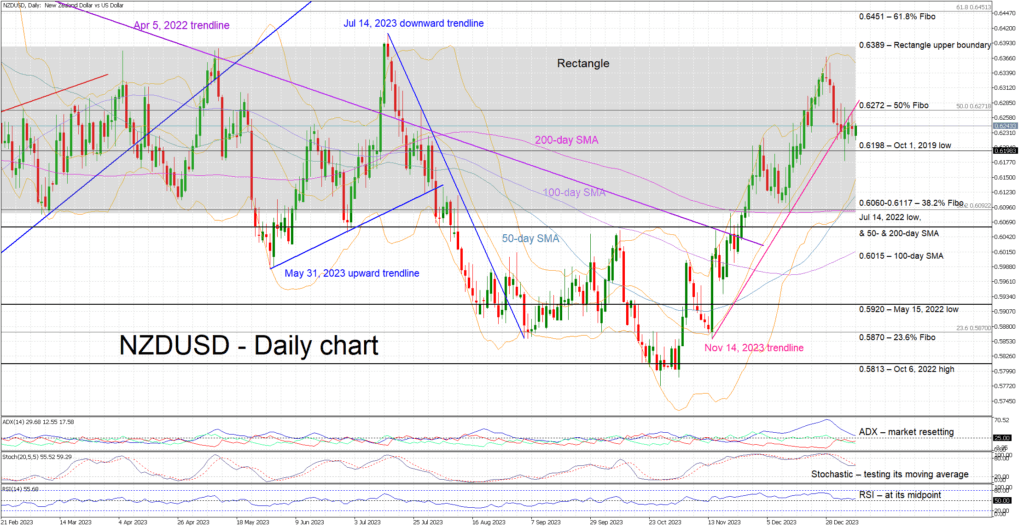

Is NZD/USD on the brink for another decent move? [Video]

-

NZDUSD continues to trade sideways.

-

It is almost at the midpoint of its 2023 rectangle.

-

Momentum indicators are in waiting mode.

![Is NZD/USD on the brink for another decent move? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/NZDUSD/new-zealand-currency-background-33709642_XtraLarge.jpg)

NZDUSD is in the green today but it continues to range-trade. Market participants appear to be in waiting mode with the bears trying to engineer another correction in order to recoup part of the losses incurred during the October-December upleg. They have managed to keep NZDUSD below the November 14, 2023 trendline but they probably need stronger US data this week to push NZDUSD even lower.

The momentum indicators remain mostly on the sidelines. More specifically, the RSI is trading sideways at its midpoint. Similarly, the Average Directional Movement Index (ADX) is moving lower, almost in a vertical fashion, towards its 25-threshold and thus signaling the end of the recent bullish trend. More importantly, the stochastic oscillator is hovering close to its midpoint and apparently prepares to test the resistance set by its moving average. The outcome of this battle could send a strong signal for the direction of NZDUSD.

If the bulls remain hungry, they could try to lead NZDUSD above the November 14, 2023 trendline and the 50% Fibonacci retracement of the April 5, 2022 – October 13, 2022 downtrend at 0.6272. If successful, they could have a go at the rectangle’s upper boundary at 0.6389 with the next resistance point being only a tad higher at the 61.8% Fibonacci retracement of 0.6451.

On the flip side, the bears are trying to regain market control. They are probably keen to push NZDUSD below the October 1, 2019 low at 0.6198 and open the door to a more protracted correction. The next support area comes at the 0.6060-0.6117 range, which is defined by 38.2% Fibonacci retracement, the July 14, 2022 low and the 50- and 200-day simple moving averages (SMAs), and could probably be the first real test of the bears’ determination.

To sum up, NZDUSD trades sideways with the bears itching for a correction but currently lacking the support of the momentum indicators.

Author

Achilleas joined XM as an Investment Analyst in November 2022. He holds a BSc in Business Economics from Middlesex University and a MSc in Mathematical Trading and Finance from Bayes Business School, City University.