Is Gold destined to lose more of its shine?

With US Treasury yields and the dollar marching north, gold has come under selling interest, breaking last week below the key zone of $1,900. Although the short-term picture of the precious metal appears to have turned bearish, whether larger declines are in store will likely depend on Fed Chair Powell’s monetary policy remarks at Jackson Hole on Friday.

US economy fires on all cylinders

August appears to be a very hot month for US Treasury yields, with the 10-year climbing from a low of 3.25% to around 4.35%, a level last seen back in 2007. What likely added fuel to this rally was the Treasury’s decision to increase the size of its quarterly auction, focusing on longer-term bonds, which came hot on the heels of Fitch’s downgrade of America’s credit rating, as well as data suggesting that the US economy is faring much better than previously thought.

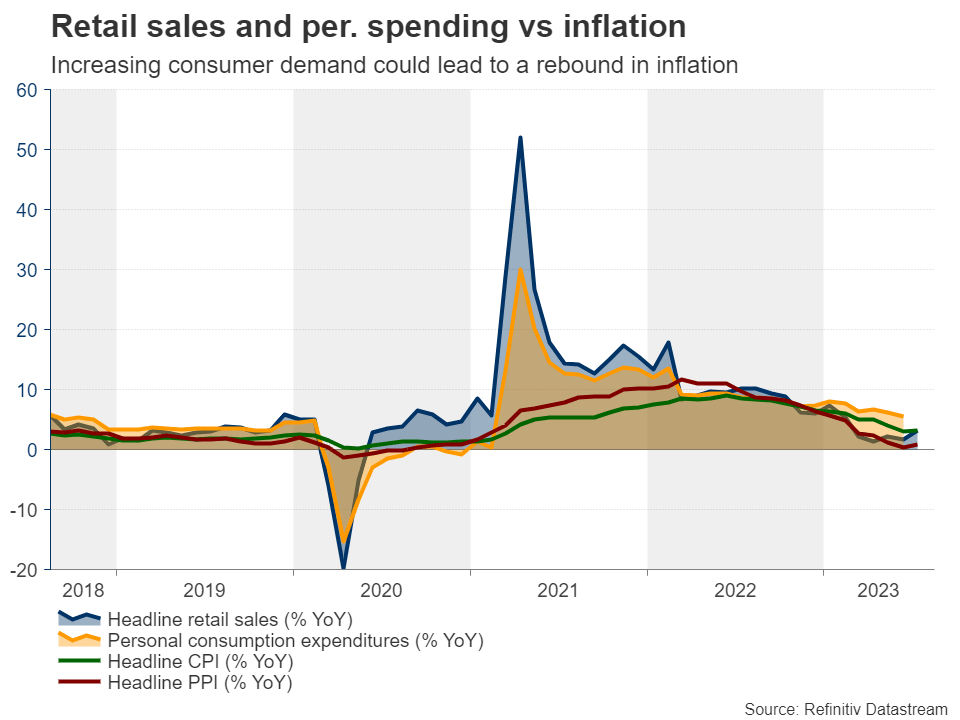

Just last week, retail sales for July well exceeded their forecasts, signaling that consumers’ purchasing power in the world’s largest economy remains strong, which combined with a still-tight labor market would make it difficult for inflation to further cool down.

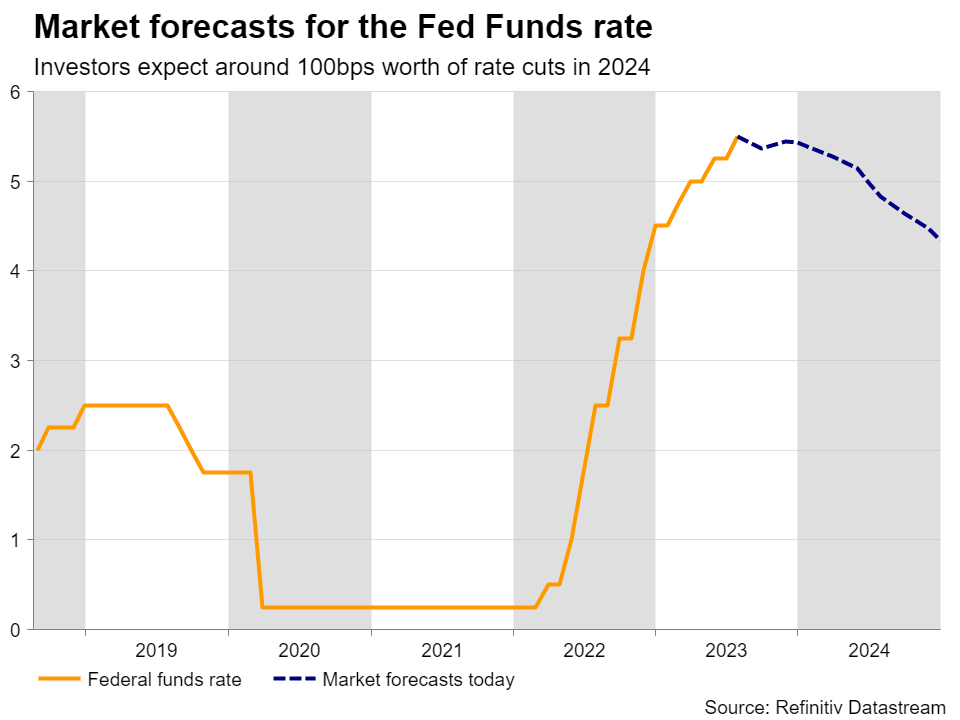

The retail sales data resulted in an upward revision to the Atlanta Fed GDP now model, which now suggests that the economy grew by an outstanding seasonally adjusted annual pace of 5.8%, and thereby prompted market participants to scale back some basis points worth of rate reductions by the Fed for next year. Now, there is also a nearly 45% probability for another Fed hike by November.

Rising yields and strong Dollar weigh on Gold

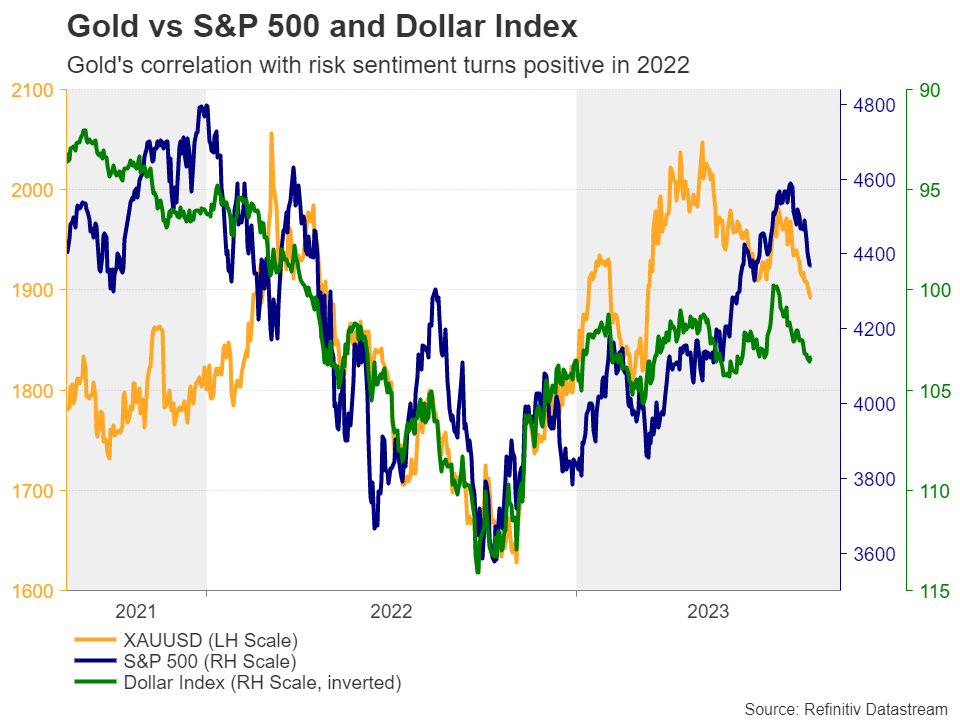

Apart from bond yields, the “higher for longer” narrative added more fuel to the dollar’s engines as well, which have been also charged by concerns surrounding the Chinese economy. The recovery in the world’s second largest economy has lost steam due to a deepening property crisis, softening consumer spending and worsening credit growth, with the latest stimulus measures by Chinese authorities and the People’s Bank of China (PBoC) failing to revive market sentiment.

With Treasury yields soaring and the US dollar wearing its safe-haven suit, the non-yielding gold maintained a positive correlation with the stock market, seemingly not included on investors’ list of preferred safe havens, despite being considered a top choice before central banks began this tightening journey.

Jackson Hole enters the limelight

The next big challenge for traders of the precious metal may be a speech by Fed Chair Powell on Friday at the Jackson Hole economic symposium. At the press conference following the Committee’s last meeting, Powell said that the central bank will make decisions meeting by meeting, closely watching economic data, adding that they could hike again in September if the data suggests so, but also that they could choose to hold steady.

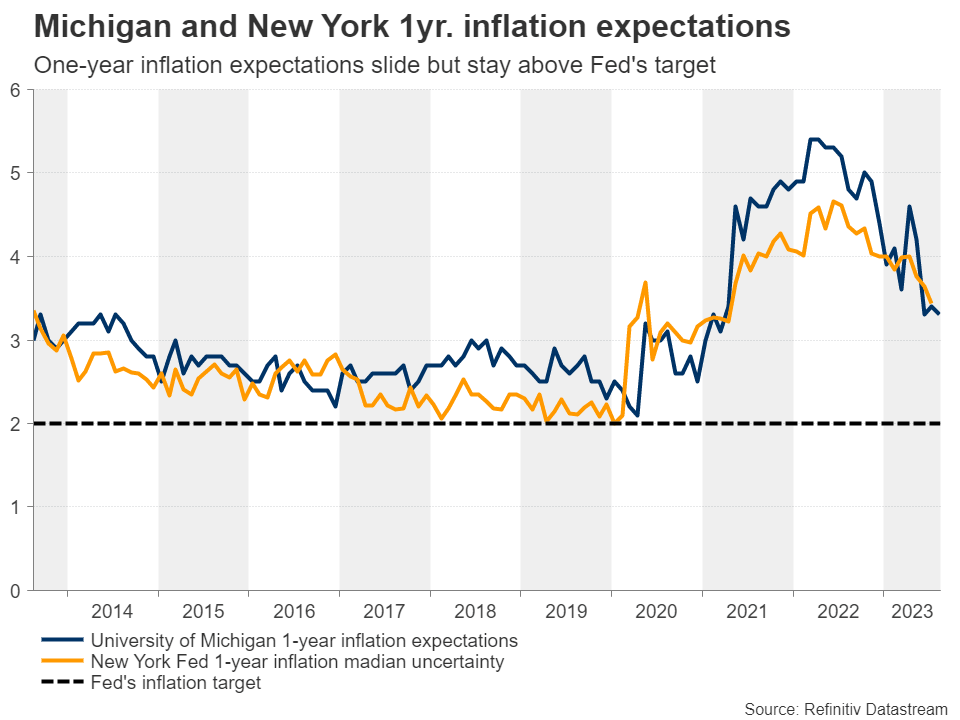

With data since then coming in better than expected and inflation expectations suggesting that inflation will still be above the Fed’s 2% objective even in 12 months, Powell may now tilt the scale towards another hike and/or highlight the need for interest rates to stay high for a longer period than the market currently anticipates. This could allow yields and the dollar to drift further north and thereby steal more of the gold’s shine. The opposite may be true if Powell appears less hawkish than expected.

Door to further declines remains wide open

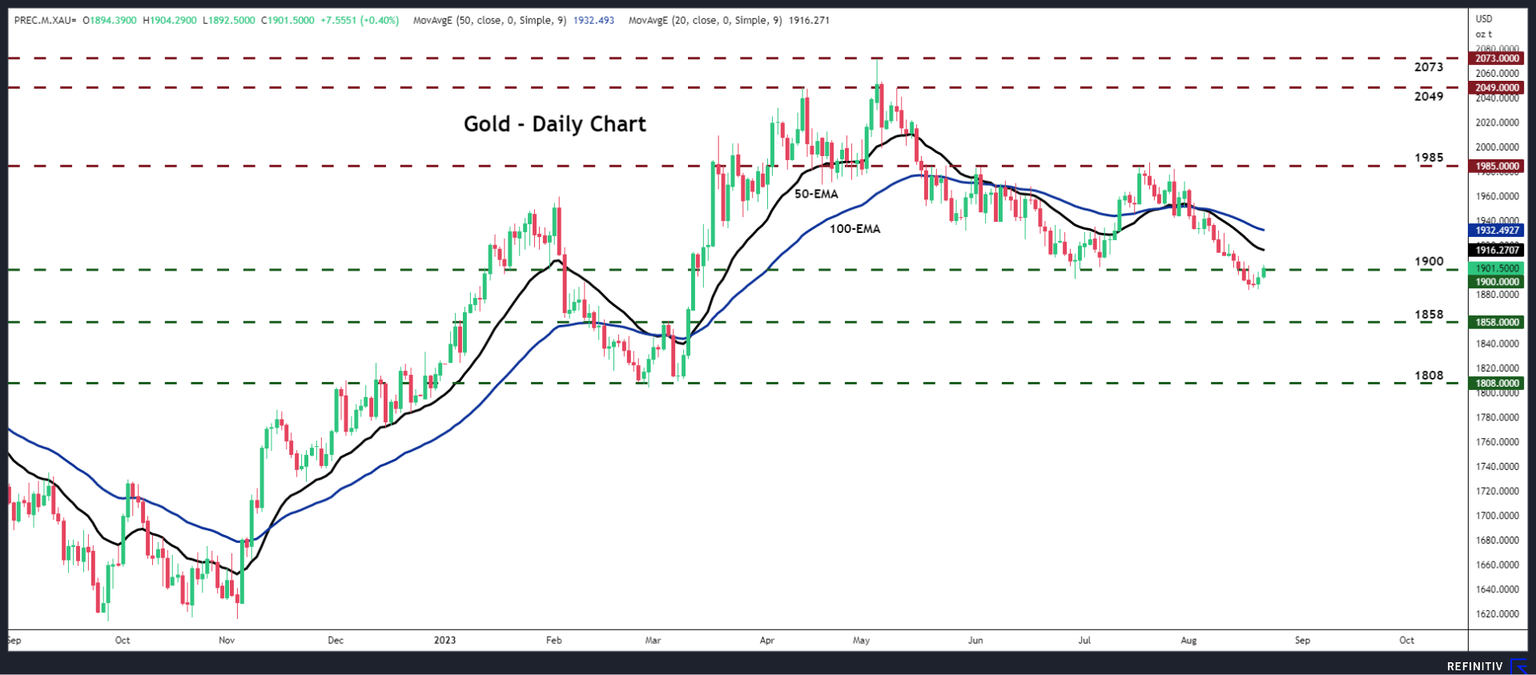

From a technical standpoint, gold fell below the 200-day exponential moving average (EMA) last Tuesday for the first time since November, while on Wednesday, it broke below the key territory of $1,900, confirming a lower low on the daily chart. Although it returned slightly above that barrier, the technical picture leaves the metal vulnerable to further declines, perhaps towards the inside swing high of March 6 at $1,858. For the outlook to brighten again, the bulls may need to drive the action all the way above the $1,985 zone.

Author

Charalampos joined the XM Investment Research department in August 2022 as a senior investment analyst.