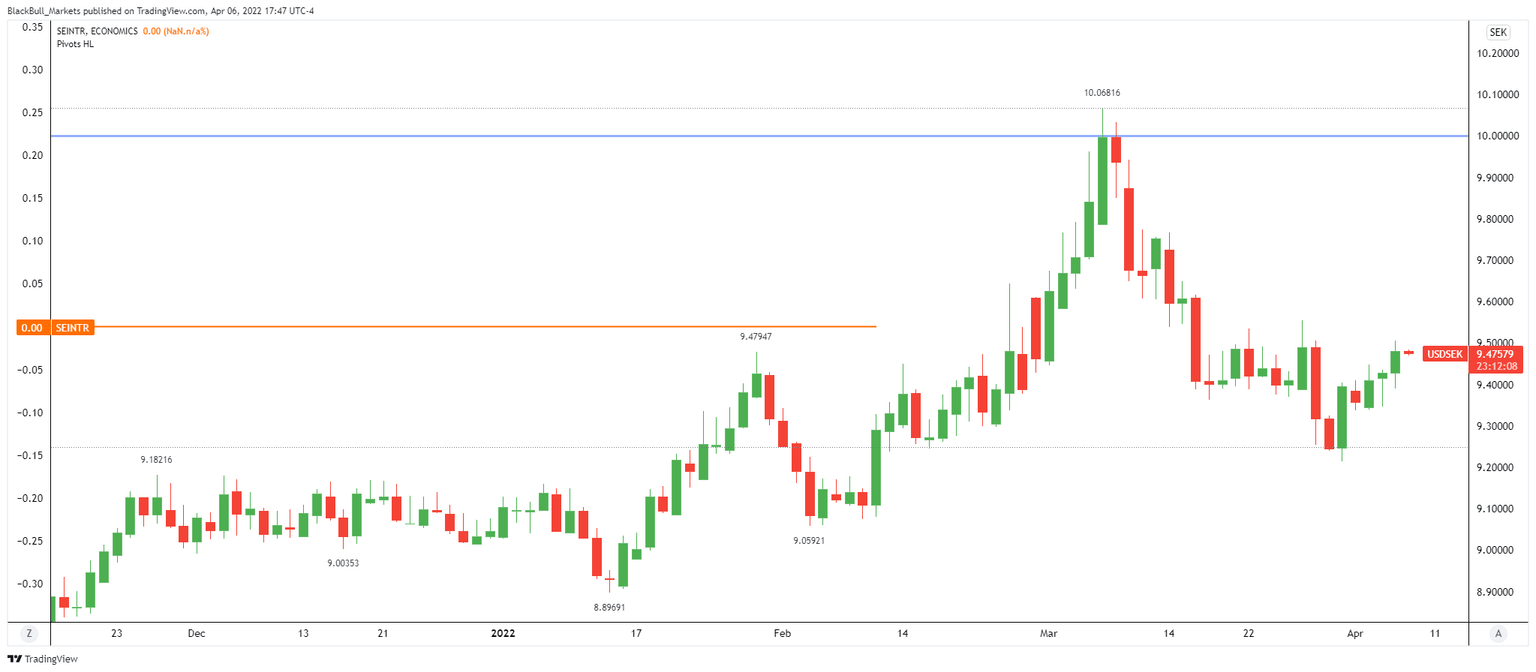

On March 7, as the third round of peace talks capped off without any breakthroughs and as energy prices surged to a 14-year high, the SEK fell to its lowest in nearly two years at almost 10 SEK per USD.

Figure 1. USDSEK D1

Dovish Riksbank

The Swedish central bank’s (Riksbank) recent dovish stance also weighs on the SEK. At its February monetary policy meeting, Riksbank kept interest rates at 0% and maintained the volume of its asset purchases unchanged. The decision dealt a further blow to the SEK, knocking its value by 2% shortly after the rate decision.

However, the pressure is growing on Riksbank Governor Stefan Ingves to hike rates as the central bank acknowledged the rising inflation rate as a result of higher energy prices.

Central bank peer pressure

Still, the central bank does not expect energy prices to continue to rise this year, it said in its most recent policy report, adding that inflation will likely fall back.

The central bank now expects a tightening of its policy in the second half of 2024, earlier than its previous forecast issued in November, amid peer pressure as the Bank of England recently hiked rates again to back to pre-pandemic levels, while the US Federal Reserve penciled in rate hikes at each of its remaining policy meetings this year.

Riksbank expects to raise its repurchase rate — or the interest it charges to commercial banks for short-term borrowings — to 0.06% in the first quarter of 2024 and to 0.31% by the first quarter of 2025.

Weakening SEK

In its February policy report, Riksbank acknowledged that the SEK is losing its value from its November 2021 levels based on the krona index. The central bank attributed the weakening of the krona to the rising turbulence on the financial markets.

"Variations in the Swedish krona exchange rate usually coincide with changes in risk appetite on the financial markets. In the coming years, the krona exchange rate is expected to slowly strengthen,” the central bank said.

Even before the COVID-19 pandemic, between 2013 and 2020, the SEK depreciated sharply due to lower interest rates and Riksbank’s quantitative easing. In an earlier report, the Riksbank said the depreciation of the SEK during the said seven-year period "is a puzzling phenomenon for an advanced economy” as the krona kept depreciating even when the interest differential stabilized.

Growing use as a reserve currency

Although Sweden’s economy is fairly smaller than its neighboring European countries including Germany, the UK, France and Italy, the Swedish krona has been classified as a safe haven currency for many foreign exchange watchers.

The IMF sees the SEK as the sixth non-traditional reserve currency globally next to the Australian and Canadian dollars, the Chinese renminbi, the Swiss franc, and the Korean won.

The SEK is becoming increasingly viable as a reserve currency as the US dollar’s dominance has been steadily declining over the past two decades as central banks turn to non-traditional currencies, according to a recent report by the International Monetary Fund.

The share of the US dollar in official reserve assets has decreased over the past two decades, which the IMF attributed to the increased share of non-traditional reserve currencies like the SEK, it said.

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.