Is Gold scared of a recession?

Despite all of the fundamental components in place for a rally, gold remained relatively weak on Sep. 28.

A beautiful setup was wasted on Sep. 28, as gold showed no strength despite weakness from U.S. Treasury yields and the USD Index. And while our out-of-consensus call for higher long-term interest rates surprised the crowd and culminated with a massive bond market sell-off, our future outlook is just as precarious for the PMs.

For example, we have long stated that this cycle should end with a recession. Six of the last seven times the headline Consumer Price Index (CPI) increased by 5% or more year-over-year (YoY) since 1948, the cycles ended with recessions. Furthermore, the one time it didn’t and the headline CPI returned to 2%, a recession occurred roughly 17 months later. Consequently, while history is not the soft landing bulls’ side, it’s still a consensus opinion.

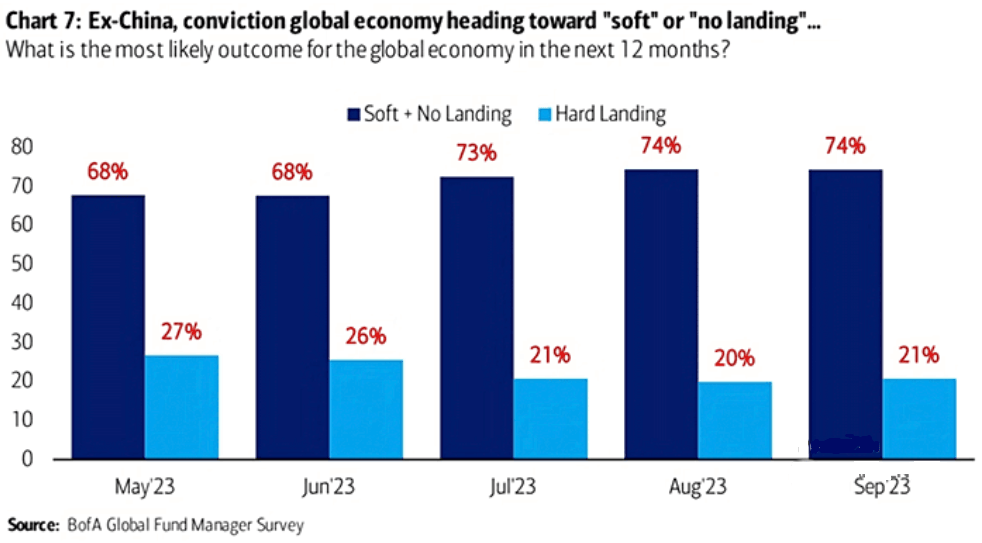

To explain, Bank of America’s latest Global Fund Manager Survey shows that only 21% of respondents expect a “hard landing” (the light blue bar) for developed markets over the next 12 months. Conversely, the majority expect a “soft” or “no landing” scenario to occur, which is a fairytale, in our opinion.

As such, while silver has suffered alongside mining stocks, there is still plenty of misguided optimism priced in that could evaporate if (when) a recession hits.

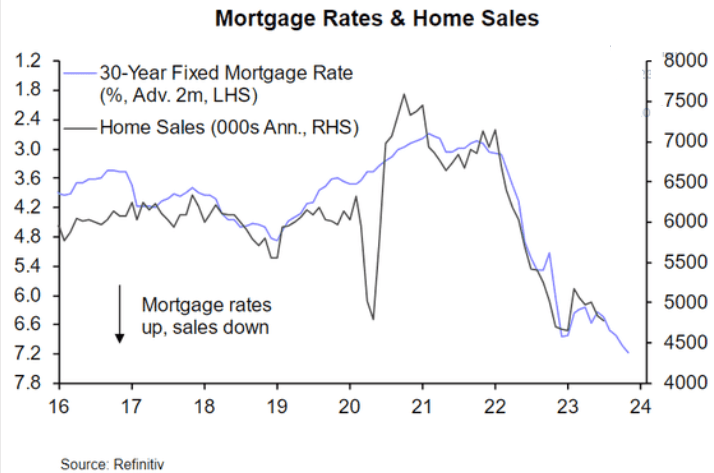

Speaking of which, the Mortgage Bankers Association (MBA) revealed on Sep. 27 that mortgage applications continue to sink, and we warned that higher long-term interest rates (not the FFR) cause recessions. Joel Kan, MBA’s Vice President and Deputy Chief Economist, said:

“Mortgage rates moved to their highest levels in over 20 years as Treasury yields increased late last week. The 30-year fixed mortgage rate increased to 7.41 percent, the highest rate since December 2000, and the 30-year fixed jumbo mortgage rate increased to 7.34 percent, the highest rate in the history of the jumbo rate series dating back to 2011.”

So, while the crowd ignores these realities, and interest rates have moved even higher this week, the ominous data should worsen until the economy weakens enough for the Fed to cut the FFR (recession).

To explain, the black line above tracks U.S. home sales, while the blue line above tracks the inverted (down means up) 30-year fixed mortgage rate. If you analyze the right side of the chart, you can see that the blue line’s descent signals more downside for the black line. Plus, if long-term rates continue to climb, even more demand destruction should unfold.

More than mortgages

While that crowd may believe the fundamental weakness is isolated to the mortgage market, there are troubling signs at nearly every turn. And with the USD Index poised to soar when the economic volatility strikes, the PMs should be on the losing end of the drama. For example, Bank of America’s Chief Investment Strategist Michael Hartnett wrote:

“Yield curve steepening -110bps to -67bps, unemployment rate up 3.4% to 3.8%, personal savings rate up 3% to 4-5% YTD, and maybe most importantly, HY defaults are up 1.6% to 3.2%, credit card delinquencies are up by half, from 0.8% to 1.2%, while auto delinquencies are soaring, up 5.0% to 7.3%.”

Thus, while we warned that many of the fundamental metrics that caused us to fade the recession talk in 2021 and 2022 have turned in negative directions, the rapid rise in long-term rates has made the outlook even more dangerous.

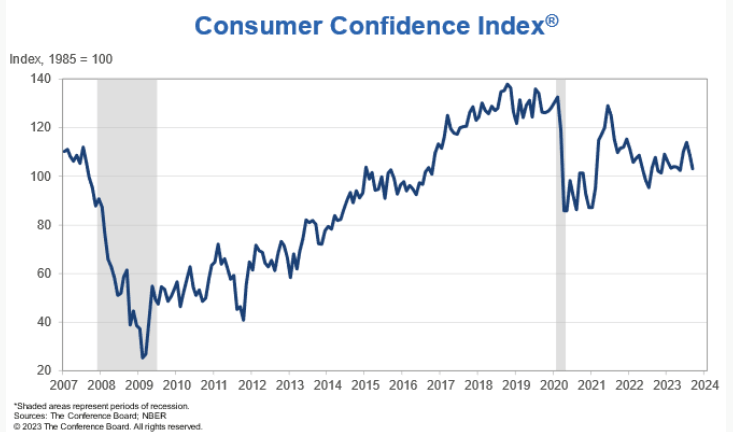

As further evidence, The Conference Board revealed on Sep. 26 that U.S. consumer confidence decreased from 108.7 in August to 103 in September. And while the present situation index remained roughly flat, the expectations index suffered mightily. Dana Peterson, Chief Economist at The Conference Board, said:

“Expectations for the next six months tumbled back below the recession threshold of 80, reflecting less confidence about future business conditions, job availability, and incomes. Consumers may be hearing more bad news about corporate earnings, while job openings are narrowing, and interest rates continue to rise, making big-ticket items more expensive.”

To explain, the blue line’s movement on the right side of the chart shows how U.S. consumer confidence has reversed its recent uptrend as long-term interest rates race to new highs. And with higher oil prices and borrowing costs poised to further reduce Americans’ disposable incomes, consumers are in worse shape now than in 2021 and 2022.

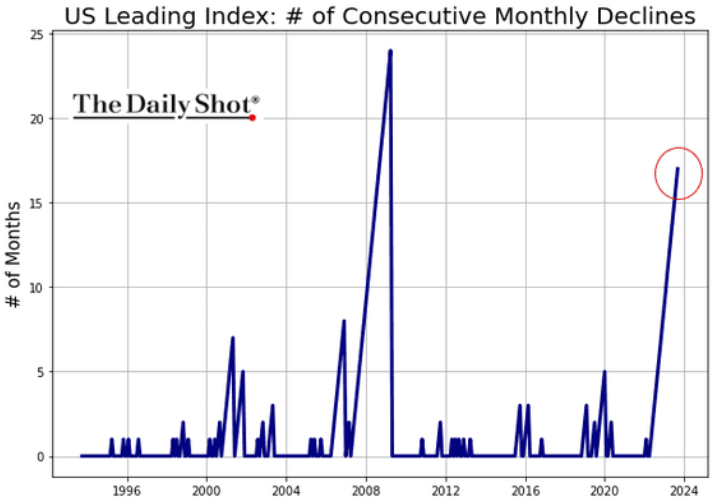

Finally, while consumer confidence was nearly at the same level pre-GFC, another ominous indicator from The Conference Board deserves plenty of attention.

To explain, the firm’s leading economic index has declined for 17 straight months, which, as you can see, is the longest stretch since before the GFC. And like now, everyone believed the soft landing narrative back then, and we all know how that story ended. As such, there is plenty of room for further precious metals downside if (when) fund managers suffer the next crisis of confidence.

Overall, the S&P 500 has felt the pain of higher interest rates, and even though it rallied on Sep. 28, a sharp sell-off should occur in the months ahead. Again, a recession won’t arrive overnight, but it’s essential to notice the warning signs, especially when the consensus firmly believes in a soft landing. Consequently, we did, and still do, think a recession will sink asset prices to their long-term lows.

For even more timely analysis, subscribe to our premium Gold Trading Alert. We have recorded 10 profitable trades in a row, and our current position has already made money for our subscribers. Moreover, the technicals are much better at predicting precise entry and exit points, while the fundamentals are more about assessing the risk-reward outlook. Therefore, becoming a premium member equips you with all the necessary tools to succeed.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Sébastien Bischeri

Sunshine Profits

Sebastien Bischeri is a former Reserve Officer in the French Armed Forces (Navy), and began his career in computer science and engineering, prior to move into banking, finance, and trading.