Is the bottom in?

Equities rallied after the opening bell, not looking back till the closing one appreached – quite in line with the premium shared expectations for rug pull not being far off, probably repeatedly.

(…) The signs of a bottom being in, are certainly fewer than those of having further to go. One or two days worth of respite? At best.

What does though selling into solid intraday strength say?

The bottoming process has further to go, in time at the least, and I suspect some more in terms of price as well. This is a quite quicksandish environment for swing traders – these best be prepared for credible signs of bottom being formed so as to buy into it (matter of a few days up till two weeks from today) – and my preference for interest rate sensitive pockets of strength leading since Jul CPI, is still valid) – while intraday traders can reap great gains such as yesterday.

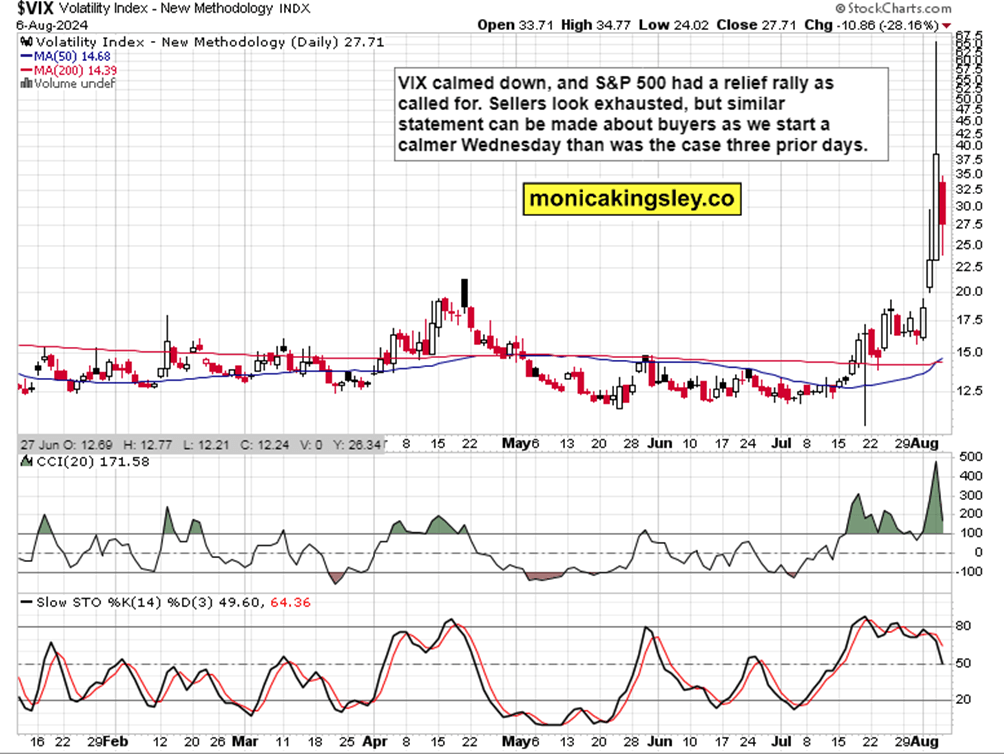

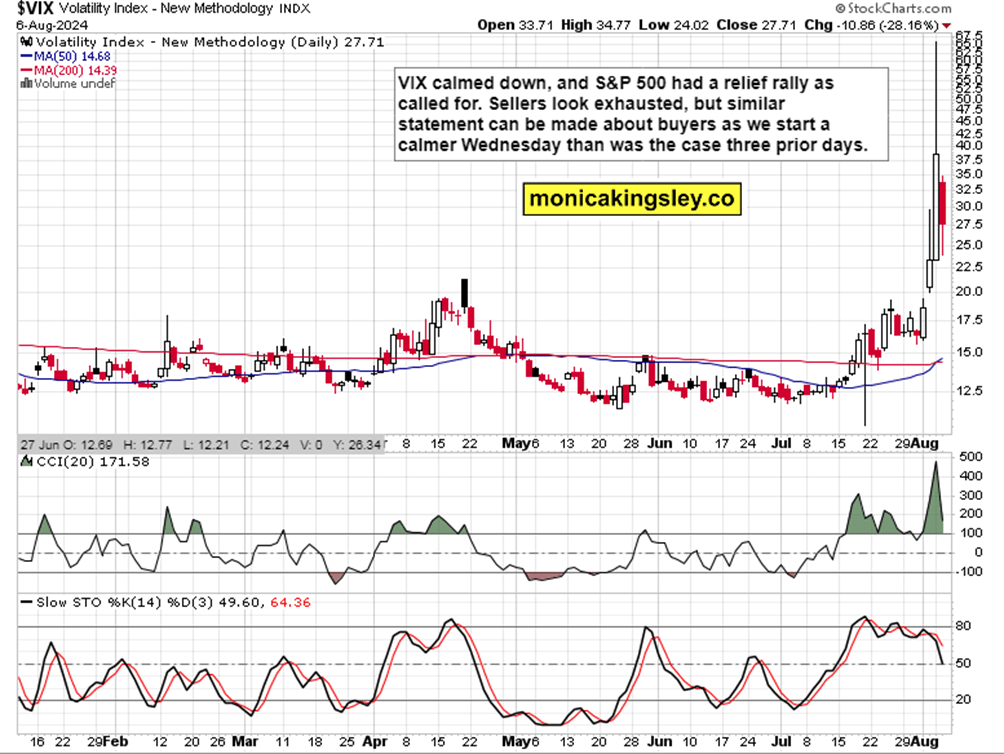

Let‘s assess the VIX and bond market charts to see where the markets stand in terms of risk taking readiness (as USD also stalled at 103.25). Neither the SMCI earnings and DELL bring good AI news.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.