Is the downtrend over for USD/CHF? [Video]

![Is the downtrend over for USD/CHF? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDCHF/swiss-currency-francs-4064962_XtraLarge.jpg)

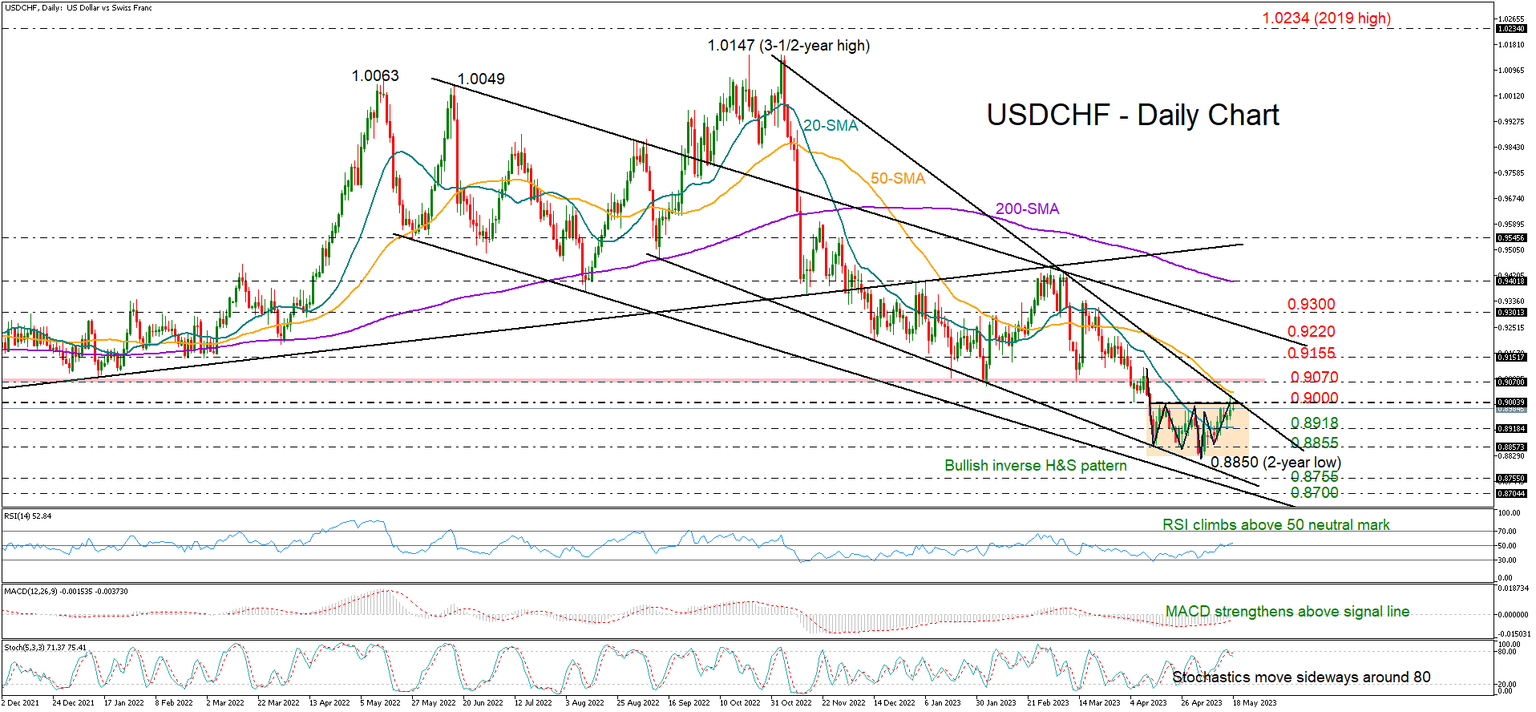

USDCHF has been building a base in the form of an inverse head and shoulders (H&S) pattern around a two-year low of 0.8850 over the past month, boosting hopes for a bullish trend reversal.

Traders are currently waiting to see whether the pair will find enough buyers to confirm the bullish structure above the 0.9000 neckline, and more importantly, mark a new higher high above the crucial 2023 constraining zone of 0.9070. Notably, the descending trendline, which connects the highs from November 2022, is located in the same area.

The RSI and the MACD are sending encouraging signals, with the former stretching its uptrend above its 50 neutral mark and the latter strengthening above its red signal line and towards the positive region. Yet, the Stochastic oscillator is warning that a continuation of the consolidation phase or a downside correction cannot be ruled out as the indicator flatlines near its 80 overbought level.

In the positive scenario, where the price closes above 0.9070, the next obstacle could emerge around 0.9155. Not far above, the resistance line drawn from June’s 2022 peak could be more demanding, around 0.9200. If the price successfully breaches that bar, the spotlight will turn to the 0.9300 psychological mark. Then, the pair will attempt to upgrade the medium-term outlook above the 200-day simple moving average (SMA) at 0.9400 and the March high of 0.9439.

Alternatively, a pullback below 0.9000 could initially halt near the 20-day SMA at 0.8918. If not, the bears will attempt to re-activate the downtrend below the 0.8855-0.8850 region with scope to reach the support line from September at 0.8755. Slightly lower, the longer-term descending line from May could be another ideal area for a pivot.

In a nutshell, USDCHF seems to have set the ground for a positive trend reversal, though only a sustainable recovery above 0.9070 would verify the case.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.